One Blue Chip Value Stock I Absolutely Love Despite The Total Market Hysteria

This name may not only benefit from a rotation to value from growth, but it could also rise in the event of market volatility.

Make no doubt about it: we are in the midst of unprecedented market hysteria.

In fact, it is getting so bad that even San Francisco Fed President Mary Daly said yesterday that the market was “euphoric”. You know shit is bad when Fed Presidents actually start touching upon iotas of truth.

Regardless, my readers know that I am as skeptical of the market as anybody right here. I’m consistently trying to pin down how and when the unprecedented monetary experiment known as quantitative easing is going to end. I’ve thrown my hands up in the air on macro analysis and believe QE’s end (whether forced or voluntary) to be the only true linchpin for determining whether or not the market is going to continue moving higher.

My experience in the short seller world keeps me away from chasing high flying names and keeps me skeptical of the market in general, where it appears to me that both bulls and bears are trapped in the same bubble together, approaching an eventual storm on the horizon that sometimes never seems like it’s truly going to strike.

And while lobotomized market participants are busy determining that Rivian is worth $170 billion despite never having produced revenue, I’m left looking for boring stories that will fit nicely in a dividend portfolio I have, or are cheap and unloved relative to the rest of the market.

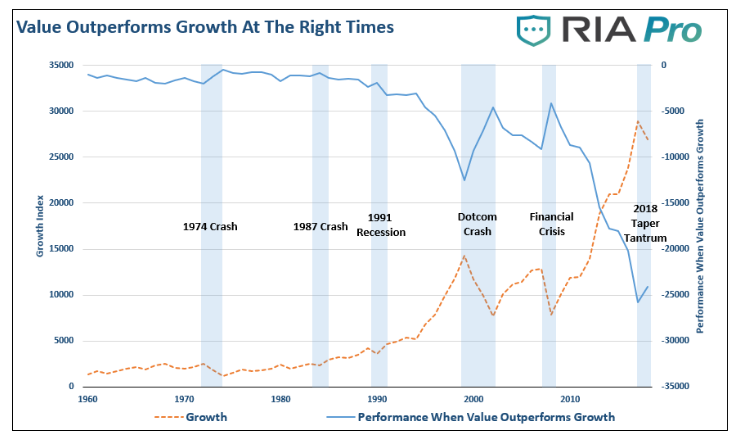

On my last podcast, I talked about the lack of love for value stocks.

The entire market is engrossed in a self fulfilling affair with “growth stocks”, many of which have no net income, some of which don’t even have revenue. This has been the result of a massive run-up in the NASDAQ.

I’ve predicted that this run up has been as much of a gamma squeeze as it has been legitimate buying. But that doesn’t matter: asset managers who are long technology and “innovation” stocks have to make an excuse as to why their assets are rising in price for their perfunctory CNBC appearances and, when they do appear on TV, they say completely batshit insane things like “value investing is dead”.

This, of course, is insane. The whole definition of value (“the regard that something is held to deserve; the importance, worth, or usefulness of something”) ensures that value investing is never actually going to die for as long as we “hold” investments.

With this in the back of my mind and looking at the staggeringly insane valuations the market has placed not only on growth stocks, but value stocks that now routinely trade at 20x to 40x P/E’s, I’ve found one name that I feel safe buying on almost any dip, for any reason, at this point.

I had added it to my dividend portfolio a while back and now have made it a part of my main portfolio. I will continue to add shares of this company should it continue to fall from these levels.

I like that the company is not only cheap, but can also act as a hedge against macroeconomic and geopolitical volatility. Already, I have seen days where the market sells off, but value names that I already own - like two of these – wind up moving higher.

I think this is indicative of a much larger growth to value trade that will be coming once we see the next bout of volatility in markets. The only problem is that now there is far less “value” than there was 20 years ago.

The stock I own and I’m likely going to continue to hold and buy on dips is Lockheed Martin (LMT).

Almost everybody knows that LMT is a “security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.” The company operates through four segments: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space. It is also extremely closely tied to the U.S. government and the Department of Defense. Lockheed Martin has a lengthy history - it’s over 100 years old. It was formed in 1912 and is located in Bethseda, MD, just miles from the Department of Defense, which is headquartered at the Pentagon.

With a staggering 114,000 employees and ttm CFFO of $6.76 billion, the company doesn’t even sport a $100 billion valuation just yet. When you compare this to a “growth” stock like Rivian, which has 6,000+ employees and burns $1 billion plus a year in cash on zero revenue with a market cap over $100 billion, one can start to really see just how disconnected growth has become from value.

Did I mention LMT is integral to our nation’s national defense and Rivian is integral to - well, nothing?

LMT suffered a series of setbacks and its stock price hasn’t meaningfully appreciated since 2018 – it has been trading at nearly the same levels for almost 4 years while the rest of the market has ripped.

Living near the LMT campus in King of Prussia, PA was an eye opening experience on just how guarded and massive of a company it is. Its sheer size and integration into our national defense causes me to quickly glaze over the “bear case”, namely that the stock has been unloved due to concerns about F-35 production and its associated revenues. This article does a great job expounding on the potential cons for LMT related to the F-35, and you should give it a read.

But I’m here to make the bull case. I want to put the F-35 issues aside because I think that they are all bumps in the road compared to the 10, 20, or 30 year thesis one might have for Lockheed. Here’s the gist of mine.

