Money Supply Growth Continues to Support the Stock Market

"Money Supply fell the entire year of 2022, bottomed in early 2023, and has been rising since."

By Peter Schiff

Money Supply is a very important indicator. It helps show how tight or loose current monetary conditions are regardless of what the Fed is doing with interest rates. Even if the Fed is tight, if Money Supply is increasing, it has an inflationary effect.

One key metric shown below is the “Wenzel” 13-week annualized money supply figure. It was made popular by the late Robert Wenzel who tracked the metric weekly as an indicator of where the economy might be headed.

Recent Trends

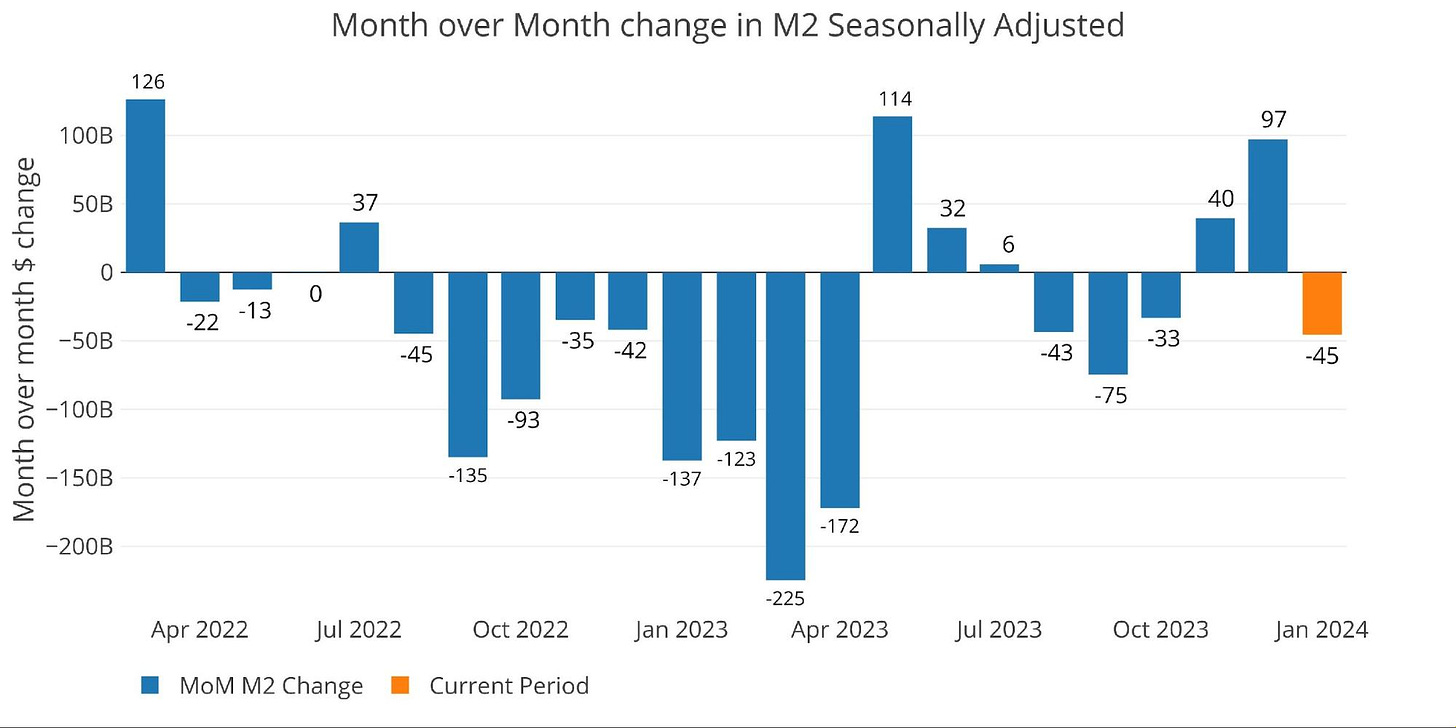

Seasonally Adjusted Money Supply is delayed by a month. The slowdown shown below is from January.

Figure: 1 MoM M2 Change (Seasonally Adjusted)

January was a pretty big drop of -2.6%.

