Gold Prices Can Go "Multiples" Higher: Larry Lepard

Friend of Fringe Finance Lawrence Lepard lays out his case for why gold could wind up "multiples higher" in the next few years.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter last week. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q2 2025. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

Larry offers up what I believe to be an extremely clear, concise and accurate analysis of the situation the U.S. finds itself in heading into the summer.

Part 1 of this letter was published yesterday. This is Part 2 where he dives into gold, the money supply and bitcoin.

FEDERAL RESERVE UPDATE

Since our last report, the Fed has had two meetings. One in January and another in March. In both meetings they left the target Fed funds rate unchanged at 4.25% to 4.50%. In the second meeting they did, however, take the step of reducing the amount of Quantitative Tightening (shrinking their balance sheet/bank reserves) by a meaningful amount, taking the monthly bond runoff from $25 billion per month to $5 billion per month. This was a form of monetary easing.

They have also had several of their high-profile mouthpieces speak about the possibility of changing the rules regarding the Supplementary Leverage Ratio (SLR) for banks, meaning banks would not be restricted in their ability to buy government bonds. Some have called this unlimited QE via the banks.

In addition, a Brookings Institute paper that was recently released called for the Fed to put in pre-emptive swap lines to large hedge funds that are involved in the “basis trade”. Briefly, the basis trade is an arbitrage that allows the hedge funds to earn a low-risk spread by purchasing government bonds. The problem is that the margins are small and so the hedge funds use extreme leverage (50:1 or 100:1) to make the profits meaningful. This all works well if markets are calm. But when they are not, the hedge funds can blow up unless they are given a swap line by the Fed. In effect, the swap lines become a bailout for the hedge funds that buy government bonds. Swap lines are effectively money printing since the Fed literally conjures up the money with a computer keyboard stroke.

Remember all of these liquidity measures are to prevent the bond market from falling apart. As we stated above, it was the bond market that forced Trump to reverse course on the tariffs. The one thing that an overindebted country cannot stand is a failing bond market with higher rates.

OUTLOOK

So after framing the situation, where might this market and economy go next?

We believe the economy is slowing and this will lead to a further declining stock market

This decline will be detrimental to the fiscal situation and may lead to a further decline in the bond markets (as deficits swell further) (doom loop)

This will force Fed to focus on its 3rd Mandate – healthy functioning markets

Fed will need to be accommodative (perhaps in a major way) and this will lead to further inflation, thus benefiting the assets in our portfolio

FISCAL DOMINANCE

In our last report, we discussed how the Federal Budget Deficit remains out of control and we pointed out that for the first two months of Fiscal 2025, the deficit grew 64% year over year. Things got somewhat better as we can see in the next schedule. However, for the first six months of the year the deficit was $1.3T, growth of 34% when compared to 2024. If we annualize this growth rate the deficit for Fiscal 2025 would be $2.6T.

Now the DOGE cost reductions have only begun to take effect, and they certainly will reduce this deficit; however, we have seen estimates that suggest that DOGE has cut only about $100B per year from expenses so the magnitude of the DOGE impact on a $2.4-$2.6T deficit will not be meaningful in our opinion.2

Note that the fundamental problem is that spending is growing at a 10% annual rate and tax revenues are growing at a 3% annual rate. Remember, this is all against the backdrop of a healthy employment situation and a healthy stock market. Historically, when the stock market has fallen, tax revenues fall as well and social costs (unemployment, etc.) increase. In the last two severe business downturns (2008 and 2020), deficits grew by between 6 and 9% of GDP, respectively. Presently our deficit is 7% of GDP. If it grew by these amounts, we would be in a full-blown debt crisis.

MONEY SUPPLY UPDATE

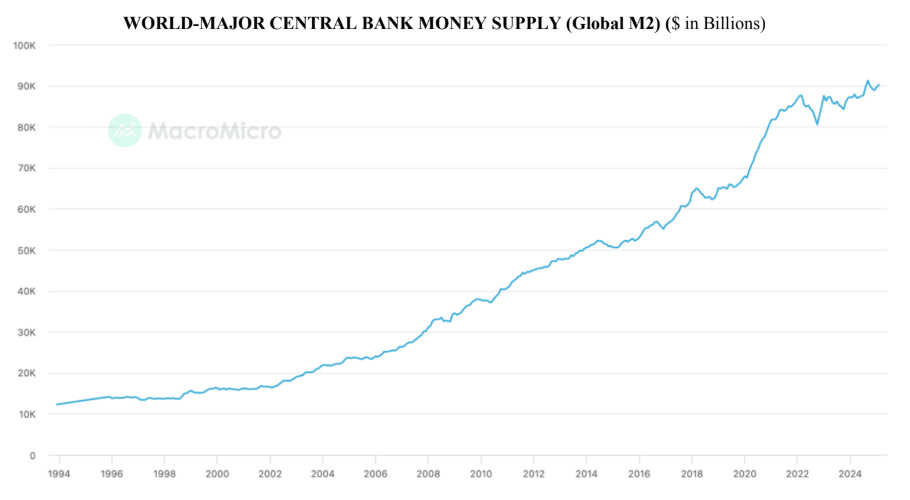

In a highly levered, debt-based system, the supply of base money must continue to grow or else the debt will be unsupportable and will collapse. Sometimes the money supply grows rapidly (COVID); sometimes less so as central banks implement a tightening cycle. The next chart is interesting because it shows the rapid growth in Global M2 during the COVID event and then the slow down brought about by Fed tightening in early 2022. Notice that the growth has resumed, and we are above the 2021 peak.

Money is extremely fungible and although the Fed has been restrictive, China and others have been aggressively printing money. In China’s case, it is to fight the downturn in their property market.

GOLD

As we expected, the breaking of the stock market bubble and the fact that the Fed is trapped have combined to create a strong bid for Gold. In addition, the Far East and BRICS countries have not wanted to recirculate their USD received from their exports into US Treasuries.