Betting On The Unthinkable

Here's one ugly investment idea I've been toying with. The risk is definitely asymmetric, but it's almost a thesis I hope doesn't play out.

What started as a passing thought during a podcast I did last week is starting to become the outline of an unthinkable investment thesis in my mind - one with asymmetric risk/reward - but one that could also have a profound impact on millions, if not billions, of people.

Right up front, I’ll say that this is a trade I have put on in extremely small size and one that I am structuring for the asymmetry that it provides. This means my capital outlay is very small, in the form of short dated out of the money puts, and my risk is defined. The thesis is based, unfortunately, on the emerging amount of evidence that Moderna’s mRNA delivery system may not be the “miracle” its been talked up to be. On top of that, it’s also based on the fact that Covid boosters may lose the confidence of the public and that Moderna could lose (1) public confidence in its “vaccines” or (2) cash flowing from the government trough.

Up front I’ll also say that this trade is really a lottery ticket of sorts - there’s a good chance it may not work out, but key to any good asymmetric investing opportunity is the idea of being early. If Moderna’s mRNA technology turns out to be dangerous - or even if there’s some skepticism and it warrants further safety study before being used ubiquitously going forward - it would be backbreaking to the company’s stock.

As a primer for this thesis, I highly suggest that you listen to Joe Rogan’s entire recent interview with Bret Weinstein and my most recent podcast with Dr. Peter McCullough. You should also review the recently released VAERS data on the vaccines, published just hours ago. And while it isn’t a definitive by any means, certain signs appear to be piling up that support the notion that the party for mRNA technology could be over - at least for the time being.

People like Dr. Robert Malone, part-inventor of the mRNA technology, and Dr. McCullough, have noted over the last few months about the fact that the messenger RNA used to carry the spike protein is being found in parts of peoples bodies that it wasn’t supposed to be turning up in, like lymph nodes - and lasting longer than expected.

We know very little about this messenger RNA, including not having long term safety studies on whether or the mRNA technology is worth using in its current form. These safety questions were squelched by the powers that be while the vaccines were being rolled out and are only being properly evaluated now. A search for “mRNA vaccine” on ClinicalTrials.gov yields more than 450 results (trials in progress).

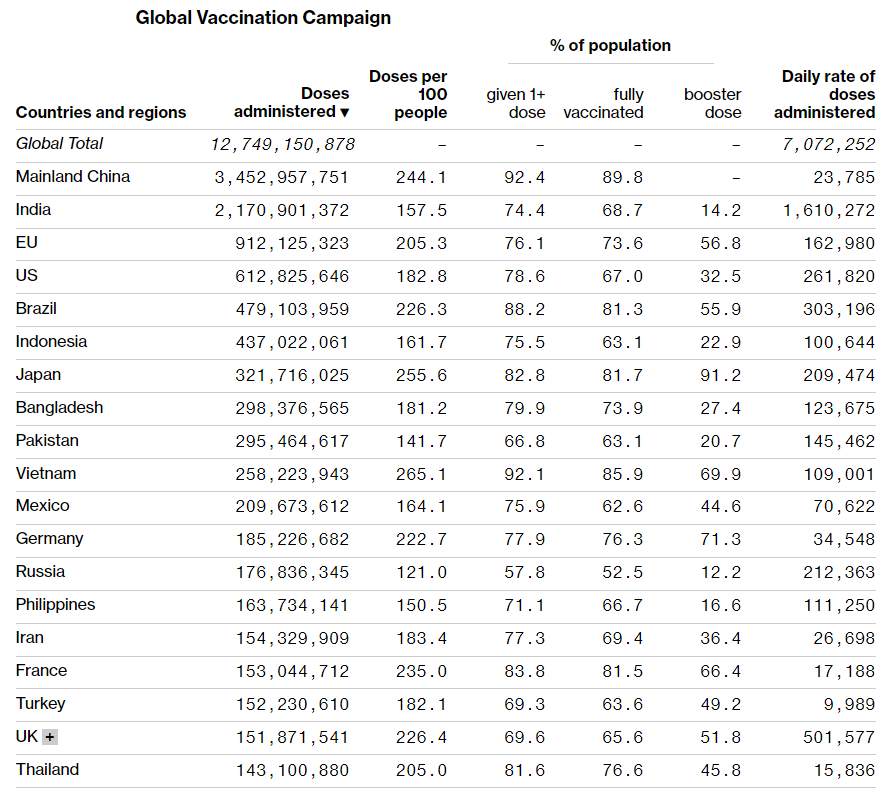

The lack of data, in and of itself, is alarming. The lack of long-term safety data was enough for my doctor back in 2020 to recommend that, based on my physical shape, age and lack of safety data, the vaccine was not a necessity for me. He was one of few people in 2020 even talking about natural immunity - a topic that was curiously removed from public discourse (more on this coming), that I noted in February 2022 was finally being talked about. This means we are officially running the world’s largest safety study with the 12 billion plus shots that had been administered by the end of 2022.

On top of this, there have also been emerging developments that certain age groups appear to be more predisposed to myocarditis and pericarditis from the vaccines.

There has also been emerging evidence that multiple shots may wind up weakening the immune system. On top of that there are emerging voices finally getting hip to the “conspiracy theory” that I pointed out almost 2 years ago after listening to Dr. Geert Vanden Bossche: that vaccines may be causing variants.

