Janet Yellen: The Lingering 'Legacy' Of A Decades-Old Monetary Policy Circus Freak Show

When the Fed’s dual mandate includes price stability, you would think that a firm understanding of inflation would be one of the only prerequisites to become Fed chair.

I want to start off this piece by linking to Rudy Havenstein’s latest about Janet Yellen, called “Janet Yellen Is A Menace To Society”. The piece does a great job of laying out exactly how wrong Yellen has been, and continues to be, about…well, everything.

Yellen has exemplified the worst of monetary policy over the last decade: first as Federal Reserve chair, keeping rates far too low for far too long while admittedly not understanding inflation, and now as Treasury Secretary, encouraging additional spending and continuing to display a stunning lack of economic basics when talking about the nation’s current inflation (and soon to be recessionary) problem.

She has been in the news over the last couple weeks after being publicly labeled with the ultimate Keynesian insult of someone who didn’t urge more spending 24 hours a day, 7 days a week. After it was reported that Yellen may have suggested the Biden administration spend less in 2021, Yellen came out last week and promptly defended her Keynesian honor by correcting the record.

She also made headlines this week for defending the country’s Covid relief spending - you know, the very same spending that is crippling the American consumer with inflation at the moment.

Because after all, no good Keynesian economist would want to be caught at any point saying that they want to stop any type of spending on anything.

In addition to this, over the last week, we’ve seen a mea culpa from Yellen that most of us predicted would be coming several years ago.

Yellen’s incompetence as Fed chair years ago was highlighted by her complete lack of understanding of inflation, which she referred to as “a mystery”. Today, Yellen is doing what all politicians do after they fly the plane at 1,000 miles an hour into the side of the mountain - apologizing halfheartedly without offering up any real signs that she’s learned anything from the situation:

Treasury Secretary Janet Yellen has now followed Federal Reserve Chair Jerome Powell in finally admitting that she was wrong last year in thinking that inflation would be a transitory phenomenon rather than becoming the country’s number one economic problem. That is to be welcomed especially considering how difficult it is for economists to admit that they were wrong.

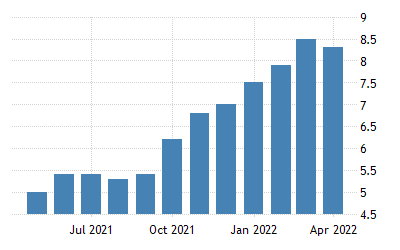

However, like Mr. Powell with the Federal Reserve, she has been very careful to avoid admitting that the policies of her Treasury Department had anything to do with inflation’s acceleration to a multi-decade high of some 8 ½ percent.

Most of us knew during Yellen’s tenure as Fed Chair that she didn’t really have a grasp on inflation. Now, we are bearing the consequences of her ignorance and policy mistakes.

In fact, it’s almost difficult to think about anybody less qualified to be a Fed chair than somebody that doesn’t understand inflation. When the Fed’s dual mandate includes price stability, you would think that a firm understanding of inflation would be one of the only prerequisites to become Fed chair.

And yet she did so well, they brought her back - Hillary style - for another seat at the country’s economic table by making her fucking Treasury Secretary.

Today’s article is free but if you’d like to support my work and have the means, I’d love to have you as a subscriber and can offer you 50% off all annual subscriptions:

But I digress.

In Janet Yellen’s wake as chair, we now have Jerome Powell heading up a consortium of “useful idiots” who attempted to lie to the American people by telling them that inflation was transitory over the last year. Powell himself also lied, prior to the pandemic, when telling Congress that the Fed’s intervention into markets to add liquidity and ease rates was not quantitative easing.

Powell is also doing his own mea culpa right now on inflation, begging a fairly simple and obvious question: how do these people keep winding up in positions of monetary policy power? I mean…is it me, or could these Fed chairs not find sand if they fell off a camel?

While financial media has been busy kissing the asses of these “experts” while also laughing at any guest or contributor with even the slightest inkling of Austrian economics running through them over the last 20 years, we have been slowly and systematically reducing our monetary system to the ticking time bomb it has become today.