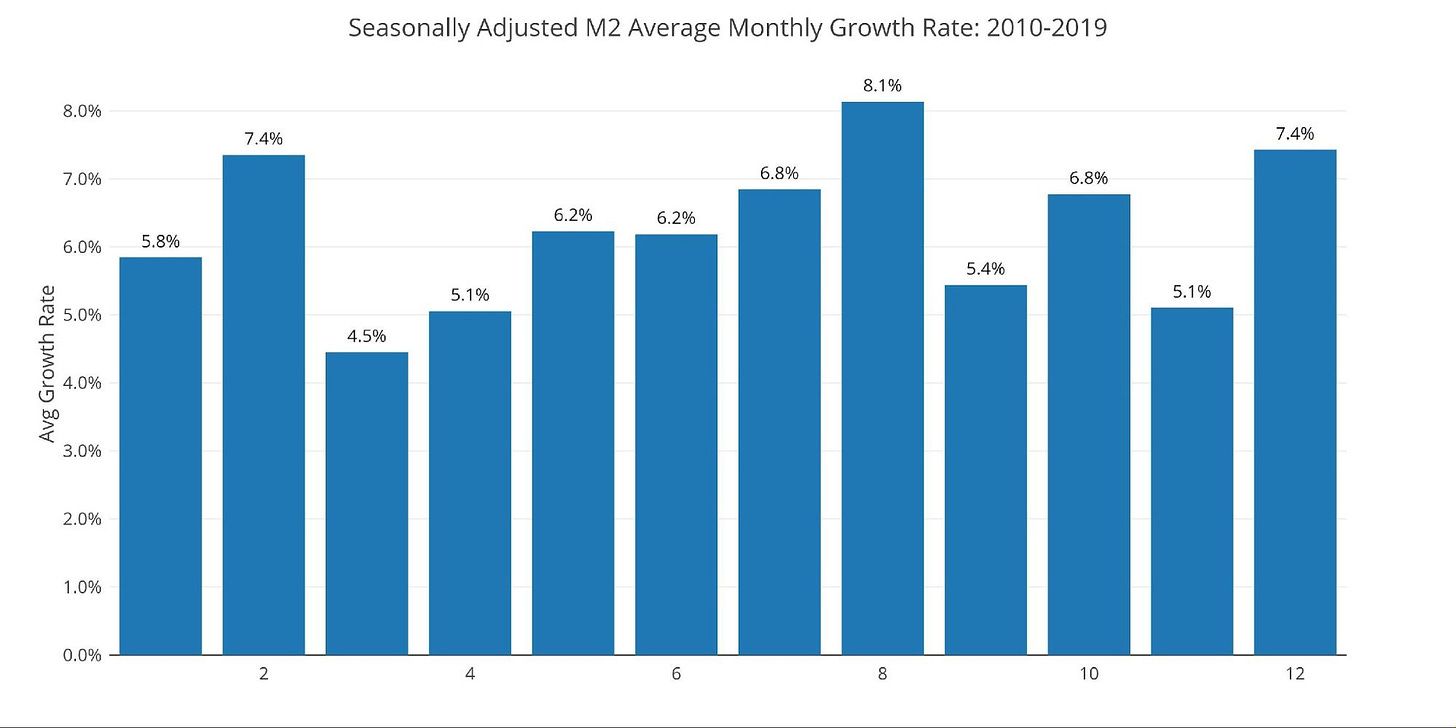

Figure: 2 M2 Growth Rates

This is well below the January average of +5.8%.

