Imagine my surprise when, a couple weeks ago, I read a headline that the former $300 million China-based fraud known as Luckin Coffee could soon be relisting its shares on US exchanges.

For those that unfamiliar with Luckin Coffee, the company was found to have “made false statements and fabricated its financial performance to lure in investors” and it “failed to disclose accurate revenue and expenses, and also obtained money through false bank statements,” according to the Seven Pillars Institute.

They were accused of fraud in early 2020 by the U.S. Securities and Exchange Commission. Per the SEC’s website, the regulators complaint alleged that, “from at least April 2019 through January 2020, Luckin intentionally fabricated more than $300 million in retail sales by using related parties to create false sales transactions through three separate purchasing schemes.”

“According to the complaint, certain Luckin employees attempted to conceal the fraud by inflating the company’s expenses by more than $190 million, creating a fake operations database, and altering accounting and bank records to reflect the false sales,” the SEC said.

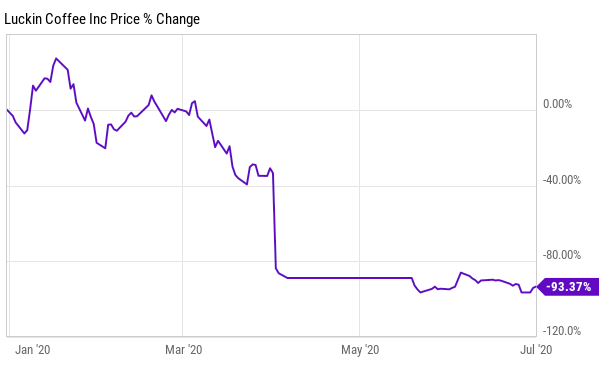

And just like in any good fraud, shareholders were porked royally as a result:

Today’s blog post has been published without a paywall because I believe the content to be far too important to deny to anyone. However, if you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off for 2022:

Luckin was only just delisted from the NASDAQ in June 2020 - not even two years ago.

The news of the company potentially re-listing in the U.S. is stomach churning, for several reasons that I wanted to write about.

The first of which is that the U.S. is in the middle of a years long attempt to bring China up to domestic audit standards for companies who wish to list on U.S. exchanges. This has been an ongoing battle that started with dozens of reverse takeover (RTO) frauds in the early 2000s absconding with billions of dollars of U.S. investor money. These frauds have been documented at length in a great movie called The China Hustle, which I highly recommend you watch if you haven’t yet. Here is a link to the movie and here is a follow up presentation given by its protagonist, and my former boss, Dan David, outlining its details.

Over the last couple of years, scrutiny around U.S. listed, China based companies has intensified - former President Donald Trump was hawkish on China, regulators like the SEC have done a better job requiring further disclosures from these companies and a tug of war broke out a couple years ago between short sellers and questionable China-based companies held in the portfolio of Bill Hwang’s now defunct Archegos Capital.

Specifically, due to high profile frauds like Luckin Coffee, U.S. politicians have urged that China-based companies follow the same audit standards as U.S. companies. This isn’t much of a reach to ask for, either - they’re only asking for the same transparency that public U.S. companies are required to disclose to trade on U.S. exchanges.

But China has been notoriously standoffish, fighting back against U.S. regulators auditing companies based in the country.

Common sense would tell me that, at the very least, until these rules and auditing standards go into effect (this will happen in 2022, they were finalized in December 2021), that no China-based company should be allowed to list on U.S. exchanges.

And, of course, that rule should apply twofold to a company that, just two years ago, was exposed for committing at $300 million fraud.

Companies go into bankruptcy or administration, or are punted to the pink sheets, before re-emerging and re-listing on a major exchange all the time. That isn’t anything new for Luckin. But if you have been found to have committed fraud on this scale, it should result in a permanent bar from listing on U.S. exchanges.

The idea that Luckin Coffee can again list in the U.S. - and that it would somehow become a headline to celebrate - just goes to show you how the system enabled this type of fraud to begin with: as long as exchange listing fees are paid, bankers get their cut of the re-listing/listing and “audit” fees are paid to the right companies willing to sign off on an audit, China-based companies will still be allowed to list here in the United States with lackadaisical oversight and poor vetting.

Once on US exchanges, China-based companies are inadvertently tucked into mutual funds and exchange traded funds that unknowing US investors wind up with exposure to. Then, once fraud is committed or found, the same US investors - who assumed vetting and due diligence was taking place during the (1) the listing of the company and (2) the inclusion of it in a fund they own, wind up suffering the losses while the people paid off by the company - and the company - make out like bandits.

Perhaps in the case of Luckin Coffee, they make out like bandits again.

Now read:

Has The Red Carpet Been Rolled Out For A Mainstream Pivot On Ivermectin?

Cancel Culture Is Now Officially A Snake Eating Its Own Tail

Shipping Expert Talks His Favorite Stocks For the Supply Chain Crisis

The St. Louis Fed Thinks $30 Trillion In National Debt Is No Big Deal

Inflation Is The Kryptonite That Will End Our Decades-Long Monetary Policy Ponzi Scheme

Absolutely right, reminds me of the scam Krispy Kreme ran and screwed everyone, yet they are still here. $DNUT they came back listed last July

@QTR -- You lost me when you mentioned the SEC.

https://www.deepcapture.com/2010/04/the-sec-and-its-culture-of-regulatory-capture/

Moral of the Story - In the Wall Street casino, it is and always has been...buyer beware.