One Unloved Tech "Falling Knife" That's Actually A Cash Cow In Disguise

This makes three tech "falling knives" I am trying to catch this year, in the midst of record inflation and the largest war in Europe in 50 years. God help me.

(Note: I do not recommend this as an investment strategy in any way and I never offer buy or sell recommendations, I only offer insight as to how I am managing my personal portfolio. Speak to your registered professional financial adviser. I exist on the fringe. I get shit wrong often.)

Back in January, before the Ukraine invasion, I wrote about two “falling knife” stocks I would continue to buy no matter how low they went during the market volatility that was just starting due to the perception of rates hikes.

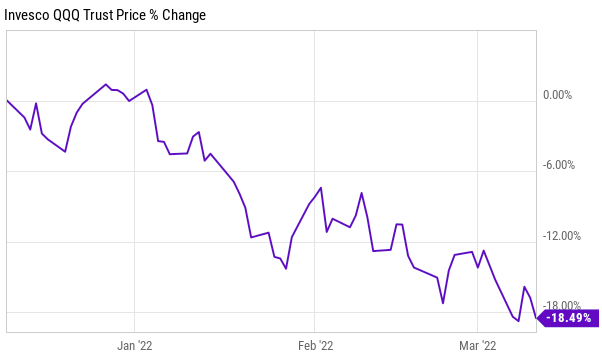

While both of those names are about 10% higher than their 52 week lows, neither has been able to catch much of a bid, as their benchmark, the NASDAQ has fallen nearly 20% in the last 3 months and the invasion of Ukraine, which wasn’t a catalyst at the time, has continued to put downward pressure on markets.

But that’s fine with me - the point of writing an article called “falling knives” was to get across the point that I thought both names had value and, barring any materially negative news, I would continue to add shares of both names when, and if, they move lower. Both names remain in my portfolio and are two of my “go-to” stocks when I am looking to add long exposure.

With the NASDAQ falling even further from January, I wanted to add a third “falling knife” that I have been happily buying over the last week - and will continue to buy if it moves lower. This “falling knife” is somewhat more attractive than the first two in the sense that it has real earnings, real cash generation and has become a household name over the last 24-36 months.