Lululemon Should Rocket Itself Further Into Menswear By Becoming A Jiu Jitsu Brand

I'd love to see lululemon jump start their men's business by capturing an extremely fast growing niche in athletics for both sexes, just as they did with yoga for their womenswear.

For years, Lululemon (LULU) has been one of my favorite retail brands that I have owned off and on. I took the recent thrashing in shares – which touched 52 week lows yet again yesterday - as an opportunity to once again reestablish a position in the name. I also added to exposure to other retail names that I have owned and liked for a while, including both Target (TGT) and Walmart (WMT), which were crushed this week.

As my friend @FredMcFeely, the artist formerly known as @RosemontSeneca and @CaetusCap put it, Walmart at these prices is “an investment grade bond”.

I feel the exact same way about Target (TGT), which my subscribers know I am long (and have been). Reading both companies’ management commentaries over the last two days it is clear that lofty expectations are no longer in order, but that doesn’t meant that the world is ending, nor does it mean these companies won’t flourish again down the road (months, years).

I own both names in a portfolio that I use almost exclusively for dividend paying names that I have a multiple year, if not multiple decade, outlook on.

But back to the retail-names-getting-mauled topic at hand: Lululemon.

After Wednesday's thrashing, the company is still "expensive" and trades at a 31x forward PE and about 6.1x sales. But they have a huge growth opportunity still in menswear, which I think the company is going to be able to capitalize on.

I nibbled the dip this week because I simply like the brand and don’t mind paying 31x earnings for it. Just days ago, the company announced it was on track to hit its 2023 goals and that it plans on doubling its business.

“The Company plans to double its 2021 revenue of $6.25 billion to $12.5 billion by 2026,” it recently said. The company is targeting total net revenue CAGR of 15% between 2021 and 2026 and EPS growth to outpace its revenue growth. Its CFO said less than a month ago:

"We are setting bold but realistic 2026 targets from a position of financial strength, while delivering on our 2023 goals with significant growth across our core business," said Meghan Frank, Chief Financial Officer. "We have a long runway ahead and are well-positioned to build on our strong momentum and deliver sustainable long-term value creation for all our stakeholders."

Despite the meltdown in retail, Lululemon could be getting dragged down at a point when it doesn’t deserve to be. If they are on track for their targets, as disclosed, then multiple compression represents an opportunity, in my opinion.

I think there is equity in the brand name, I like the fact that they do not engage in deep discounts and that you can’t find their clothes at Marshalls or TJ Maxx, and I believe that they remain akin to Apple for clothing, in the sense that they are well known and widely accepted as an expensive, high-end luxury athletic brand.

They are now what Under Armour could have been if the latter brand didn’t totally sacrifice its brand’s prestige, equity, and exclusivity at the altar of selling a couple extra coats by offloading them to the Ross discount rack, as I discussed in 2020 with retail expert Jeff Macke.

Lululemon appears to be - as Jeff says about Nike - a brand run with discipline. They know their niche and they are not interested in moving too far out of it. They are strategic and clearly concerned with preserving the prestige of their brand.

I also think this makes them a premium acquisition target if they continue you get cheaper. The company generated about $1.4 billion in cash from operations and about $876 million in levered FCF over the last 12 months. While this still puts them at premium FCF multiples, its plans for growth could be attractive to an acquirer. It still has a very, very large total addressable market that it can expand to by expanding into other sports, adjusting price points and moving into menswear. They can do this strategically while maintaining their brand equity. It’s a balancing act, but it can be done.

I found myself in a Lululemon store this week looking to buy a new pair of running shorts and was thinking about the fact that my Asics running shorts usually also double as my no-gi jiu jitsu shorts (that’s me, on the right, wearing my Asics shorts - which I also love).

It had already dawned on me years ago that menswear represents an enormous opportunity for Lululemon that has remained relatively untapped. They don’t have to sacrifice any of the things that make the brand what it is in order to become a well-known and successful men’s brand, as well.

But what the brand is missing for men is a core supporting community to build off of.

Lululemon built their women’s business off of yoga, which is primarily a woman’s sport that some men also participate in. It dawned on me that the company could have an incredible jumping off point for its menswear line if they started catering to the jiu jitsu community.

