Market Moves Like These "Have Not Ended Well"

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q3 2024. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 1 of his letter, part two will be published later this week.

QUARTERLY OVERVIEW

In the second quarter ended June 30, the most notable development was that silver performed very well and followed the Q1 break-out in gold. Recall, in early March gold broke through the 3-year resistance ceiling at $2,070/oz. and subsequently shot as high as $2,400 before backing off to the $2,375 area presently. In the case of silver, the ceiling was in the $26 -- $27/oz area, and in early April silver broke through this and subsequently traded up to $32 before settling at $30-$31/oz area presently.

This is important because, historically, silver tends to lag gold, but when silver gets going it moves much higher and much faster. The silver break-out confirms gold’s break-out and historically a falling gold to silver ratio is a part of all precious metals bull markets.

Another interesting development in the quarter was the S&P 500. After a rocky April, where the S&P 500 index was down -4.1%, the stock market came storming back in May and June and hit a new record high on June 29, leaving the stock market up + 15.3% in the 1H 2024. Nothing seems to slow this stock market down and it is now up +81% since January 1, 2020. Investors seem convinced that stocks are invincible and the winning strategy since 2008 has been to buy the dip. Given record valuations and higher interest rates that are just beginning to have an impact on consumption, we believe there is vulnerability there, even though we would not short it. (meaning it is probably ready to break).

The next chart is incredible. It depicts the “everything bubble” driven by fiat money creation.

Note the S&P 500 (white line) and how it’s so FAR ABOVE its 200 Day Moving Average (yellow line)

In both 2000 and 2008, the S&P 500 corrected back to its 200 day moving average

That would be a 55% crash if that happened now

Also note the M2 Money Supply (blue line), which has blown this everything bubble for the past 15 years. o M2 has increasingly had to do more heavy lifting over the past four years

That’s what happens in a levered economy – you need to print more to keep the game going

S&P 500 Index / 200 Day Moving Avg vs. M2 Money Supply: 1980-Present

What makes this bubble particularly risky is that it exists at the sovereign debt/currency level. Not simply dotcoms or houses. Historically, parabolic moves like the one above have not ended well. But who are we to say when it will end. When it does end, no amount of monetary accommodation is going to save it, and the amount of M2 growth necessary just to keep the system functioning is going to be substantial.

