Gold Allocations Still "Very Low", Silver A "Very Special Metal"

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q3 2024. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 2 of his letter, part 1 can be found here.

FEDERAL GOVERNMENT FINANCES ARE A MESS

As we have discussed ad nauseum, the US Federal Government’s fiscal situation is in a “debt doom loop” with large and growing deficits, and the interest cost of servicing this debt growing the deficit even further. As a good macro analyst, Joe Consorti, recently pointed out:

“In June, the US spent $140 billion on debt interest, bringing the YTD total to $868 billion, on pace to hit $1.144 trillion by EOY. This was the single-biggest monthly outlay ever. How big, exactly? That's over 30% of all US revenue (mostly taxes) in June... just to cover debt interest.”

- Joe Consorti July 13, 2024

The Fed believes that the solution to inflation is higher interest rates to slow the economy. However, that only makes the cost of funding the government larger. Thus, the more they raise rates, the more debt they have to sell to cover the deficits. More debt generally leads to even higher rates. It is a vicious loop.

Compounding this problem, these deficits are occurring at a time when by most measures the economy is relatively healthy. The stock market and housing prices are at record highs and yet tax receipts are flat!

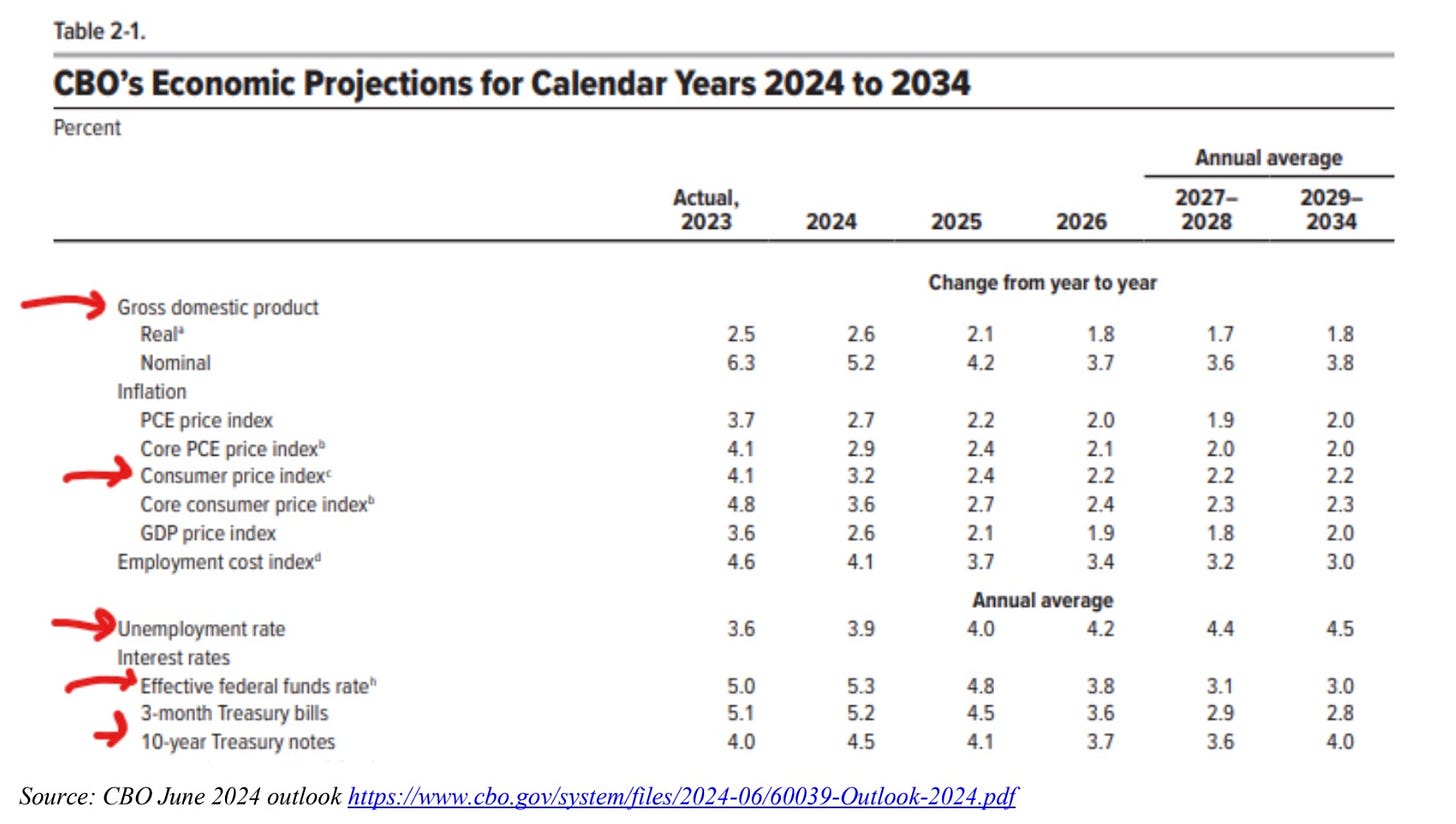

Looking at the Congressional Budget Office’s (CBO) recent economic projections: In Q1 FY 2024 (SeptDec 2023), the government recorded a deficit of $500B. In Q2 (Jan-Mar 2024), the government recorded a deficit of $600B. Then in June, the bi-partisan CBO gave the following update:

“The CBO estimates that if no new legislation affecting spending and revenues is enacted, the budget deficit for fiscal year 2024 will total $1.9T. That amount is $408B (or 27%) more than the $1.5T deficit that the agency estimated in February 2024”.

- Congressional Budget Office, June 2024

However, what’s even more astounding, the CBO’s estimates assume only Sunny days for the economy for the next 10 years – no recessions, low unemployment, low inflation and low interest rates:

Imagine what will happen to the deficit in an economic downturn. Allow us to provide some recession deficit math: (h/t to @infraa_ on Twitter for this math).