Figure: 3 Average Monthly Growth Rates

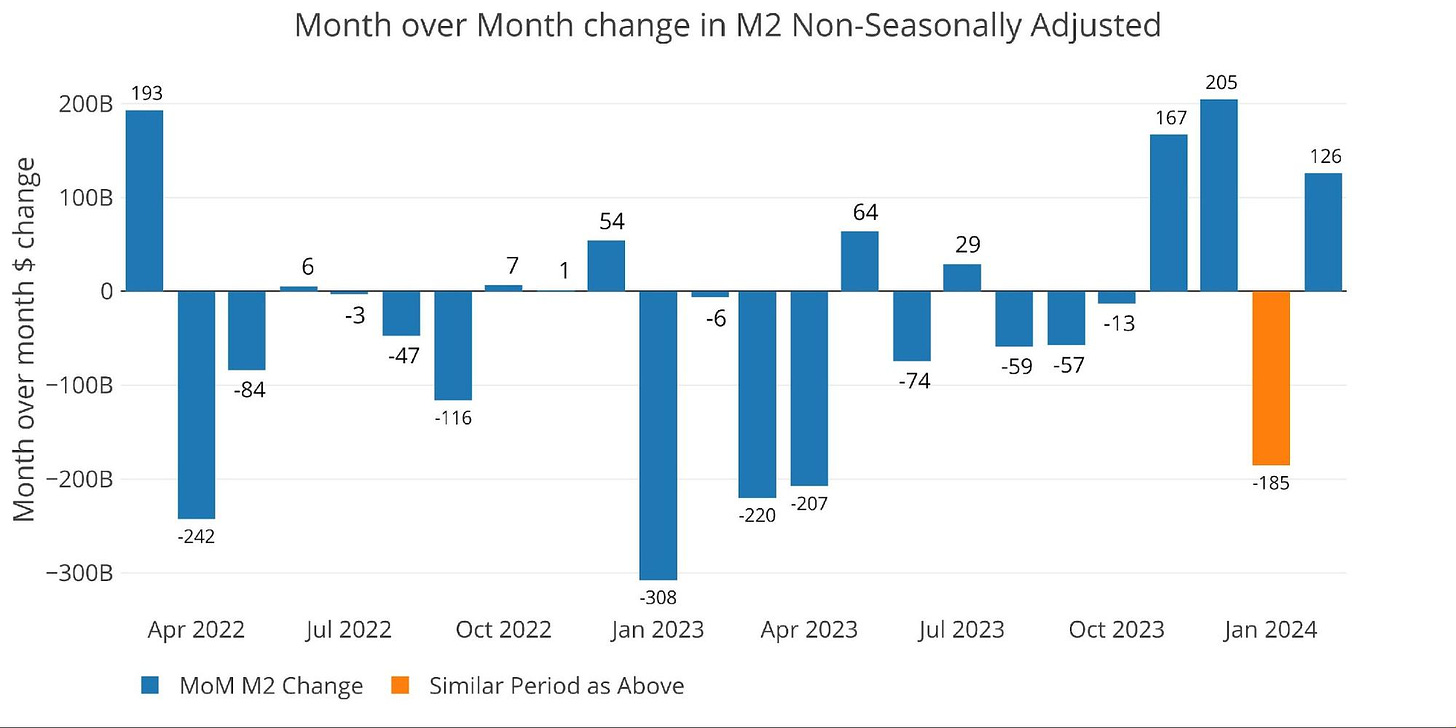

Non-seasonally adjusted numbers show data through early February, with a large uptick in the most recent period.

Figure: 4 MoM M2 Change (Non-Seasonally Adjusted)

