"Nothing Changes Sentiment Like Price": Phil Bak Talks Cathie, Crypto Carnage & Congress

"I just wish the purists…that they had done a better job of self-policing the promoters and charlatans that have been out there the whole time.”

I was happy to have my new friend Phil Bak on the podcast this weekend to discuss all things Cathie Wood, crypto meltdown and the state of markets.

The first thing we talked about was Cathie Wood and ARKK. Phil - who has a robust background in the ETF world - had a different take than most people nowadays on Wood, making the argument that, despite her recent poor performance, an active manager sticking to a strategy and putting a face to a fund is actually good for the world of active management.

“I’m a fan of Cathie Wood…I think she’s done a tremendous service for the industry in that coming out with conviction - whatever the strategy is, just that it was so differentiated - somebody coming in with a real strategy, I think she, in some respects, saved active management,” Phil said.

He continued, making the point that most of the market had surrendered to passive management over the last decade: “She really brought back the idea of stock picking, which was close to dying.”

I pushed back a little, asking Phil about how managers who are supposed to be able to navigate markets (and even “hedge”) could have missed the downturn based on the Fed’s posturing of ending its easy money strategies.

“People’s best hopes and wishes were calcified on the way up…and then you get backed up by incredible price movement, people feel more emboldened, and then you’re not prepared for the turn,” Phil commented.

I also made the point that stock pickers like Cathie Wood and Ross Gerber have underperformed their benchmarks on the way down, which Phil attributed to the fact that they are high beta ETFs.

“You look at these active shops, they’re basically index funds - they’re just beta. They’re just beta. So to have someone come in and do something different [i.e. higher beta] - I think if we had more of that the markets would be a better place,” Phil says.

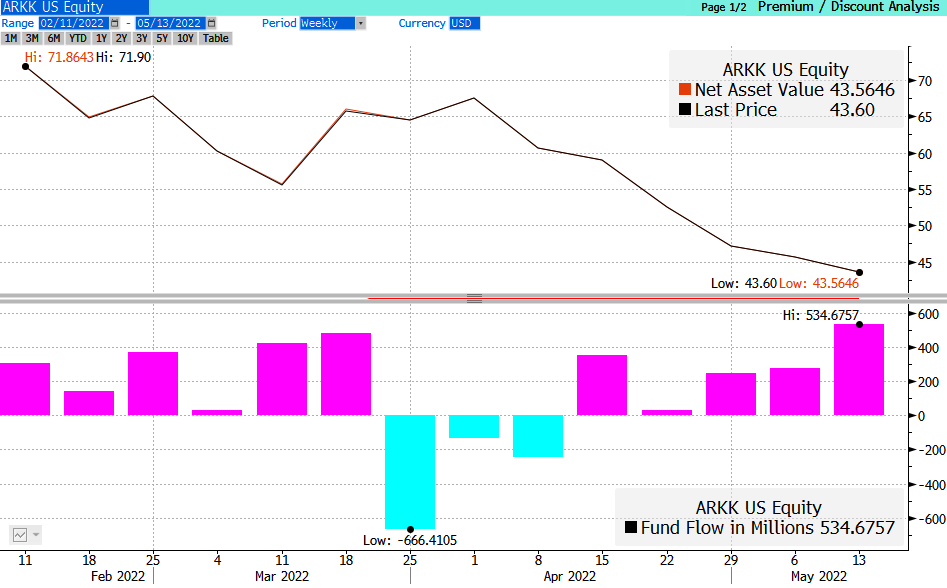

I then go on to point out the fact that ARK’s flagship ETF, the ARKK Innovation Fund, has still seen an influx of inflows, despite its poor performance.

“Narrative drives flows and flows drive performance,” Phil says. “It means someone is trying to catch a bottom. Instead of a leveraged NASDAQ, you buy ARKK. You try to pick a bottom, you can’t use leverage, maybe you just use ARKK. That’s probably tactical or short-term money.”

My friend and senior ETF analyst at Bloomberg Eric Balchunas pointed out last week that ARKK just posted its biggest week of inflows in over a year with $534 million. On its 5th week of inflows, Balchunas notes, it has taken in nearly $2 billion since February 11, during which it is down 39%.

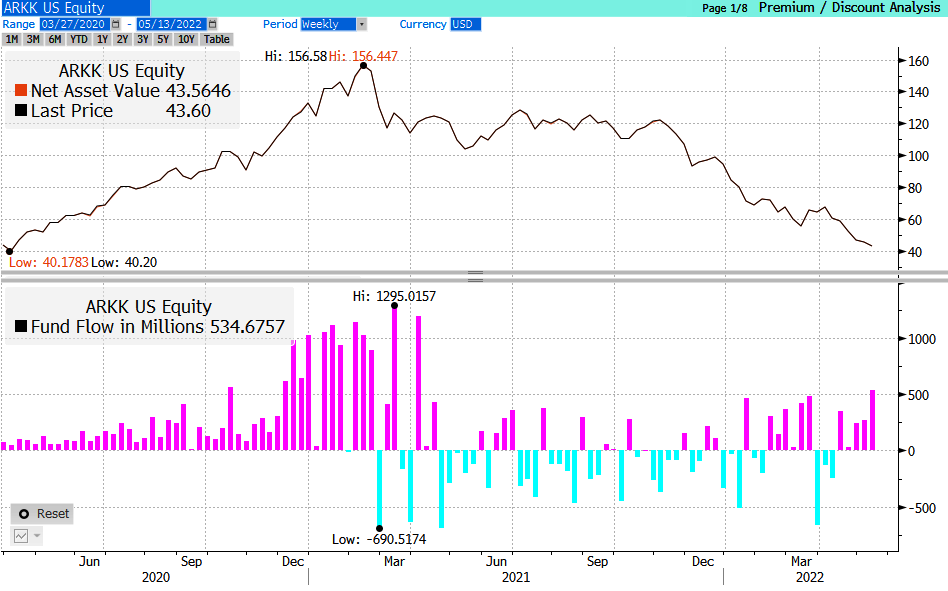

“Here's what this looks like zoomed out,” Balchunas wrote.

