Financial Fear-Mongering Fallacies

Austrian school thinkers are often ostracized as fear mongers or broken clocks - but a wide spectrum of ideas about markets is precisely what all savvy investors should be demanding.

As I was browsing Twitter a couple of days ago, I noticed somebody taking shots at friend of the blog Lawrence Lepard, whose most recent investor letter I published here (Part 1) and here (Part 2).

Larry is, in my opinion, one of the few truth tellers left in the market and, for better or for worse, sees the world of macro in the same way that I do. Many people do not see the financial world like we do and, rather than consider our opinion seriously, they write us off as sensationalists, trying to ruffle feathers for no other reason than to sell our products or services, or gain social media popularity.

This occurrence brings me to a couple things I want to discuss today: something I’m going to call “financial free speech” and then my most recent take on where markets stand.

Financial Free Speech

The way I see it, Austrian economists are the true purveyors of free speech in financial markets. We have seen both free markets and free speech challenged in this country - the former with the Fed manipulating, well…everything it can get its fucking hands on in the world of markets and finance and the latter with wide-eyed left-wing snowflakes and globalist-conference-attending elitists trying to control what “misinformation” is while criminalizing free speech and opinions that they don’t like.

Austrian economists/thinkers have the honor of acting as roadblocks for both of these nefarious agendas, so it really isn’t much of a surprise that we get a lot of shit.

I happen to believe that almost all of what Larry advocates for – spearheaded by a return to sound money – makes sense.

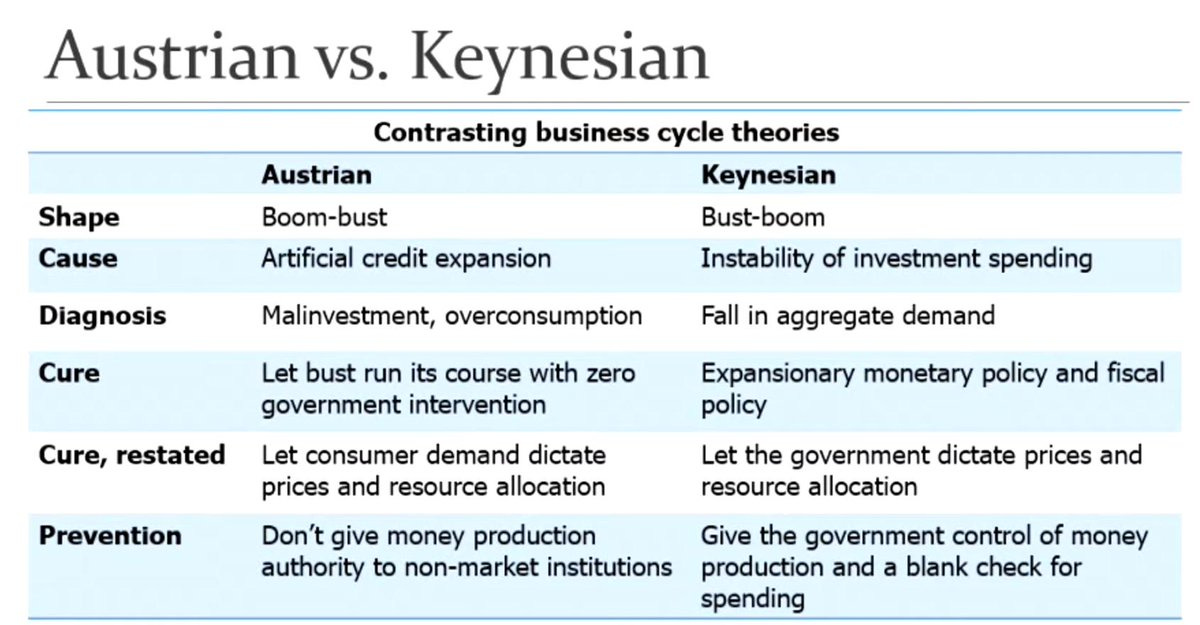

I can understand how people that have lived within the Keynesian system, and especially those whose electability, reputations and sometimes even celebrity, depend on it, could disagree with Larry. There is probably also a small constituency of individuals that simply don’t understand Austrian school thinking, though I happen to think these people are in the minority.

But that’s what’s great about being an Austrian school thinker. There’s no senseless jargon or PhD level postmodern bullshit to remember: all you’re doing is tearing down the walls and going back to the studs of economics.

This means that, in theory, if you are “smart “enough to understand the dumbassery that is Modern Monetary Theory, you should be able to understand Austrian economics 100 times over.

But unfortunately, no matter how “smart” people are, it doesn’t mean they understand the importance of dropping their ego, not being arrogance, or dialing down hubris.

I was already considering writing a piece about why Austrian school thinkers are important, but the criticism of Larry pushed me over the edge.

Of course, I’ve heard all the same bullshit as he has. In fact, my original motivation for writing this piece was somebody making a comment that they couldn’t believe that I had “monetized my fear mongering” by having a Substack.

To which I reply: I’m not “fear mongering” anyone, except maybe myself. The blog represents my thoughts and I am legitimately worried about the grave consequences of our current economic and political paths. If that makes me paranoid, anxious or outright wrong about things, that’s one thing. But don’t say I don’t come by the beliefs honestly, because I do.

At the end of the day what I’m “selling” is my unique view on markets and equities, as well as aggregating content from people I believe are intelligent, think differently and don’t get the media coverage they deserve relative to the value and perspective they bring to the table.

People say about the first amendment that it’s most important to protect it when it comes to people who say things you don’t agree with.

There are two ways to look at something you disagree with: the first is understanding that you disagree and supporting a person’s right to use their voice, which of course honors our free speech rights. And the second is to demonize and vilify the person - and in some cases even claim their speech is criminal. No matter how ugly their words may be, this dishonors the breadth of the notion of free speech.

While it may not take any extra brain horsepower to understand Austrian economics for those already involved in markets, it does take a little mental horsepower to understand the concept that a wide spectrum of opinions isn’t just what makes a market, it is what allows market participants to think critically and then draw their own conclusions.

It should come as no surprise to you that I’m definitely going to get things wrong in the future. I’m not selling fear, but even moreso, I’m not selling certainty. I don’t put timelines or definitives on prognostications that I make. I do my best to offer what I believe is a unique and valuable take, and then it is up to the reader to take it or leave it. As a libertarian, the very last thing I want do is force my views on people, and I would never want somebody who doesn’t think that the perspective is worthwhile to feel like they need to read or consider my opinion. After all, I don’t spend my days reading shit that I don’t find valuable. Why should you?

My Take On Markets Heading Into February 2023

With that venting out of the way (you guys should be billing me by the hour), I want to take a second and also talk about my macro stance on markets heading into February 2023.