Gold Miners Will Trade At "Multiples" Of Current Prices: Lawrence Lepard

In particular, China and Russia have been "enormous buyers".

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q2 2024. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 2 of his letter, Part 1 was released earlier this week.

STOCK MARKET UPDATE

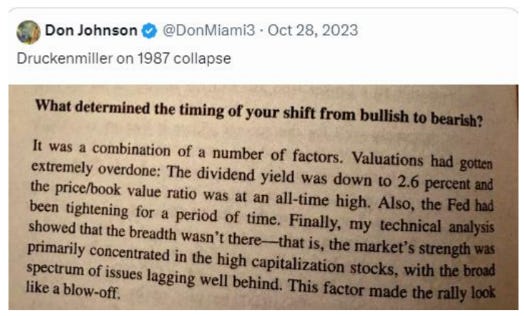

The U.S. Stock Market is very overvalued and vulnerable to a significant correction. We cannot predict how or when this correction will occur. This tweet regarding Stan Druckenmiller’s reflection of the 1987 crash sounds awfully familiar with recent times.

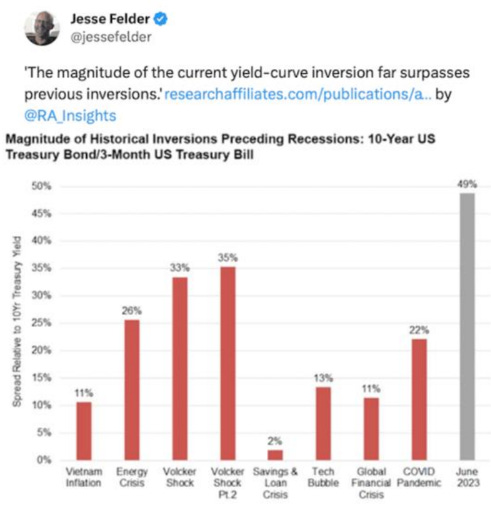

We note the following three data points in today’s markets: First, as shown in the tweet below by Jesse Felder, the magnitude of the yield curve inversion that took place during this Fed rate hiking cycle is historically large and all of these prior events led to recessions.

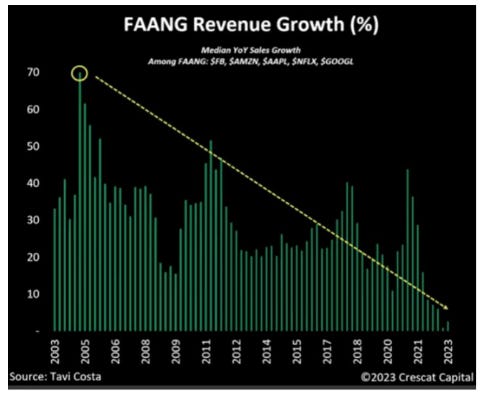

Second, the U.S. Stock Market performance has been driven by the FAANG stocks and the Magnificent 7. As the chart below shows, there is a distinct slow-down in the revenue growth of these stocks.

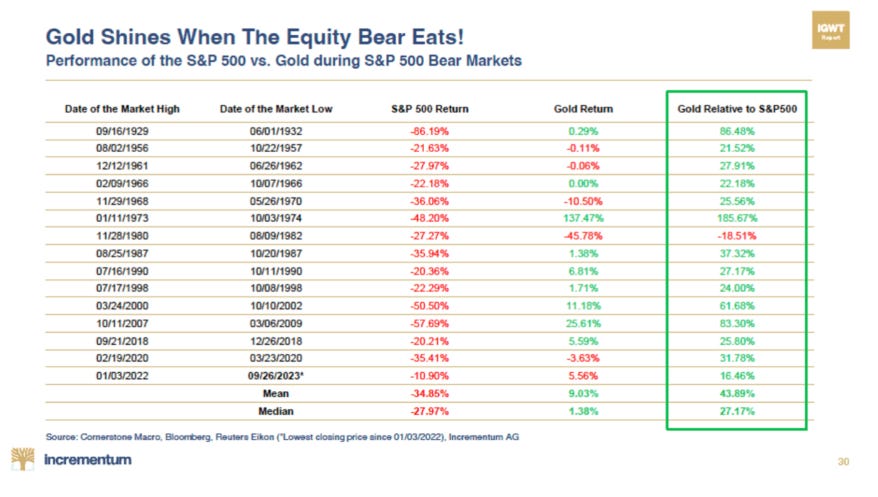

Our final point would be that when this equity market declines, all of that capital will be looking for a new home that is performing well. Notably, as shown in the excellent chart below by Ronni Stoeferle, gold does extremely well on a relative basis during equity bear markets.

INFLATION UPDATE