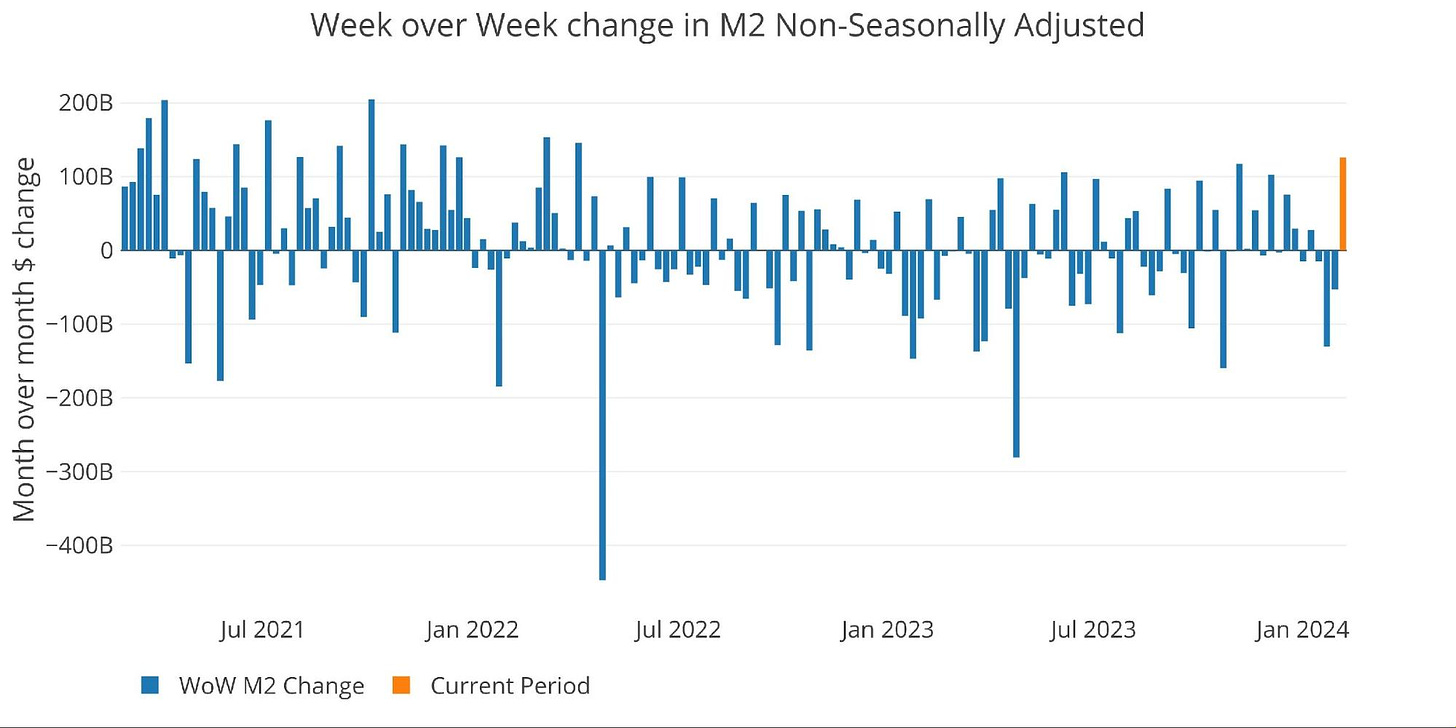

The weekly data below shows the activity over the last month in unadjusted money supply. You can see the big jump in the most recent week.

Figure: 5 WoW M2 Change

The “Wenzel” 13-week Money Supply

The late Robert Wenzel of Economic Policy Journal used a modified calculation to track Money Supply. He used a trailing 13-week average growth rate annualized as defined in his book The Fed Flunks. He specifically used the weekly data that was not seasonally adjusted. His analogy was that in order to know what to wear outside, he wants to know the current weather, not temperatures that have been averaged throughout the year.

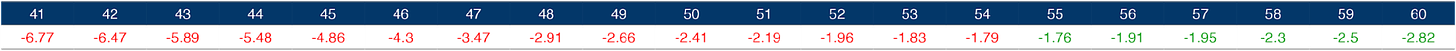

The objective of the 13-week average is to smooth some of the choppy data without bringing in too much history that could blind someone from seeing what’s in front of them. The 13-week average growth rate can be seen in the table below. Decelerating trends are in red and accelerating trends are in green.

