"God Help Us In The Next Crisis": Lawrence Lepard

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q4 2023. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is the most recent investor letter from my good friend Lawrence Lepard, which contains a detailed writeup on the following and will be broken up into two parts:

2023 Year in Review

The FED and Treasury Blink in Q4

Inflation

Gold and Bitcoin Got the Memo

US Fiscal Position Not Improving

Catalysts for a Full Fed Pivot

When The Fed Pivots, We Get Paid

Gold’s Outlook Is Improving

2023 YEAR IN REVIEW

Here are the major developments of 2023:

• No Recession – the rapid rate hikes of 2022 (basically from zero to 4.33% at year-end 2022) did not have the negative impact that we expected on the economy in 2023. “Fiscal Dominance” / “Bidenomics” (fiscal spending of $6.2 Trillion, not far off the COVID high of $7.2 Trillion) more than offset the Fed’s hawkishness as GDP growth was solid (+2.8%) and unemployment remained low (3.7%). There was very little spending restraint this year with continued “can kicking” on budget decisions ongoing until perhaps after the election.

• Stock Market Nears Record High – this one really surprised us. Despite the massive increase in interest rates, the S&P 500 rallied +26 % ending just shy of its January 3, 2022 all-time high. Our view is the US stock market is expensive and at risk of a major decline. Notice in the chart below the current 19.5x PEx with 10 year UST yields at 3.9%. This compares to the October 2007 (just prior to 2008 crash) 15.1x PEx when treasury yields were at 4.7%. Recall that following the 2000 bubble and the 2007 peak, the S& P500 declined 49% and 57%, respectively.

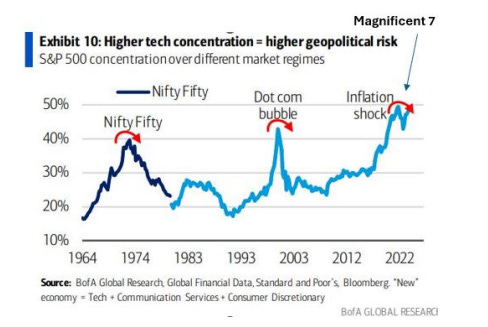

Most of the S&P 500 gains were in the “Magnificent 7” large tech stocks, each of which was up between 48%-239%! It’s reminiscent of the early 1970s and the concentration of market capitalization in “The Nifty Fifty” stocks back then. As the chart below shows, the Nifty Fifty did not end well, and we suspect the Mag 7 will have a similar fate.

• Silicon Valley Bank – in March 2023, two of the largest bank failures in US history transpired. We covered this in our Q1 report. At the time, the US banking system was on the verge of a run as Treasury Secretary Yellen flip flopped several times on the possibility of guaranteeing the entire $17.6 Trillion US deposit base. Instead, the government violated the Dodd Frank law and created a new funding mechanism the BTFP1 which rapidly grew to $80 Billion, and it continues to grow to this day -- increasing significantly in the past several months to $140 Billion. It is set to expire (require repayment) in March of 2024. We will believe it when we see it.

This credit event was very severe and shows how shaky the system is and how the Fed and Treasury will always provide a financial liquidity “put” (print money) for financial players and banks in times of trouble.

The BTFP was only the small visible part of the bail out. Pam Martens at “Wall Street on Parade” highlighted that the real bail out came via the Federal Home Loan Bank as it provided over $1 Trillion of liquidity to the banking system in March 2023, $100 billion more than provided in the GFC of 2008.

• Geopolitics – generally the markets have ignored (perhaps at their own peril) various geopolitical hot buttons –the ongoing Ukraine war, the growing unification of the BRICs bloc, the Israel Hamas war, or even the Red Sea happenings as the Houthis (likely backed by Iran/Russia) continue to create havoc in the Freight markets. Some speculate that this is the work of others trying to draw the US into the war in support of Israel vs. Iran.

• US Politics – the polarization of politics continued, with more “can-kicking” budget resolutions and the fight over the Speakership/removal of Kevin McCarthy. As far as the upcoming 2024 election, perhaps it’s apathy or just how polarizing politics are, but it seems to us that very few people want to discuss it. The most important political takeaway for us is that while political news will certainly grow this spring and summer, the outcome is unlikely to affect the fiscal spending trajectory, regardless of which party wins. Debt is debt, and math is math.

THE FED (AND TREASURY) BLINK

We start the discussion of current events by referring you to our Q3 report. In that report, we presented how the US Government Fiscal doom loop was getting worse and how mathematically US Federal borrowings were crowding out the debt markets - sending interest rates higher.

The nearly parabolic growth in US Federal interest costs is making the deficit worse and without monetary accommodation, we suggested that the debt and equity markets were headed for real trouble. Lyn Alden’s chart (below) points out that it is only a matter of time before the Fed will be forced to grow its balance sheet again (print money). In a heavily indebted system, the supply of money needs to continually grow or the debt becomes unserviceable.

The Fed began to blink in Q4. This is enormously important and supports our thesis that the Fed and Treasury have no choice but to loosen monetary conditions (further debase the currency) in order to prevent market dysfunction. Let’s review what happened.