If We Have a Strong Economy, Why Are Americans Struggling?

"...there are no free lunches in economics, no matter what central bankers may say."

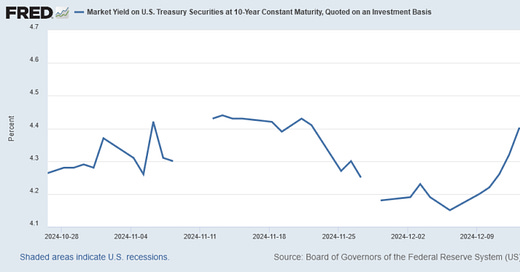

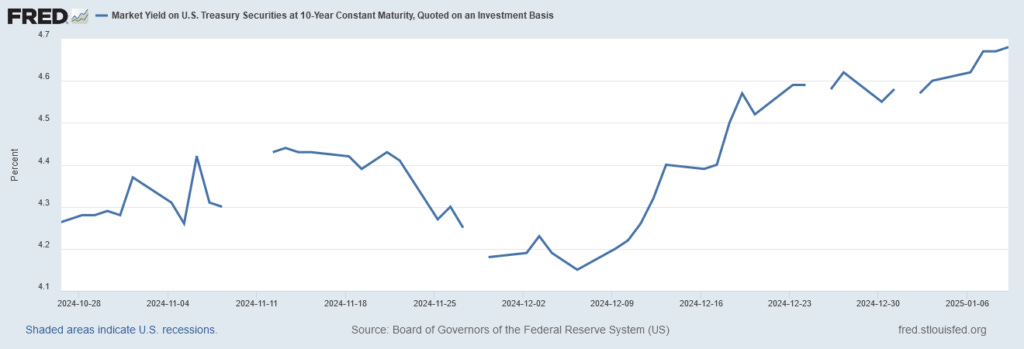

The 10-year treasury yield rocketed up to near 5%, and analysts say it’s because the economy is strong despite higher inflation. But if the economy is so strong, why are Americans so indebted, cash-poor, and desperate?

The recent spike in 10-year yields has been explained away by many as the result of a strong economy, but they fail to mention that high inflation makes the 10-year yield harder to contain. High 10-year yields support higher rates for things like car loans and mortgages, and with the world still under the inflationary spell of COVID-era QE and free money “stimulus,” the only answer may be—you guessed it—more free money QE to “stimulate” an economy that’s already stuck in an infinite loop of inflation. As Peter Schiff said recently:

“I think that they’ve already lost control of the long end of the bond market…the Fed is going to be pressured to try to lower long-term rates, and the only way it would be able to do that is by buying the long term bonds, and the only way to get the money to do that is to print it.”

But not even the Fed has a clue for how it would deal with a stagnation scenario.

“It was almost humorous and even it got a laugh out of Powell. A reporter asked him at the last press conference, ‘What’s your plan for stagflation?’ And he laughed and says, ‘Our plan for stagnation is that we’re not going to have it.’”

But we already do. For now. markets are also still trying to figure out how to react to Trump’s win, and uncertainty breeds volatility. So, high inflation coupled with uncertainty and “strong” economic data are the three factors being attributed to the spike in yields. The inflation part is partially right; the only problem is that it doesn’t go far enough, because inflation is actually much worse than what’s being reported. The other problem is that the “strong jobs data” being partially blamed for the rise in yields is never really as strong as what gets reported, as the jobs reports and other economic data are unreliable and designed to paint as rosy a picture as possible.

As Treasury yields keep rising, mortgage rates keep going up, and basic needs keep getting more expensive, 2025 is already shaping up to be a marvel of stagflationary chaos. As predicted, the bond market and broader economy are getting spooky, and Central Banks will keep buying gold to protect themselves from the same problems that government and central bank interventions create.

The question is, how many Americans will protect themselves? The answer is very few, as the average American has hardly any money saved and is living paycheck-to-paycheck while becoming increasingly over-indebted. After all, when economies are extremely weak or extremely strong, they will always be what decides elections even if the root causes go far deeper than any one president, which they always do.

But when Americans are struggling, seeing drastic price increases, and watching with enraged awe as their government continues donating taxpayer money to proxy wars in Ukraine and Israel as American cities flood, burn, and lose their critical infrastructure, they’re going to vote for the other candidate. So, while Trump signed the inflationary COVID stimulus checks, he was able to convince voters even after losing in 2020 that he should be given another chance after the economic deterioration of the last four years..

Whether or not Trumponomics itself ends up being inflationary, central bank monetary policy will always revert back to the only real tool in its toolbox, which is printing money. Whether or not DOGE, tariffs, and other promises materialize, the result of statist intervention to bring down prices is almost always, ironically enough, higher prices. Even if the intervention causes costs to go down in one place, they generally go up somewhere else.

That’s because there are no free lunches in economics, no matter what central bankers may say.

QTR’s Note: I really enjoyed this video for perspective on where the conundrum is for the U.S. economy and Fed, as it relates to inflation, as I’ve discussed.

In Peter’s latest, he discusses Trump's proposal to annex Canada, trade deficits, Biden's inflation handling, higher commodity prices, and challenges with U.S. economic policies. This is worth an hour of your time:

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

For most of us who follow you and the past 40 years of financial shenanigans (albeit: Kick the can down the road) we are now at a point where we are still waiting for the world to end. Who could have predicted that since 2008 and the GFC that the markets would perform the way they have? Many responsible investors chose to either stay out of the market or invested prudently while most "uninformed" investors continued to dollar cost average into their 401K's and only experienced 2 down markets from 2009 to 2024 (2018 down 4.38 and 2022 down 18) and have experienced higher than average returns...The noise created by so much information on the internet has only served to make matters worse...Perhaps Ron Paul has been right all along? "End the Fed is a 2009 book by Congressman Ron Paul of Texas. The book debuted at number six on the New York Times Best Seller list[1] and advocates the abolition of the United States Federal Reserve System "because it is immoral, unconstitutional, impractical, promotes bad economics, and undermines liberty."[2] The book argues that the booms, bubbles and busts of the business cycle are caused by the Federal Reserve's actions.[3][2]" (from Wikipedia)...In the end those Americans who are living check to check need to be more frugal...How can anyone expect Americans to be responsible financially when our own Government is the most financially irresponsible agency in the world...

But, I was told that those who want free stuff are getting it for free from the government and that I am not paying for it. No. Really. This is how badly our school systems have failed. 🤷♀️