Figure: 6 WoW Trailing 13-week Average Money Supply Growth

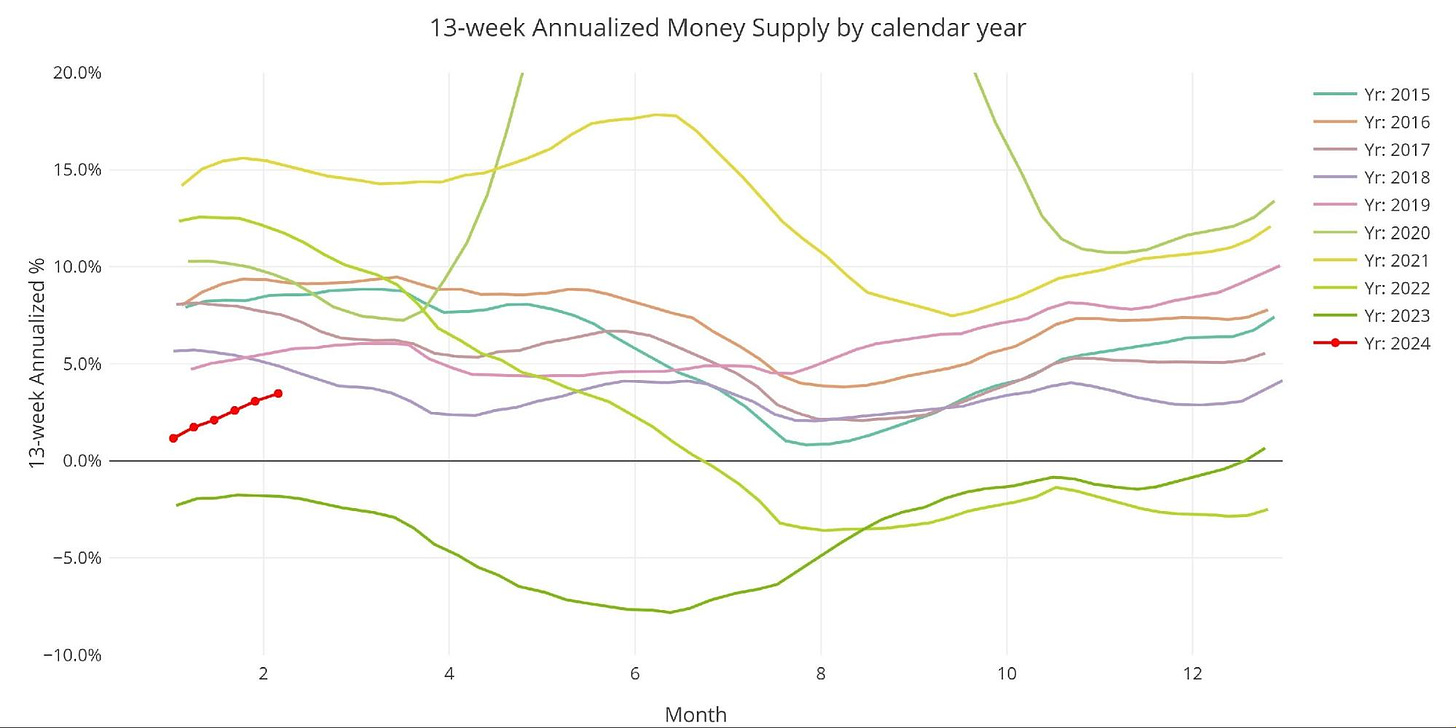

The plot below shows how this year compares with previous years. The 13-week average reached an all-time low back in May of last year but has been accelerating ever since. This could be one of the components driving the stock market higher. Record negative Money Supply growth turning positive will certainly provide a tailwind to equities.

