As always, I’m stoked to be able to bring you content from one of my favorite investors, Chris DeMuth Jr. Chris took the time to share his up-to-the-minute thoughts on the market for Fringe Finance subscribers this week.

I enjoy reading Chris as much as I love publishing him. In today’s piece, he talks about his next idea — that I also think makes wonderful sense (or I wouldn’t have published it!)

Chris founded event driven hedge fund Rangeley Capital and research service Sifting the World. Rangeley’s strategy is to invest in mispriced securities with limited downsides and corporate events that unlock shareholder value. He also hosts Sifting the World, Seeking Alpha’s SPAC and event driven research product.

Chris also writes the Vale Tudo Substack, which can be found here and the Sifting the World Special Purpose Research Substack, which can be found here.

Chris is one of the smartest people I’ve had the chance to meet during my time as an investor. He was one of the first people to ever to be nice to me when I got my start writing on companies more than a decade ago. His acumen is widely respected by many people whose work I admire and follow - and by me.

All information contained herein is opinion only of Chris DeMuth & does not constitute investment recommendations. Nothing is a solicitation to buy or sell securities.

Kill Your Good Ideas

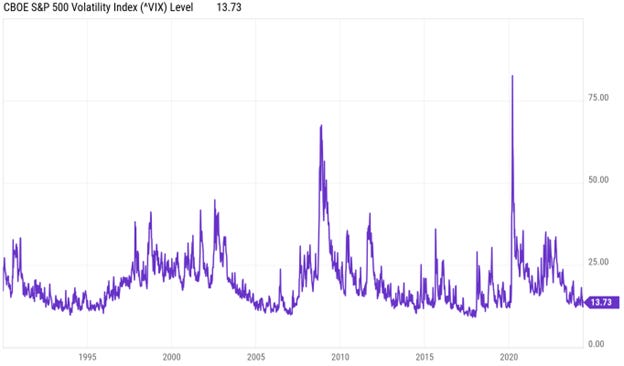

Implied volatility is quite low.

This doesn’t seem to comport with the number of discrete issues that have a material (at least 1%) chance of happening and far greater (at least 5%) chance of spooking the market if concerns grow.