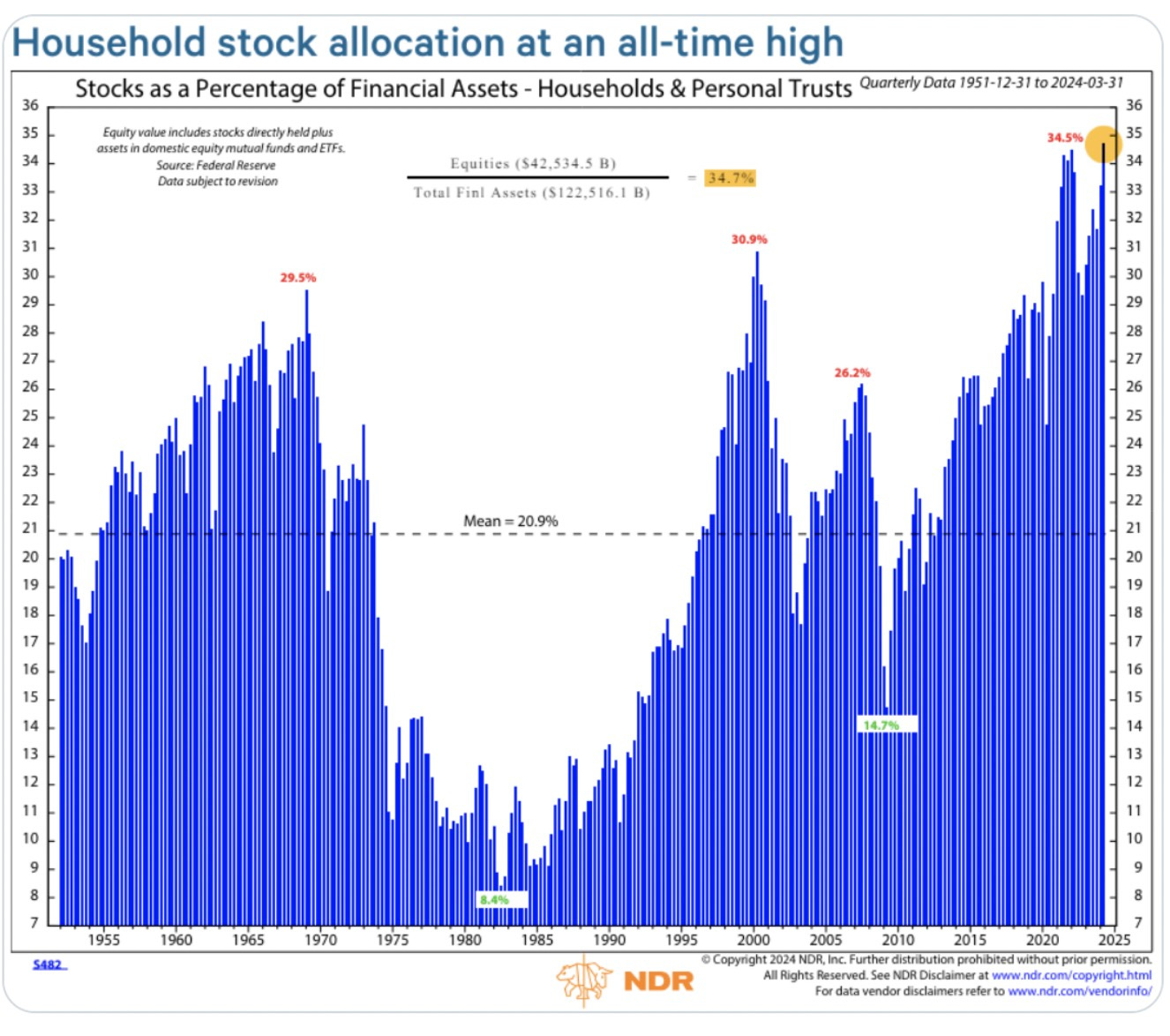

The chart below shows another view of this bubble. People sure do love their stocks with stocks comprising approximately 35% of household’s overall assets. Historically, peaks like this have led to rather large future drawdowns. Most particularly in the inflationary decade of the 1970’s, a period that we believe shares the same characteristics as the one we are now entering.

The reason we are focusing on the US stock market is that it is sucking all of the air out of the room for gold and silver mining stocks. People chase performance and so we need gold and silver shares to outperform the broader markets on a consistent basis and then more people will pay attention to them.