Figure: 7 Yearly 13-week Overlay

Inflation and Money Supply

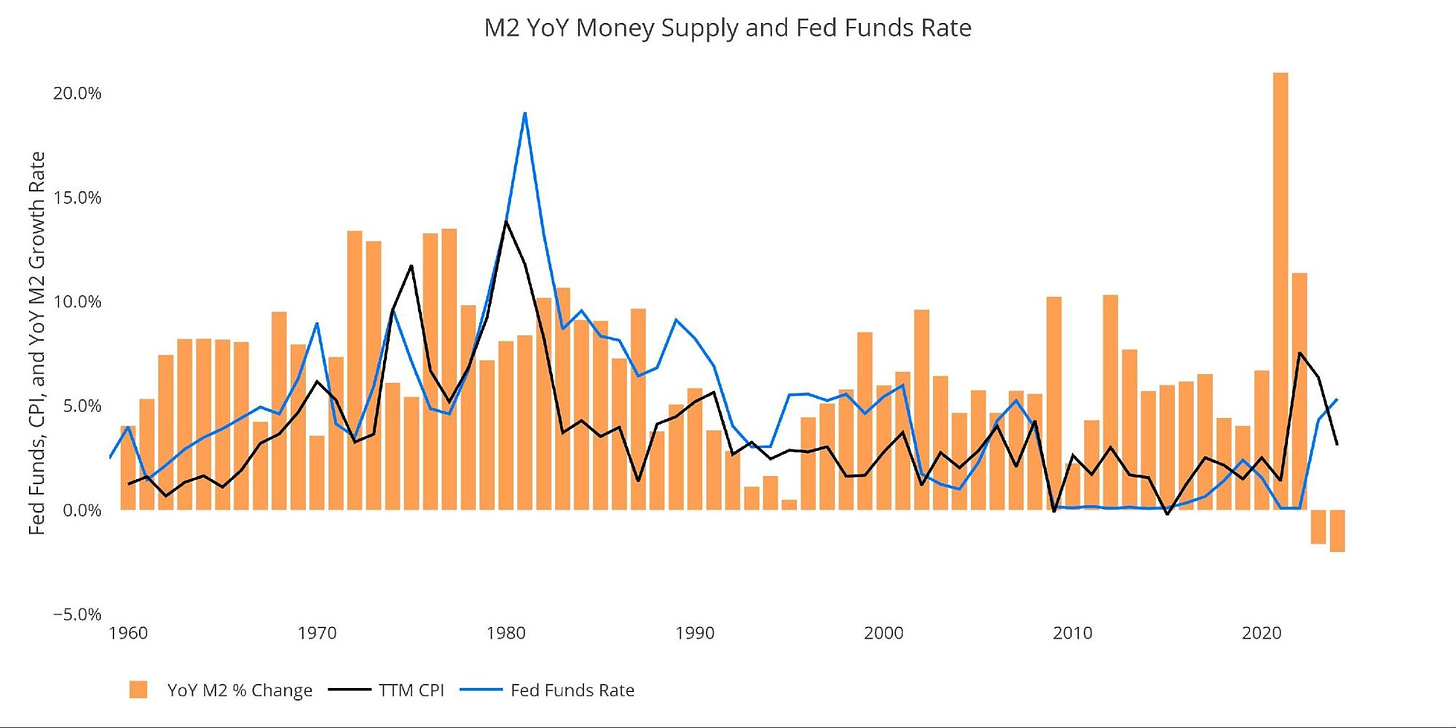

The chart below shows the history of inflation, Money Supply, and Fed Funds. As shown, in 1970 inflation worked with 2 year lag compared to Money Supply. Given this, another bout of inflation may be lurking just under the surface.

Figure: 8 YoY M2 Change with CPI and Fed Funds

Historical Perspective

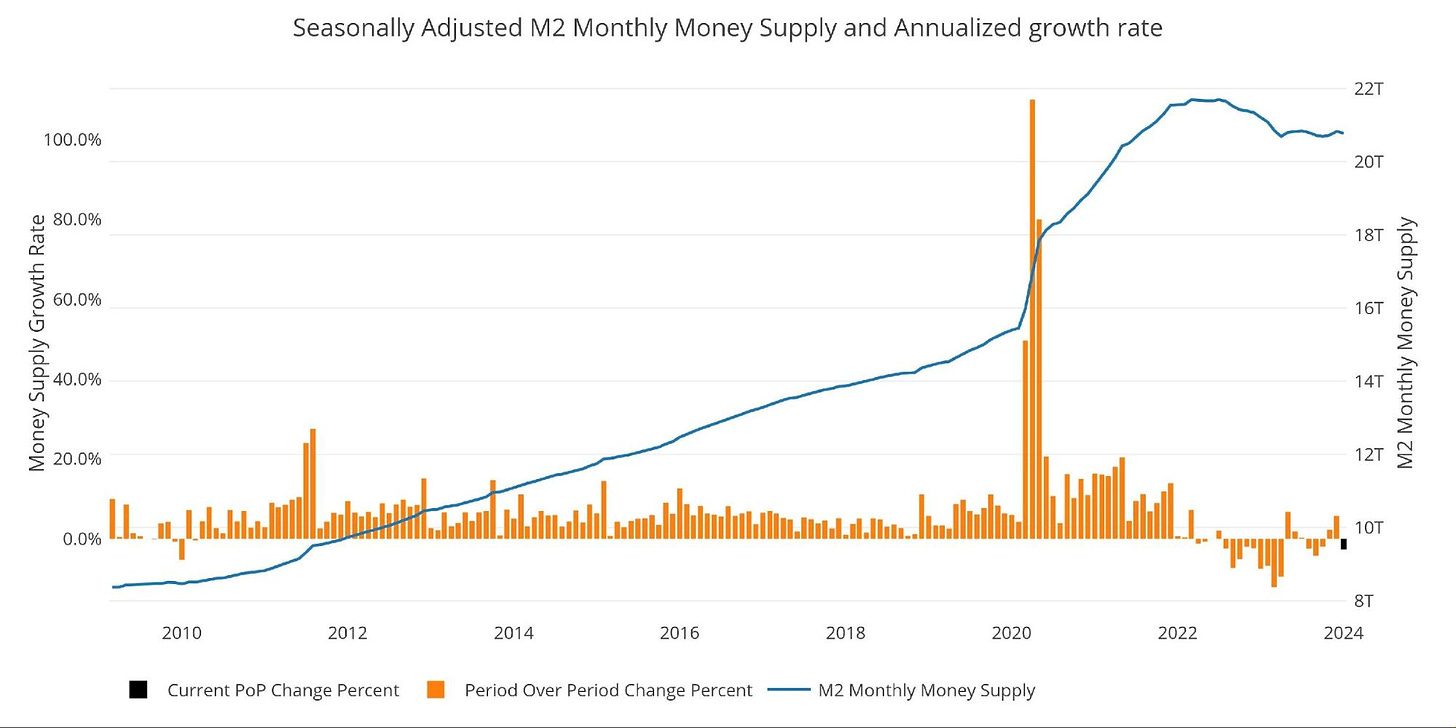

The charts below are designed to put the current trends into historical perspective. The orange bars represent annualized percentage change rather than a raw dollar amount.

