Modern Monetary Theory And Boiling Frogs

"When it comes to climate change, inequality, healthcare for all, and all the other Green New Deal issues, they want a world in which nobody asks about the costs."

By Jonathan Newman, Mises Institute

“Why do we borrow our own currency in the first place?”

Stephanie Kelton posed this question in her new documentary, Finding the Money, and a clip of Jared Berstein’s fumbled response to the question has gone viral on social media. Bernstein is the Chair of the Council of Economic Advisers to Biden, and so we would expect that he would have an articulate answer to Kelton’s question, but he did not.

Instead of trying to parse his response or explain why he fumbled, I want to provide an answer: the State borrows to expropriate real resources from the private, productive part of society.

When I made this claim on Twitter, one MMTer responded (somewhat) approvingly: “We all agree on this part. The question is how they do it and what the effect is. MMT gets that part right [and] Austrians get it wrong.”

So let me go into a bit more detail. The reason the State borrows money (money that it also has the power to tax and print) is so that it can balance the negative political consequences of its various methods of expropriation.

Murray Rothbard would take issue with the original question as soon as the third word, “we,” is uttered:

The useful collective term “we” has enabled an ideological camouflage to be thrown over the reality of political life. If “we are the government,” then anything a government does to an individual is not only just and untyrannical but also “voluntary” on the part of the individual concerned. If the government has incurred a huge public debt which must be paid by taxing one group for the benefit of another, this reality of burden is obscured by saying that “we owe it to ourselves” (Anatomy of the State, p. 10)

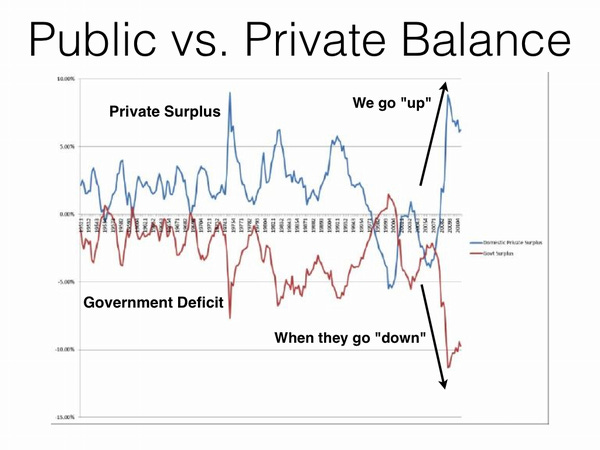

Rothbard was responding to those who downplay the burden of government debt by over-aggregating the groups of winners and losers into one “we.” MMTers, on the other hand, go many strides further by claiming that public debt isn’t a burden at all. For them, public debt is private savings—they literally flip public debts and deficits upside down.

While they describe their framework as providing the “full picture” of government finance, they do not proceed in their analysis (at least not in sufficient detail) by asking what happens when the government pays the people holding the bonds. The money used to pay back the bondholder ultimately comes from taxing and printing, both of which involve expropriation from the private sector.

So MMT’s public-debt-as-private-savings falls apart with just one additional step of analysis. The closest Kelton gets to this insight in her book, The Deficit Myth, is this: “In truth, paying interest on government bonds is no more difficult than processing any other payment. To pay the interest, the Federal Reserve simply credits the appropriate bank account.” Later, she describes that the only potential constraint is price inflation: “Every dollar that is paid in the form of interest becomes income to bondholders. If those interest payments become too large, the risk is that total spending could push the economy above its speed limit.”

And that’s the end of it. Paying bondholders might have negative consequences in the form of excessive price inflation. MMTers don’t connect debt service to their prior claims that public debt is actually private savings because it negates the alleged aggregate benefits of government bonds held by the public. Paying bondholders requires an expropriation from the productive part of society in the form of either taxes or diminished purchasing power, which means public debt is not private savings in the aggregate.

They employ an individual bondholder’s perspective when it suits them and employ an aggregate perspective when it suits them. They see, correctly, that holding a bond means that you can receive payments from Uncle Sam in the future, but then gloss over the costs of Uncle Sam servicing this debt. It’s a perfect example of a violation of what Henry Hazlitt described in 1946 as the art of economics: “The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups.”

In Economics in One Lesson, Hazlitt relied on the work of Frédéric Bastiat from 1850. Despite its name, Modern Monetary Theory is full of old errors. The only thing new about it is the jargon they use to do something people have been doing for millennia: disguise the true costs of government expropriation.

Since the State has nothing and produces nothing, everything it does involves expropriation and distortion. The reason it employs a variety of methods of expropriation is because each one has negative political consequences. If any one method is employed “too much,” the politicians and bureaucrats who wield that particular weapon get blamed and can lose their position. Using one particular weapon “too much” makes the State’s expropriation obvious and risks revolt in either soft or hard forms.

Heavy taxation is unpopular. High interest rates are unpopular. Price inflation is unpopular. But if the State can blend taxing, borrowing, and printing in just the right amounts, then they can boil the frogs without them jumping out of the pot.

This insight reveals something about MMT. As much as its proponents brandish accounting tautologies and purely descriptive claims about government finance, in the end it is 100% political. Their framework is about giving the State maximum power—power to expropriate and power to override what would prevail in unhampered markets. This is on full display in their writings and in their new film. They want to revolutionize the way politicians and voters view money and debt for the sake of their progressive agenda. When it comes to climate change, inequality, healthcare for all, and all the other Green New Deal issues, they want a world in which nobody asks about the costs.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. They are either submitted to QTR, reprinted under a Creative Commons license or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

So, I watched the video until I developed severe nausea and had to discontinue around the 50 minute mark. From the start professor Kelton basis, her entire thesis on a false premise. She says that The US Treasury prints our “money” and it does not. Apparently she’s unaware or lying about the fact that the federal reserve, A cluster of private bank, issue our currency. Congress passes the spending ball and then borrow money from the Fed of reserve at an interest rate. She seems to think that, unlike while Zimbabwe,, Germany, Rome, Venezuela, whatever other failed state that printed their own currency without control, somehow we will be different

MMT: Wherein the MMT Moron observes the Snake eating itself from the tail end, and proclaiming that it is "Well fed".