Philadelphia "Feeling The Pain" As Home Ownership Rates Set To Keep Falling

"...many first timers and less financially solvent buyers are being forced to quit before they’ve even begun."

Since Fringe Finance has started, I’ve scoured the Earth far and wide to try and bring a perspective on real estate to the blog that is going to be both no bullshit and an unfiltered on-the-ground opinion that I know and trust (and could add value to my readers). After all, it’s an asset class that I am not nearly as in-tune with as I am with equities and, well…beer.

And to be honest, I didn’t have to scour much, as a good friend of mine is a brilliant up and comer in the world of real estate in Philadelphia. I’ve worked with her several times and have known her for years - she’s insightful, pragmatic, conscientious and has a serious pulse on the industry. I know for a fact that she works her ass off, eating, sleeping and breathing real estate on the daily.

As such, my kind friend, award-winning realtor Kira Mason, has agreed to drop in once in a while to offer up her take on the pulse of the industry for benefit of my readers. Kira runs the Substack Gritty City Real Estate, which you can read & follow free here and she is @kmasonrealtor on Twitter.

Today’s post - free to read - is being syndicated with Kira’s permission. She will continue to contribute exclusive content for Fringe Finance readers as well.

Philly's Affordability Issue Just Got a Lot Worse

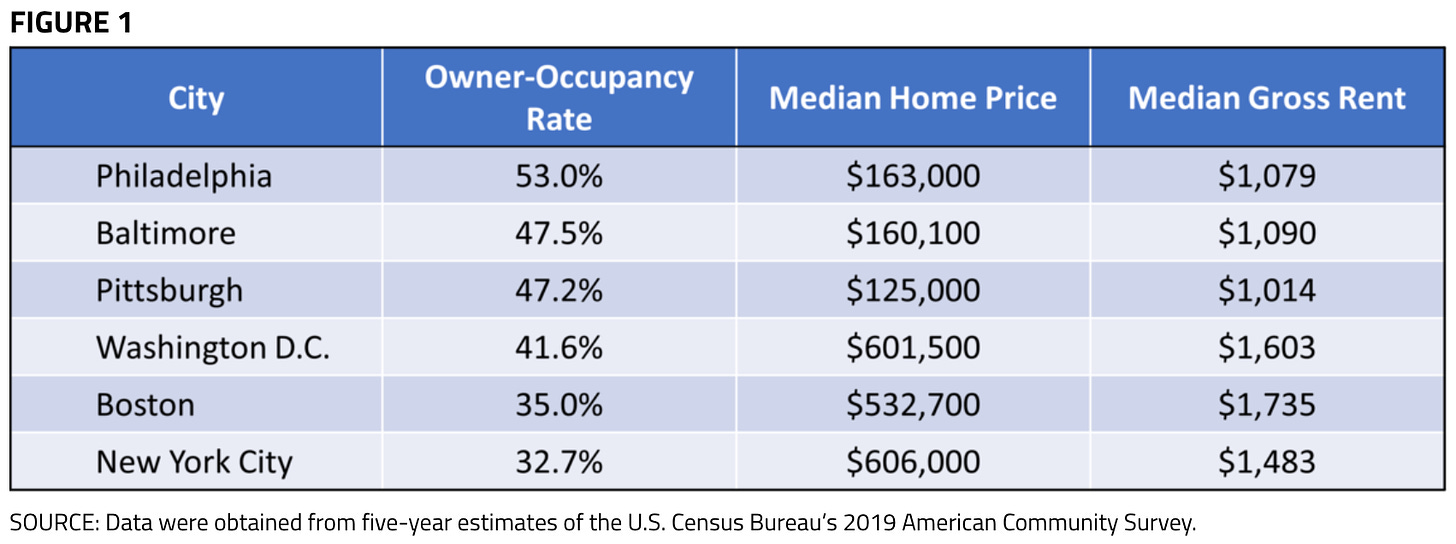

Philadelphia has long been praised for its affordability when compared with other cities in the Northeast. Due in large part to relatively low-cost housing and some very compelling grants and regional loan programs, it has a higher percentage of individuals living in homes that they own than do DC, New York City, Baltimore, Pittsburgh, and Boston. But despite higher levels of homeownership, a key element of wealth-building, over 23% of Philadelphians live below the poverty line (double the US average). Homeownership is an important piece of keeping that number from getting even higher, and I fear and suspect that the shift taking place in the housing market today will further stratify a Philadelphia that is already starkly divided along class lines.

Even before interest rates made their historic jump above 7% this fall, homeownership numbers in our city had started to decline. In 2019, they were down almost 9% from their highest recorded level of 58.2% in 2006. Many will attribute this shift to developers outbidding first time buyers in Philadelphia’s most affordable neighborhoods. I saw this firsthand in 2020 and 2021; those of my buyers who had the biggest hurdles to overcome on their paths to home ownership were repeatedly losing bidding wars to investors, even when putting forth offers that were significantly above asking price with favorable non-monetary terms.