Figure: 9 M2 with Growth Rate

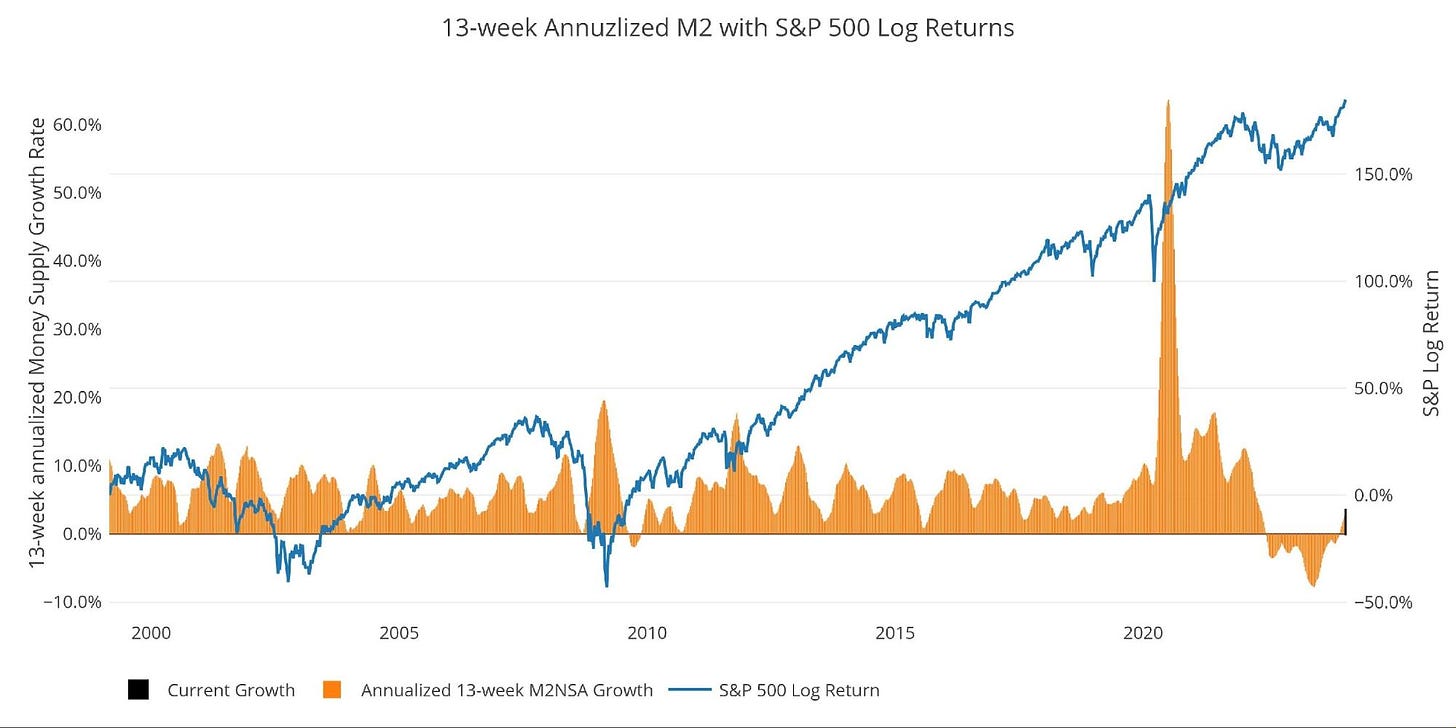

Below is the 13-week annualized average over history. This chart overlays the log return of the S&P. Mr. Wenzel proposed that large drops in Money Supply could be a sign of stock market pullbacks. His theory, derived from Murray Rothbard, states that when the market experiences a shrinking growth rate of Money Supply (or even negative) it can create liquidity issues in the stock market, leading to a sell-off.

While not a perfect predictive tool, many of the dips in Money Supply precede market dips. Specifically, the major dips in 2002 and 2008 from +10% down to 0%. 2022 was highly correlated with a fall in Money Supply and the rebound has corresponded with the big stock market move we have seen recently.

Please note the chart only shows market data through Feb 5th to align with available M2 data.