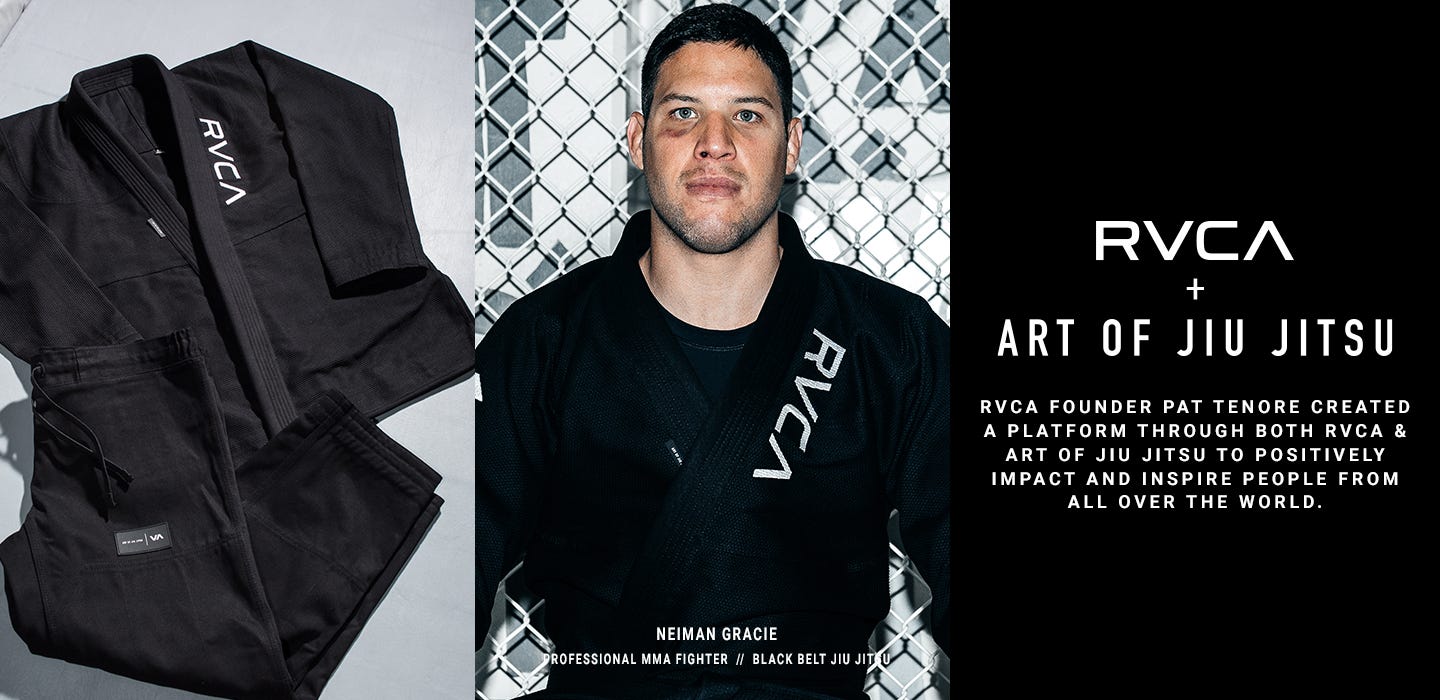

Jiu jitsu is one of the fastest growing sports in the world right now - it runs hand-in-hand with UFC - and it really only has a small number of niche brands that make clothing specifically for its use. Many of these brands are specifically jiu jistu/fighting brands like Shoyoroll, Venum, Hayabusa, Hyperfly, Fuji, etc. Some other primarily clothing brands, like RVCA, also cater to the jiu jitsu community.

I was having a conversation with a employee at the Lululemon store who was recommending a certain type of shorts for use in jiu jitsu because they were less likely to succumb to wear and tear and the thought just dawned on me: Lululemon should tether itself to this exceptionally fast growing sport, which is majority male but also has an extremely robust female base, too. The company could do well to shoehorn itself into its men’s closets by taking the backdoor via the jiu jitsu community.

In addition to opening the door to a whole new group of customers, it alleviates some of whatever little stigma there is for men of the company being a yoga brand that is made specifically for women.

The key would be to start developing the line now - sponsor a couple of premier jiu jitsu athletes - and catch the popularity of fighting and grappling in its upward trajectory. Other companies have done exactly this. For example, FloSports started covering mostly wrestling and track when it started, but it has, in 16 years, established a very well known brand that was able to branch out into other sports. It started with $10,000 in seed money in 2006, and now has raised almost $100 million and has 300 employees.

Finally, Lululemon could be one of the first major athletic brands to cater specifically to this growing group of athletes which no other major brand, including Nike, has really done yet (though brands like Nike and Asics have a presence in wrestling).

I think the move could be strategic enough to retain Lululemon’s brand prestige, while at the same time moving it further into a new TAM that that would benefit shareholders. As a shareholder myself, I’d love nothing more than to see the company branch out in this direction.

Disclaimer: I am long LULU and own equity and options. This is not a recommendation to buy or sell any stocks or securities. I own or may own all crypto/stocks I mentioned or linked to in this piece. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Jujulemon - i like it. Recession problems aside for the near term trading environment, I see the brand as emergent out the other side of the recession. This isn't a complete killing kind of recession, brands that produce quality and focus on the buyer that demands quality will do fine. Those brands that need volume to survive will suffer. I haven't dove into Lulu much, I only casually understand the niche via a close family member (and their friends) who are heavily in the dance, yoga, workout communities. Most of them are relatively wealthy and seemingly only buy high quality. Therefore I deduce they see Lulu as quality.

I just don't see it happening. I'm heavily into mountain biking and have often thought their training shirts would be great for mountain biking as well. The same argument could be said for them getting into mountain biking outerwear. There is a large community of active and passionate individuals, often with money to spend. Some mountain bikes cost $10k or more. I could actually see them getting into this before Jiu-jitsu. I feel Lululemon has a woke culture and many would argue that Jiu-jitsu is toxic masculinity or some bs.