Markets Have More Downside & Tesla's Hypergrowth Story Is Over: Mark Spiegel

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter last week, with his updated take on the market’s valuation and Tesla.

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter last week, with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast (and will be coming back on again soon hopefully) and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Mark was kind enough to allow me to share his thoughts from his September 2022 investor letter, where he noted that his fund was up 0.6% for the month.

(FYI: This post also includes a Fringe Finance exclusive addendum from Mark, written on October 9, 2022, that was not including in his September letter to investors, since the letter was published before numerous developments in the Twitter trial and Q3’s delivery numbers were posted.)

Mark’s Thoughts On The Market

This month our shorts kept us from losing money while our longs kept us from making much. Nevertheless, as the month progressed and the market became increasingly oversold I added to those longs and even bought a new one (which I discuss later in this letter), and by month’s end the market became so short-term oversold that I (perhaps temporarily) closed out our SPY short (which I may reinitiate from higher levels) and, for the first time since last year, the fund is now slightly net long. (We do, of course, remain short Tesla, the bubble-fraud poster child for Fed and regulatory incompetence, malevolence and stupidity.)

Despite covering our SPY short due to oversold market conditions, I still believe the major stock indexes— although not all individual stocks—have more downside to go, the inevitable hangover from the biggest asset bubble in U.S. history. For far too long, the Fed printed $120 billion a month and held short-term rates at zero while the government concurrently ran a record fiscal deficit. Now, thanks to the massive inflationary hangover from those idiotic policies, the Fed is reducing its balance sheet and raising interest rates, and although the current rate of > 8% year-over-year inflation is almost certainly unsustainable, the war on fossil fuel (watch the price of oil when Biden’s blatantly political drawdown of our SPR ends after the midterms!), expensive “onshoring” and fewer available workers make a new baseline of at around 4% inflation likely.

In addition to tighter money, why else do I think the stock indexes are eventually headed lower? First and foremost, stocks are still expensive. According to Standard & Poor’s, Q2 GAAP S&P 500 earnings plus estimates for the next three quarters total around $192. A 15x multiple on that—generous for a rising rate, recessionary (or even just slow-growth) environment—would bring the S&P 500 down to 2880 vs. September’s close of 3585. And remember, just as in bull markets PE multiples usually overshoot to the upside, in bear markets they often overshoot to the downside. A bottom formed at 14x, 13x or even 12x earnings is not unfathomable.

[QTR’s Note: I wrote about this in my piece The Illusion of Safety]

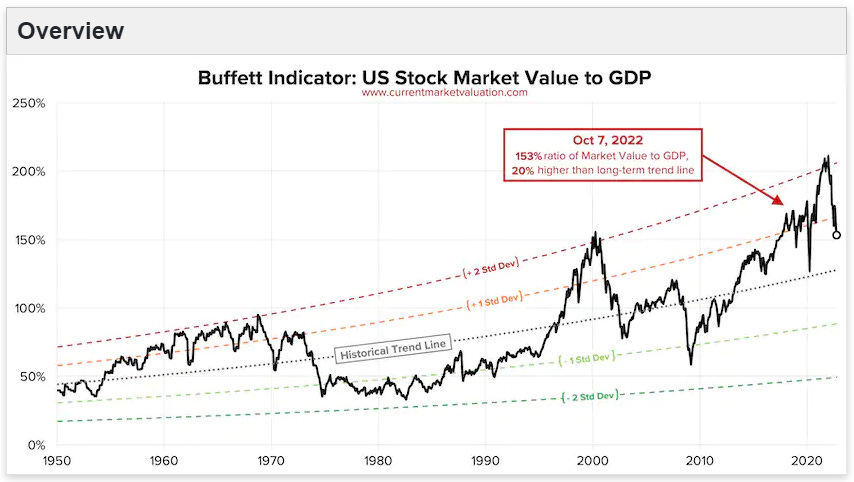

Additionally, we can see from CurrentMarketValuation.com that the U.S. stock market’s valuation as a percentage of GDP (the so-called “Buffett Indicator”) is still very high, and thus valuations have a long way to go before reaching “normalcy”:

Interest costs on the Federal debt are already set to grow massively. Does anyone seriously think this Fed has the stomach to face the political firestorm of Congress having to slash Medicare, the defense budget, etc. in order to pay the even higher interest cost that would be created by upping those rates to a level commensurate with crushing even just 4% inflation?

Powell doesn’t have the guts for that, nor does anyone else in Washington; thus, this Fed will likely be behind the inflation curve for at least a decade. And that’s why we remain long gold (via the GLD ETF).

Mark’s Positions & Thoughts On Tesla

We continue to own a long position in Volkswagen AG (via its VWAPY ADR, which represent “preference shares” that are identical to “ordinary” shares except they lack voting rights and thus sell at a discount).

VW currently sells at less than 4x estimated 2022 earnings (an estimate that will likely come down a bit) due to a combination of “recession fears” and short-term issues obtaining energy (until either the Ukraine war is over or alternative supplies are in place), but it controls a massive number of terrific brands including Porsche, of which in September it IPO’d a small percentage at a $73 billion valuation—valuing the rest of the company at only around $10 billion; I believe Audi alone is worth 4x that! Additionally, VW will pay a January special dividend of around $1.85 per VWAPY share in proceeds from Porsche’s IPO, and the regular yield is currently over 5%!

Meanwhile VW Group’s EVs (several of which are more technologically advanced than any Tesla) combine to heavily outsell Tesla in Europe and by 2025 should outsell Tesla worldwide. In total (without supply chain shortages) VW sells roughly 9 million vehicles a year vs. around 1.3 million a year for Tesla.

Yet Tesla’s market cap (at around $831 billion) is around 11x VW’s, meaning that an investor pays around 76x as much for each Tesla sold as for each VW sold! Meanwhile, in July the company reported excellent financial results for the first half of 2022 along with positive guidance for the second half, and replaced its showboating, Musk-fanboy CEO Herbert Diess with Oliver Blume, who has a PhD in mechanical engineering and created record profits running Porsche… an excellent decision, I believe. And in August VW announced a deal with Canada to obtain raw materials for batteries, thus ensuring that many of its North America-assembled models will eventually qualify for the full new U.S. EV tax credit.

We continue to own a long position in General Motors (GM), which currently sells for only around 4.6x the $7/share midpoint of 2022’s adjusted EPS guidance (which I assume will likely come down a bit). GM is doing all the right things in electric cars, autonomous driving (via its Cruise ownership) and software, yet it’s extremely cheap because, as with other established automakers, investors have (for now) forsaken it in favor of “electric car pure-plays,” a sector which has thus become the largest valuation bubble in history. And regarding “autonomy,” keep in mind that unlike Tesla, which sells a LiDAR-less fraud to rubes, Cruise is already running a fleet of fully autonomous cars in San Francisco (and soon Phoenix and Austin); you can see many videos of this on its YouTube channel. GM will also benefit more than any other manufacturer from the proposed new EV tax credit, as it will soon have the largest variety of North American-made (a requirement of the credit) EV models fitting within the new price restrictions. Additionally, in August the company reinstituted a modest dividend.

We also have a new long position.