Figure: 10 13-week M2 Annualized and S&P 500

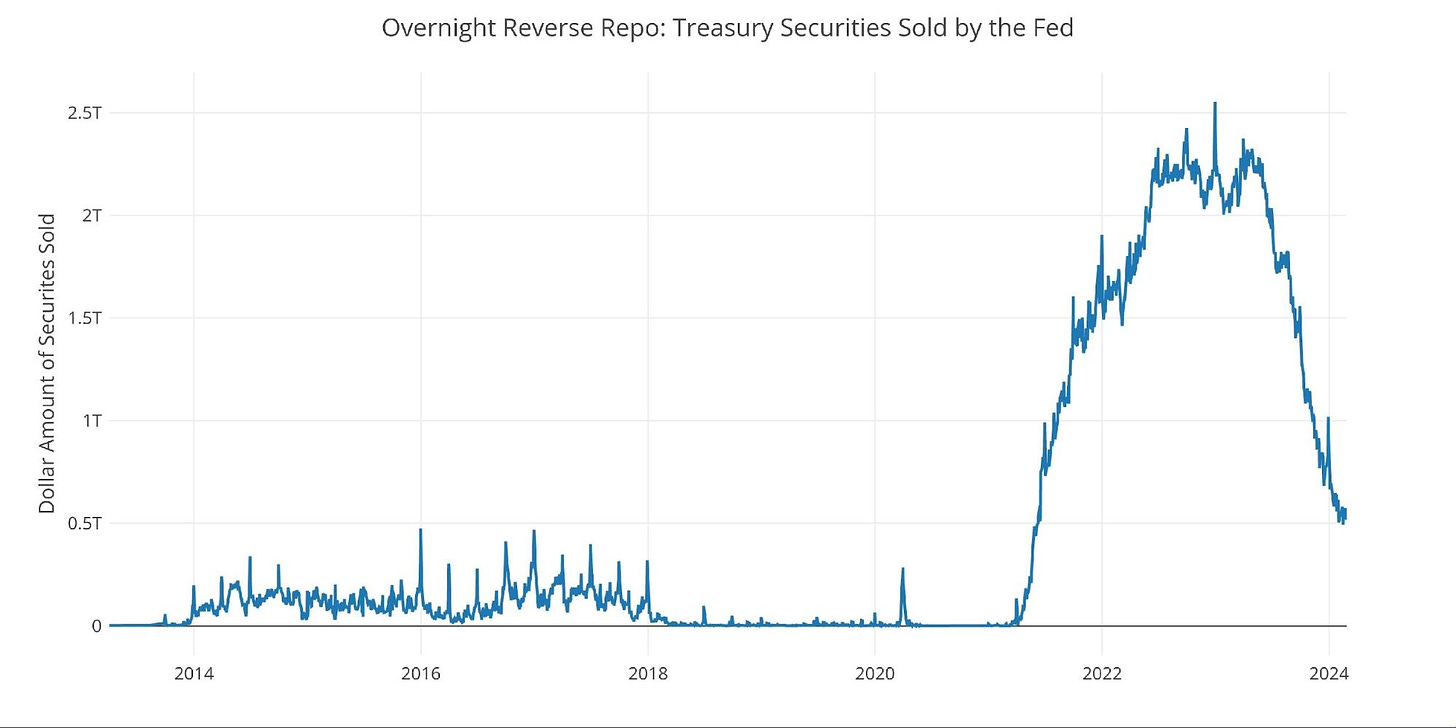

One other consideration is the reverse repo market at the Fed. This is a tool that allows financial institutions to swap cash for instruments on the Fed balance sheet.

Reverse Repos peaked at $2.55T on Dec 30, 2022. Money has been gushing out ever since. While the Fed has been maintaining higher interest rates, this drop in reverse repos is certainly providing liquidity to the economy, driving Money Supply and the stock market higher.

Figure: 11 Fed Reverse Repurchase Agreements

Wrapping Up

Money Supply can be a leading indicator and help explain the action in the stock market. Money Supply fell the entire year of 2022, bottomed in early 2023, and has been rising since. Keeping an eye on Money Supply can help one understand how much wind the stock market has at its back.

Data Source: https://fred.stlouisfed.org/series/M2SL and also series WM2NS and RRPONTSYD. Historical data changes over time so the numbers of future articles may not match exactly. M1 is not used because the calculation was recently changed and backdated to March 2020, distorting the graph.

Data Updated: Monthly on fourth Tuesday of the month on 3-week lag

Schiff Gold: Interested in learning how to buy gold and buy silver? Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I do not fact check contributor material that I aggregate from other sources. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

The concept makes sense and is in all likelihood true, but the charts provided don’t show the clear correlation. There could be a better way to show proof of concept

Thanks for the great article. It's my observation too that the environment has been pro-liquidity for a while now. The Fed has had a tough time getting its efforts to stick against the backdrop of consistently large fiscal deficits.

I'll be curious to see how the market reacts when the BTFP expires and if/when the Fed more clearly signals rate cuts are due much later than anticipated.