Government Expenses Increase in a Downturn:

• Government expenses will increase (social programs, food stamps, etc.)

• In the last two severe downturns, the burst of the Dotcom bubble and the GFC, government expenditures went up 13% (2001) and 9% (2009). o Take the average of 11% and another downturn would take expenditures up to $7.5 Trillion (note: President Biden recently proposed a $7.3 Trillion dollar budget for fiscal 2025).

Tax Revenues Decrease in a Downturn:

• During recessions, tax revenues plunge given lackluster stock market returns/capital gains.

• Tax revenues fell by 24% in the 2000 Dotcom bubble burst and by 32% in the GFC.

o So, the average decrease was 28% which portends that Tax revenues would fall from $4.9 Trillion to $3.5 Trillion.

o This would lead to a deficit of $4.0 Trillion. Or more than the government collects in taxes.

• If GDP remains flat at $27 Trillion (unlikely, it fell 4% after the GFC and 10% during COVID) then the deficit would be 15% of GDP. Higher than the WWII level of 12%!

Deficit in a Recession

• So, conservatively in the next recession, government deficits could equal $4 - $6 Trillion per year. Who is going to finance this?

Keep in mind that these figures assume there would be no new government programs to deal with the downturn. As the COVID crisis showed, this seems like an unrealistic assumption, as that crisis almost permanently added $2 trillion/year to the Government’s expense run rate.

COVID led to a $3T plus spending orgy, and since that time spending has not corrected much.

Of course, this level of spending has led to record debt issuance.

If the US Government were a company, it would be bankrupt already. This problem only gets worse if the economy turns down or the stock market falters. We get it though; the government has a printing press to manage this problem. That is precisely what they will be forced to do more and more in the coming years. The next BIG PRINT is coming. We just do not know the date. The system is constructed such that it cannot function without monetary debasement which is why owning forms of money that the Government cannot print (Gold, Silver, Bitcoin) is so critical to storing value in a monetary medium.