Markets Are Breaking

Ethereum is down 23%. Bitcoin 10%. Japan's index more than 5%. Central bankers...it's your move.

While I have no idea what the U.S. market will look like by the cash open tomorrow morning, one thing is for sure: panic in Japan has continued, and it is setting off a long-overdue psychological time bomb in the United States.

On Friday, I noted that the drastic sell-off taking place was a result of three things: Japan unexpectedly hiking rates into a slowdown, the tensions and uncertainty surrounding the escalation between Israel and Iran, and just enough macroeconomic data in the Friday jobs report and 4.3% unemployment rate to kindly remind U.S. investors that a soft landing is all but a mathematical impossibility.

As of late Sunday night, none of these issues have been addressed, and until they are, I expect the turmoil to continue. By the time the market opens in the US in about 10 hours, the Bank of Japan or the Fed may have tried to step in and talk their way out of the situation, either directly or through reporters and banks who act as their respective mouthpieces.

Regardless of what interventions central banks may try to put in place tonight or tomorrow, there’s no denying the fact that, in my opinion, confidence in the market has officially broken.

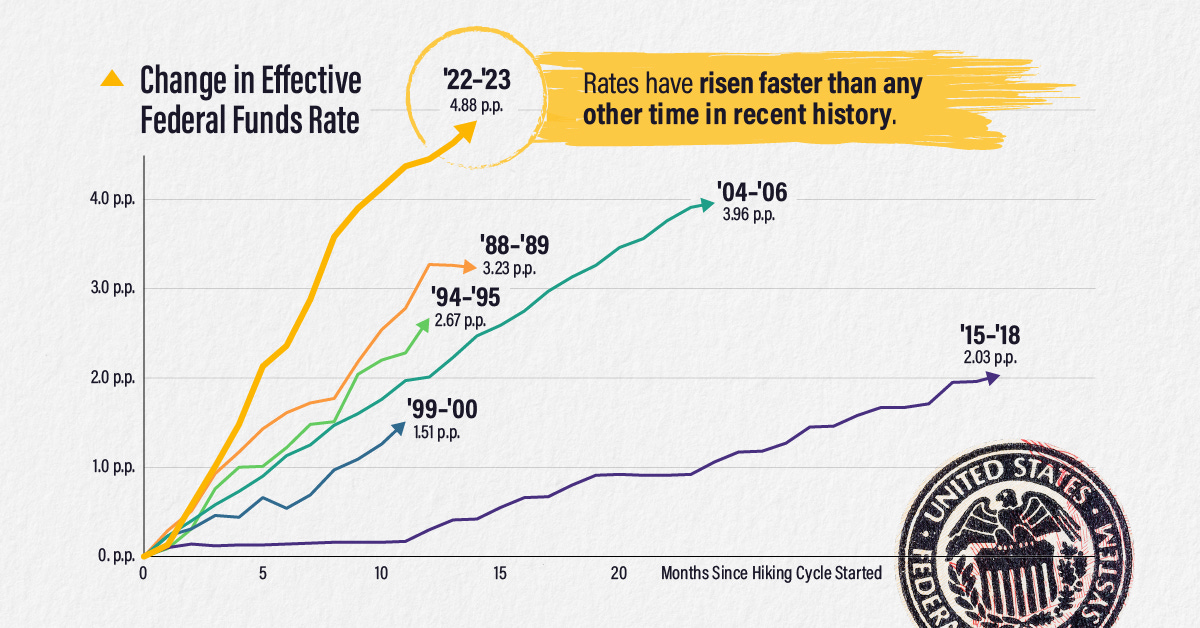

For two years, I have been warning about the obvious reality of things: that hiking rates at an accelerated pace on the largest debt bubble in history is a one-way ticket to economic calamity.

And, for two years, everybody has pretended that one plus one doesn’t, in fact, equal two, and that somehow the Fed had harnessed a superpower that was going to allow them to perform an end-around, avoiding the natural laws of math and economics, and engineer a “soft landing”.

It takes a special type of hubris to believe this, given the definitive nature of the numbers involved, but that’s the specialty of most financial media.

Make no mistake about it, however, that fairytale has just ended in a big way. At this point, it doesn’t matter whether Japan is the fuse that lights the recession bomb in the U.S. or if U.S. markets are going to have a comeuppance unrelated to Japan. What matters is that the attitude has drastically shifted in the last two trading sessions to tremendously “risk-off”. This is evident in the extreme moves lower we are seeing in cryptocurrencies, which I have often described as the lowest-hanging “risk-on” fruit.

People have heard me say it about the Covid crash multiple times: it’s never a problem until one day you wake up and everything’s different. I think these shocks to equity markets - and crypto - over the last two sessions officially mark a turning point where now “everything’s going to be different.” Here’s why.