At some point, the laughing is going to stop in a big way and people are going to realize that we are far beyond the point of no return. By then, it’ll be too late, as I noted in 2018:

As I noted then, with news networks, it’s either the worst cognitive dissonance I’ve ever seen or it is a sickening display of ignorance involving how the system works. Either way, financial news should be taken with several grains of salt and those who ridiculed economists like Peter Schiff who actually predicted the housing collapse should be called out publicly this time around. But, like those who were complicit in helping the whole system go off the rails in 2008, they won't be held accountable and rather will be making up excuses for the powers that be, once again, this time around.

Sure, there is an argument that the Fed shouldn’t come out and cause panic by saying that we are heading towards a recession, but on the other hand, what is the point of always offering positive outlook for the economy regardless of what economic data and economic conditions are dictating?

The Fed is at it again, with Yellen stating last week that she “did not anticipate a recession”.

“There’s nothing to suggest a recession is in the works,” Yellen said, while GDP estimates collapse and inflation runs rampant.

And what is the point of even lying when GDP indictors can tell us definitively whether or not we are heading into recession (surprise, we are), regardless of what bullshit narrative Fed officials wrap the numbers in. From CNBC:

A widely followed Federal Reserve gauge is indicating that the U.S. economy could be headed for a second consecutive quarter of negative growth, meeting a rule-of-thumb definition for a recession.

In an update posted Tuesday, the Atlanta Fed’s GDPNow tracker is now pointing to an annualized gain of just 0.9% for the second quarter. Following a 1.5% drop in the first three months of the year, the indicator is showing the economy doesn’t have much further to go before it slides into what many consider a recession.

GDPNow follows economic data in real time and uses it to project the way the economy is heading. Tuesday’s data, combined with other recent releases, resulted in the model downgrading what had been an estimate of 1.3% growth as of June 1 to the new outlook for a 0.9% gain.

And a report out of the Atlanta Fed this week “shows the economy on course for zero percent growth in the second quarter of 2022”.

And now feels like a great time to remind you that Janet Yellen, during her tenure as Fed chair in 2017, said that she didn’t see another financial crisis “in our lifetimes”.

Questions should be asked not only as to why Yellen was put in such a position of power to begin with despite her basic shortcomings when it comes to understanding economics, but why we continue to perpetuate the Keynesian myths that dictate our policy prescriptions - that she pushes - to this day?

Bernanke got the subprime crisis dead wrong in 2008, Yellen got inflation dead wrong during her tenure and our current Fed - all while possibly insider trading stocks based on decisions they would be making post-Covid-crash - is stuck between a rate hike rock and an inflationary hard place with nowhere to go.

When is the country going to see that Yellen, Bernanke and Powell are symptoms of a much larger problem: a grandiose misunderstanding of economics and monetary policy born out of our own arrogance, ignorance and belief that we can micromanage the most basic laws of economics?

Are we totally sure Yellen is clueless? The ruling elite knows full well what they are doing. They just play "dumb" to keep the rubes in line. The Federal Reserve's REAL mandate is, as a banking cartel, to wring out as much profit as possible from the interest on the debt issued to everyone from people to corporations, to entire countries. The Federal Reserve's monetary policy is very short term as they, as you have pointed out, have very little tools in their toolkit to really make a difference. It's all about profit and power. Having said all of this, Yellen has done remarkably well and that is why she has been brought back to the table. She understands inflation all too well and is well aware where it is leading us as a country. But, she gets a nice paycheck and a few homes here and there. Life is good...why mess it up by telling the truth? Far easier to play "dumb."

They love to throw the word "data" around. "As the data comes in..." (As if they can do anything useful with it when they have no historical data to use for back-testing their models.) They say their decisions are "data-driven," get that data from the Executive branch, and then claim to be "independent."

With 1/4 of the CPI being a farcical quesstimate (owners equivalent of rent of residence), the CPI badly understates inflation. And since inflation is the "deflator" when calculating GDP, if you understate inflation you overstate growth...

They don't anticipate a recession??? Hell. we're already in one. If they understood inflation and measured it correctly they'd know that.