“You can see this was biggest week since the Glory Days but also note the in and out style of the flows, it's a now bonafide trading tool for many, which is one reason it will hang around long term vs. say other high flying MFs of era past,” he continued.

From there, Phil and I went on to tackle the carnage in the crypto space.

“Crypto was the excess valve, the runoff valve for the economy,” Phil said. “There wasn’t enough places for the money to go. So it soaked up like $2 trillion in assets like nothing.”

“A lot of very smart people I know are in [crypto] in size and are true believers in it. I just wish the purists…that they had done a better job of self-policing the promoters and charlatans that have been out there the whole time.”

I also brought up my previous article about statements that crypto promoters like Alex Mashinsky have publicly made, including that gold has “no value” and that bitcoin “pays a yield”. You can read that previous article here:

Phil responded: “It’s really amazing that you look at the regulatory environment on the registered securities side - you’re literally not allowed to say your ticker. If somebody asks me for the name of my ETF, I can’t tell you the name, I can’t tell you the ticker…I can’t say anything, but [crypto promoters] can say literally anything.”

“We’ve had people say you should sell your home and mortgage your home to buy bitcoin!”

From there, we spoke a little bit about freedom and libertarian principles of government compared to how Democrats are currently trying to micromanage the economy and play identity politics.

After discussing the example of the Canadian truckers pushing back on Justin Trudeau and Philadelphia rejecting the mayor’s proposed re-implementation of the mask mandate several weeks ago, Phil concluded:

“We have as much freedom as we’re willing to demand.”

You can listen to my full interview with Phil Bak here:

Additionally, as a reminder and if you’re interested in the ETF world, I took the time to speak with Eric Balchunas earlier this year about ETFs. I brought him on because I wanted to better understand how ETFs work, and also because I enjoy his Twitter feed. He is one of the most quoted and well known ETF experts I often see in financial media. On our podcast back in January 2022 we discussed:

Exactly how ETFs are made up and what differentiates them from mutual funds (i.e. why have they rocketed to popularity over the last decade)

Whether or not it’s possible, with so many ETFs out there, for the “tail to wag the dog” eventually and ETFs to drive equity prices instead of the other way around

How inflows and outflows work; the process of ETFs buying and selling components to adjust for AUM

How and why ETFs pay distributions

What it costs to own ETFs and how to make sense of net expense ratios

How ETFs can be used for both conservative passive investing, as well as themed investing and to gain exposure to more or less risk

Eric’s take on crypto, which he calls a “seven dimensional object” that he can’t get his head around fully. “There’s an element of religion to it,” he says.

Why he thinks gold is underrated as a store of value

Life in South Philadelphia

You can listen to that podcast here:

About Phil Bak: Phil is the founder/CEO of atNav, a startup solving the problem of liquidity in the ETF market. Phil has previously been the Founder/CEO of Exponential ETFs, an ETF issuer and sub-advisor (acquired by Toroso Asset Management), Managing Director at New York Stock Exchange, and Chief Investment Officer at Signal Advisors. Phil is an active voice advocating on behalf of entrepreneurs and innovators in the media and on his Substack he is @philbak1 on Twitter.

Disclaimer: I own positions in many gold and silver names and small speculative positions in crypto and crypto related names. This is not a recommendation to buy or sell any stocks or securities. I own or may own all crypto/stocks I mentioned or linked to in this piece. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

So…an example to be held aloft……an icon and a mascot to active management is a person who has crashed & burned and lost people millions. Really? Is he related to Joe Biden? This is guy is an utter tit. To be successful in life you do indeed need to be 1) different and contrarian 2) it is critical however that you are RIGHT. There are loads of “different people” who remain utterly wrong. Which is fine if you want to live on a beach and smoke weed….but NOT if you are managing peoples money and everyone is living in a MASS PSYCHOSIS thats leading to mini-cults sprouting up all over the place. Thats this guy attempts to defend this example of financial hooliganism suggests he is an inmate.

Chris - I’m glad you and Phil called out some of the promoters and pumpers in btc. It’s one of the biggest points of contention I have with my fellow (bitcoin) cult members; the zombie like zeal to affiliate with whatever big name says ‘bitcoin is good, all hale the bitcoin because bitcoin is good”. Last summer I was discussing this with my research partner; I said then and still think that if push comes to shove there is zero reliable ideological commitment to holding bitcoin if Saylor, Wood, etc need liquidity. There is even greater danger for retail and small capital investors to take these large names at face value without addressing the risk of a liquidity run by those same names (or them just selling off after the affiliate scam has run it’s course). What I like are the large positions taken by relatively quiet names. Afterthought: I’m glad to hear you call out Max Keiser for his ‘red meat for the bitcoin masses’ bs. Still hoping for you to get Pompliano as a guest.