And thanks to Elon Musk (never thought I’d be saying that) and Alex Berenson digging into another episode of The Twitter Files last night, we now also know that Dr. Scott Gottlieb, Pfizer director, engaged with a lobbyist to try and quell “corrosive” Tweets that correctly indicated that natural immunity was more robust that vaccine immunity.

If you were one to write these concerns off because “the science” has concluded that the vaccines are safe, this seems like a good time to remind you what has happened with Johnson & Johnson’s former Covid-19 vaccine. Haven’t heard about it in a while, right? That’s because it has been pulled from the market.

“After conducting an updated analysis, evaluation and investigation of reported cases, the FDA has determined that the risk of thrombosis with thrombocytopenia syndrome (TTS), a syndrome of rare and potentially life-threatening blood clots in combination with low levels of blood platelets with onset of symptoms approximately one to two weeks following administration of the Janssen COVID-19 Vaccine, warrants limiting the authorized use of the vaccine,” the FDA wrote in May 2022.

Like the other vaccines, Johnson & Johnson was rushed to market - and it was the one with the conventional DNA spike protein delivery. Think about it: one month everybody was saying it was 100% safe and the next month it was no longer on the market. While the FDA will write this off as a precautionary measure based on rare circumstances and a few outlier cases, all you need to know is that it was enough for them to pull the damn thing off the market. And now, there is a growing body of evidence that tells me there is a greater than 0% chance that the mRNA vaccines could suffer the same fate.

And if the problem becomes the delivery method in question, that envelops Moderna’s entire pipeline for the most part - and certainly their main source of revenue. The company said on Monday they plan to charge $110 to $130 for shots once the government gravy train comes to an end. My wild-ass guess is they are going to be slightly more hard pressed to get reimbursement for these shots as a rolling body of safety studies continues to reach its respective conclusions as the days move forward.

Meanwhile, public scrutiny of mRNA technology is at an all-time high, following the innumerable amount of athletes mysteriously collapsing in the midst of strenuous activity, not the least of which was the Buffalo Bills’ Damar Hamlin, who recently gave a nationwide television audience of millions a prompt to start asking questions about what the nature of his cardiac arrest was. Despite the fact that many potential explanations remain on the table, scrutiny of whether or not Hamlin was vaccinated began - for better or for worse - almost instantly after his collapse.

Pulling this thesis out now is interesting, because it was literally just a couple of days ago I was considering Moderna as a long after their Phase II cancer drug results with Merck. The long thesis would rest on the case that the mRNA technology is safe and works. I don’t really know what I was thinking at the time - perhaps the skeptical side of me hadn’t caught up with the excitement of a new idea yet - or I hadn’t realized what the risks were yet. Either way, the company is almost assuredly going to experience a significant amount of volatility in one direction or the other over the next couple of years. I haven’t looked at the idea of a long straddle yet to potentially try and just get long the volatility, but for now I continue to structure my trade on the name with very cheap, way out of the money puts that are short dated. In essence, I’m paying for lottery tickets and defining my risk, betting on one bad headline overnight that could send the stock down 50% all at once. It’s a long-shot, but if there are material negatives in the company’s future, there is still plenty of meat on the bone to the downside - it has a $70 billion market cap, trades at 28x forward earnings and has a book value of somewhere around $47 per share. If the company sees its income/cash flow prospects rudely interrupted, it could re-rate lower with gusto - quickly.

There will be a natural waning off of the vaccines regardless, which means that Moderna may need to show the proof in its technology’s pudding regardless of what they use the delivery for next. I had already identified back in January 2022 that shorting the vaccine makers would eventually make sense. In the event my current thesis turns out to be right, it’s unfortunate from a humanitarian standpoint, because it means that there are billions of people walking around with this “safe” technology in them. I thought long and hard about the ethics of this idea before writing this over the course of last weekend. I eventually decided that the damage has already been done either way (i.e. billions have gotten the shots already), so it doesn’t make betting against the company unethical. In fact, as the facts come to light, it looks more and more like simply a rational investment decision.

The upside risk is obviously if somebody finds Moderna’s platform valuable – like Merck may be doing, for instance - which could make them a takeover target. However, in the case of questions arising, the unspoken liabilities stack up and then no one would even want to buy Moderna even for the cash. Still, this type of upside situation is why I’ve been defining my risk with very deep out of the money put options that I expect to lose 100% on. The market is saying my thesis is bunk and doesn’t hold any water - so is “the science” and “fact checkers”.

But hey, it wouldn’t be the first time I showed up to a party a little early…

QTR’s Disclaimer: I’m short MRNA and own puts. I am not a financial advisor. I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Chris, I’m so happy to see you covering this space. Although it’s absolutely fantastic to see you taking this on, I’ve been staying out of investing around this subject because of the volatility and the unfortunate power of “the science.” But if you’re a reader of Malone, McCullough, Berenson, and Geert Vanden Bossche, you get what’s going on. I actually renewed my long-forgotten New York bar license (at age 57), just in order to try to take on cases like this. Defending Dr. Kory and the others. Making cases against those behind censorship they experienced... there is no end of those ‘apostates’ who needs defending and of those who need to be exposed (seemingly 3/4 of doctors who should be granted the Medal of Honor for cowardice in the line of action.)

I’m hoping to spring into action once my license is resumed. I’ve NEVER practiced law, but nothing his aroused my fire about law ever since law school... got too obsessed with horse racing, songwriting, and investing. But now I’ve got a purpose to practice and when I’m on something that fires me up, I follow through. Anyway, enough about me. Great piece here. Thank you!

Feels good to be a pureblood