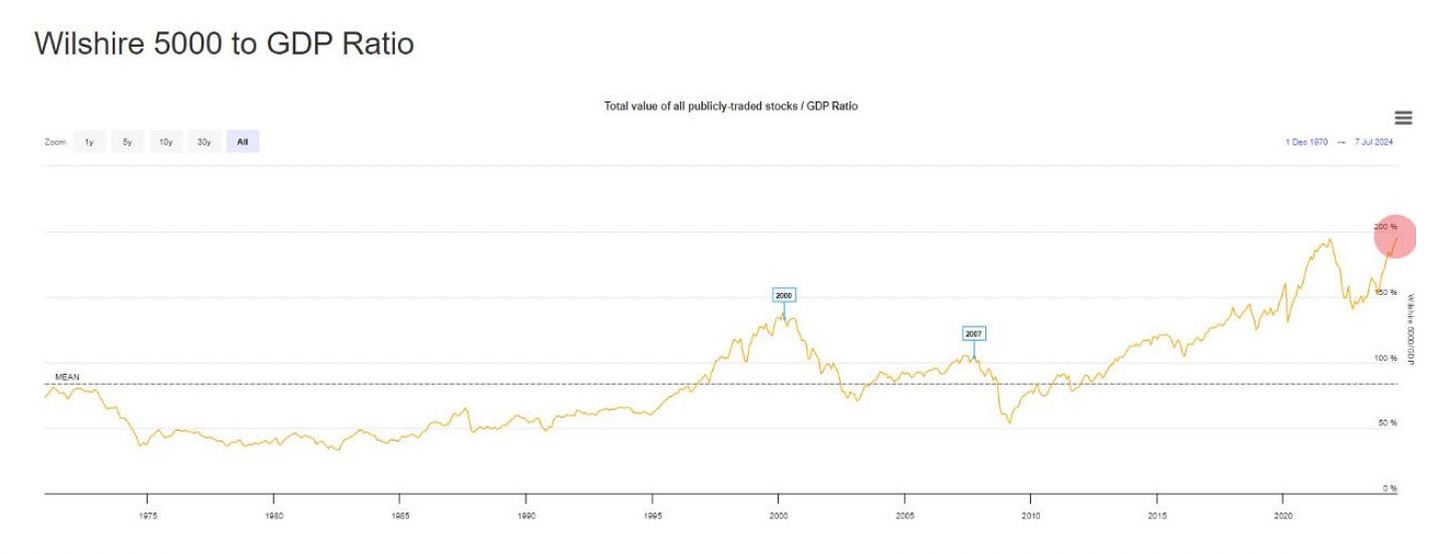

Warren Buffett’s favorite dashboard item, the Total Stock Market value / GDP Ratio shows we are back to the 2021 all-time high.

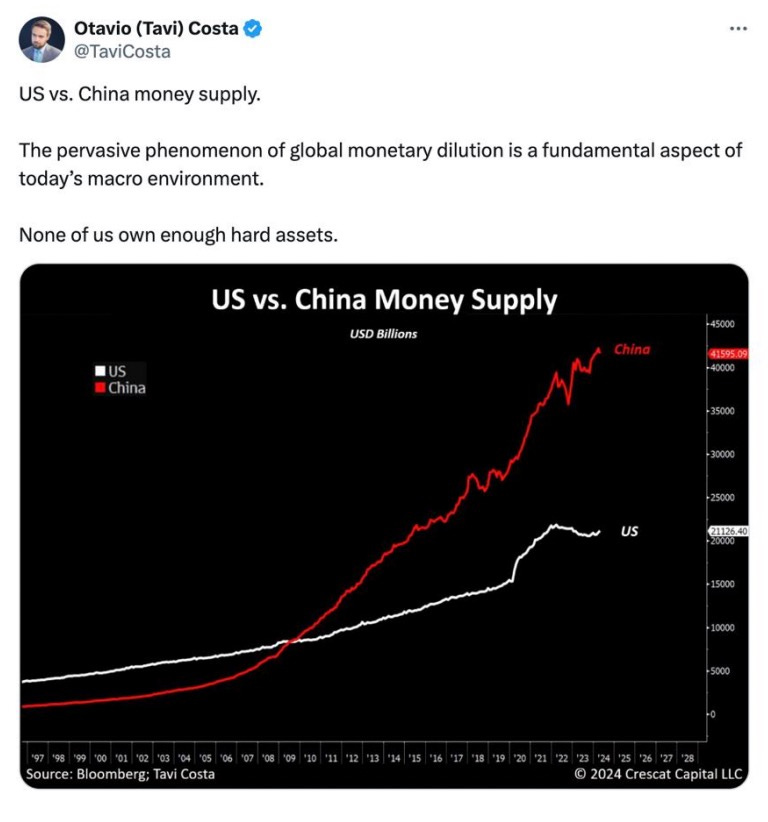

The schedule below shows how the growth in fiat currency is not just a US phenomenon. China has outpaced the US in creating fiat currency. This surely has had an impact on prices of all assets worldwide.