"Monetary Debasement" Is Highly Likely: Larry Lepard

This week, I published the most recent letter from one of my good friends, hedge fund manager Lawrence Lepard.

This week, I published the most recent letter from one of my good friends, hedge fund manager Lawrence Lepard.

His thoughts heading into Q4 are broken down into two parts which you can read here. Today, I wanted to slide in one more excerpt from Larry’s 30+ page writeup about the state of the economy and the “fiscal doom loop” we find ourselves in.

In his letter’s appendix, Larry emphasizes how Federal interest expensive is very sensitive to a rapidly growing short end yield. He issued 2 charts to show why he believes we are in a “debt doom loop”.

FROM LARRY’S Q3 2023 LETTER

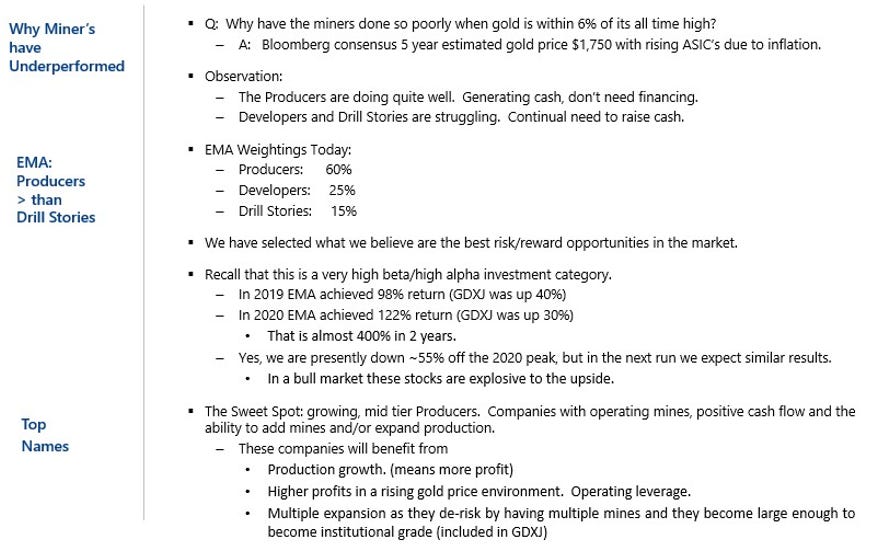

Below is a snapshot of comments on our current portfolio positioning:

The musical genius, Tom Petty was surely correct when he wrote the song “The Waiting Is The Hardest Part”. Some of the lyrics are genius: “every day you see one more card, you take it on faith, you take it to the heart” (Chorus).

We will say this. We like the cards we see. We wish the game was moving a little faster, but we remain highly confident that our thesis is correct and that we will do the job you entrusted us with over the next few years. It is hard to be patient, we know. It has not worked as we expected. But there are very few things in finance and investing that are highly likely, and we strongly believe that given the system of Governments and Central Banks that we live under that “monetary debasement” is highly likely. That is the good news. The bad news is getting the timing right is tough, but when it does happen, we are not talking about small upside. The upside is very outsized.

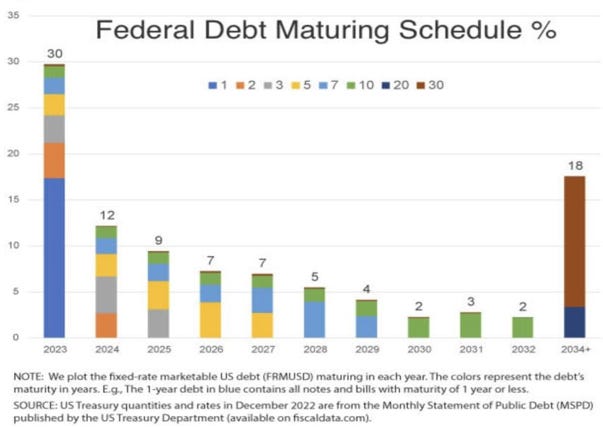

We think that it is important to understand how front end weighted the US Federal Debt has become. This means that the Federal interest expense is very sensitive to the short term interest rate. The next two charts help us to understand this more clearly.

First, see the chart below. Note how half of the debt will need to be rolled over within the next 3 years.

Most of this debt was issued with interest rates that are way below today’s level.

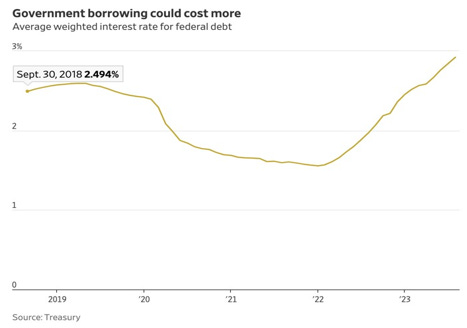

Then consider the following chart which shows that presently the US Federal Government is paying 2.49% on average on its debt burden. Consider that US Federal Interest expense is running at a $970B annual rate (see Parts 1 and 2 of this letter).

Further, consider that US Bond interest rates now range between 4.6% and 5.4%, or nearly twice the average that is being paid now. As the bonds above mature they will need to be rolled over at higher rates. Total US Federal Debt is $35.5T but it is growing at $2-3T per year (conservatively).

Let’s say the average interest rate becomes 4.6% over the next few years and deficits run at $2.5T per year. This means that in two years US Federal interest expense will be $1.9T, or more than double today’s run rate. All else equal we would add another $1 Trillion to the deficit. This helps to explain why we are in a debt doom loop.

You can read Larry’s full 30+ page Q3 letter here.

Larry’s Disclaimer: These presentation materials shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell, any securities or services. Any such offering may only be made at the time a qualified investor receives from EMA formal materials describing an offering plus related subscription documentation (“offering materials”). In the case of any inconsistency between the information in this presentation and any such offering materials, including an offering memorandum, the offering materials shall control.

Securities shall not be offered or sold in any jurisdiction in which such offer or sale would be unlawful unless the requirements of the applicable laws of such jurisdiction have been satisfied. Any decision to invest in securities must be based solely upon the information set forth in the applicable offering materials, which should be read carefully by prospective investors prior to investing. An investment in EMA not suitable or desirable for all investors; investors may lose all or a portion of the capital invested. Investors may be required to bear the financial risks of an investment for an indefinite period of time. Investors and prospective investors are urged to consult with their own legal, financial and tax advisors before making any investment.

The statements contained in this presentation are made as of the date printed on the cover, and access to this presentation at any given time shall not give rise to any implication that there has been no change in the facts and circumstances set forth in this presentation since that date. These presentation materials may contain forward-looking statements within the meaning of US securities laws. The forward-looking statements are based on EMA’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to it, and can change as a result of known (and unknown) risks, uncertainties and other unpredictable factors. No representations or warranties are made as to the accuracy of such forward-looking statements. EMA does not undertake any obligation to update any forward-looking statements to reflect circumstances or events that occur after the date on which such statements were made. Historical data and other information contained herein, including information obtained from third-party sources, are believed to be reliable but no representation is made to its accuracy, completeness, or suitability for any specific purpose.

No representation is being made that any investment will or is likely to achieve profits or losses similar to those shown. Past performance is not indicative of future results. This report is prepared for the exclusive use of EMA investors and other persons that EMA has determined should receive these presentation materials. This presentation may not be reproduced, distributed or disclosed without the express permission of EMA.

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

Thanks for the Petty reference. Its been very frustrating watching high cash flow energy positions stagnate. Patience.

This is a great article. It would also be a great podcast. I really seek out Larry Lepard and other like Luke Gromen, and try to hear what they have to say in long-form interviews.