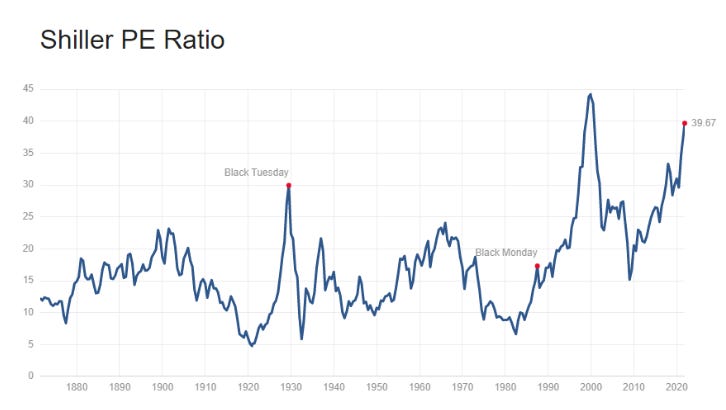

First, let’s just look at how the company is valued. Lockheed Martin trades at a forward PE of about 12x at a time when the Shiller PE is approaching 40x. There are very few blue chip names left that aren’t in the automotive sector that trade at such a modest price to earnings ratio. Super conservative staples like Proctor and Gamble (26x ttm PE), 3M (18x ttm PE), Clorox (49x ttm PE), Raytheon (40x ttm PE) and Johnson & Johnson (24x ttm PE), just to name a basket of blue chips, go to show how low a 12x valuation truly is in this market.

Second, the company has significant earnings power. Lockheed did an astounding $66 billion in revenue over the ttm period and $8.68 billion in EBITDA. This is real cash flow the company has been using to reduce its share count relatively aggressively. There is no need for capital raises and the company has a manageable ~2x EBITDA in debt at about $12 billion.

Third, the company pays a 3.29% dividend. Call it old school, call it whatever you would like - the payment of a dividend each quarter remains a staple of value investing and Lockheed Martin has plenty of dividend coverage and can begin compounding the first quarter one owns it.

Fourth, the company is basically a wholly owned subsidiary of the United States Department of Defense, as I have mentioned. Lockheed Martin is among a small group of names, including Raytheon and Boeing, that almost seem completely untouchable due to how they are intertwined within the US government. Now that government spending is no longer an issue (yuk yuk) because we can theoretically print as much money as we would like, I would expect defense budgets to continue to balloon and companies like Lockheed Martin to be the beneficiary.

Fifth, the company acts as a hedge against any type of hot war scenario that could wind up damaging other stocks. There aren’t too many things out there that could stop the party in the stock market right now, but a war would be one of them. While it doesn’t seem as though the drum beat of a hot war has gotten too loud lately, there are conflicts – like ones between Russia and Ukraine and between China and Taiwan – that are worth keeping a very close eye on. In an instance where the US military is involved, or where (God forbid) the U.S. is directly involved, defense spending would rise astronomically and names like LMT would wind up getting a serious boost.

Sixth, even without a wartime scenario, a serious rotation from growth to value could happen if, and when, market euphoria dies down as a result of inflation. Make no mistake about it, inflation is on the forefront of every tech investor’s mind right now.

Higher than expected inflation readings have dragged down the NASDAQ and will continue to drag down the overall broader market as higher prices raise costs for manufacturers, who have to pass those costs on to customers, who will have to purchase less and spend more discretionarily as a result. This begets a “risk off” attitude - not only in life, but also in investments – and that could wind up dragging the market lower. The mindset of the consumer goes to finding value on store shelves and the mindset of the investor, similarly, goes to finding value in investments.

In conclusion, there is no doubt that the world is eventually going to rotate from growth back to value, the only question is when. When this happens, a name like Lockheed Martin is going to be sitting there by itself, prime for the picking.

Quantitative models looking for rock solid companies that generate cash and pay dividends with low price to earnings ratios are all going to return this name, in my opinion. When asset managers and portfolio managers realize how LMT is basically a bet that’s as good as betting on the Department of Defense, it’s going to become a no brainer buy, in my opinion.

Estimates have come down but analysts are still expecting $26.45 in EPS for 2022. A price to earnings ratio of 18x on these estimates, which I think is modest given the above, puts the company at about $475. Considering that PE is about half of where the rest of the market is trading at now, it wouldn’t surprise me if a geopolitical event or a large drawdown in the overall market, resulting in a rotation to value, gets Lockheed Martin there over the next couple of years. In the meantime, I’m happy collecting the dividend and waiting.

DISCLAIMER:

I am long LMT. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. None of this is a solicitation to buy or sell securities. Doomberg has contributed to my podcast but this interview was not part of any sponsorship or ad deal or contract, it was initiated by me because I enjoy the blog’s content and wanted to ask questions that I believed my readers would benefit from. It is only a look into our personal opinions and portfolios. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe.

MORE DISCLAIMER:

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. If I am here listing things I got right or things I think will happen in the future, note that there are likely twice as many things I got wrong over the same period of time. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. Leave me a alone and do your research elsewhere. If you can find somewhere to rate this Substack one star, please do so as to save future readers from the misery of my often wholly incorrect prognostications.

One star, lol