Dry Powder

One of my favorite investors shares what he's long - and what he's holding out for.

As always, I’m stoked to be able to bring you content from one of my favorite investors, Chris DeMuth Jr. Chris took the time to prepare up-to-the-minute thoughts for Fringe Finance subscribers this week.

Chris is one of the smartest people I’ve had the chance to meet during my time as an investor. He was one of the first people to ever to be nice to me when I got my start writing on companies more than a decade ago. His acumen is widely respected by many people whose work I admire and follow - and by me.

All information contained herein is opinion only of Chris DeMuth & does not constitute investment recommendations. Nothing is a solicitation to buy or sell securities.

This has been shared with permission from my dear friend Chris DeMuth’s Substack, which you can read here. Please read our respective disclaimers below.

The way to get really rich is to have $10 million sitting in your checking account so that when a great opportunity comes along, you can act.

- Charlie Munger

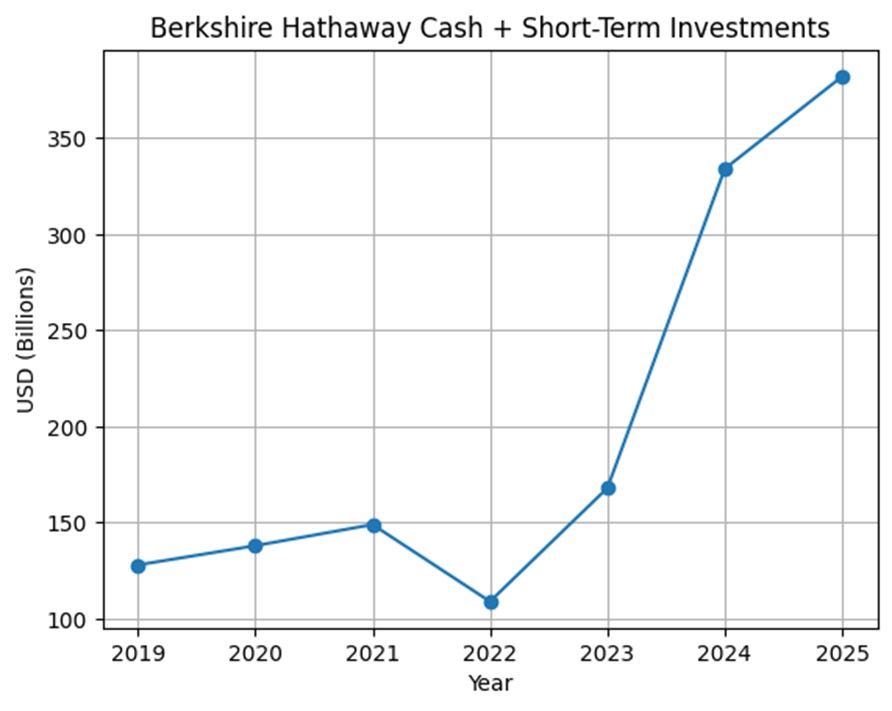

Berkshire Hathaway (BRK.A) (BRK.B) listened to Charlie with over $382 billion in cash and short-term investments such as U.S. Treasuries. They’re ready to act when a great opportunity comes along. I am at least 90% sure that there will be great opportunities in the next five years. Many of those, probably the vast majority, are not yet ripe today. So get ready. Store dry power. If not $10 million, then put $2 million aside to keep up with inflation but otherwise ready for future deployment. If not $2 million, then everyone should have at least $100k.

This is an emergency fund for financial emergencies, which can be positive or negative. It might be a crisis or an opportunity but both are urgent needs for fresh capital. Have some. How much? More than your marginal counterparty at times when liquidity dries up. On the most panicked days, you want to be on offense. If you’re on defense then your preparations failed you. The easiest financial analysis that you’ll ever do is when you’re dealing with forced selling and have new capital.

Now’s the time to store dry powder. The Buffett indicator of market cap to GDP sits at ~224%, showing a significantly overvalued US equity market likely to offer a negative total return from current prices.

We are currently in the second year of the presidential term, which is the historically weakest, returning ~3% on average, less than half as much as the second weakest year in the cycle.

The Shiller PE ratio is ~41, 49% higher than its 20-year average of ~27. Technology stocks are especially high at ~64. Tech is now over 30% of the US market cap, which is a level at which prior sector leaders have aggressively mean reverted. As a country market, the US is far more expensive than alternatives such as the UK.

The S&P VIX Index is helpful for monitoring complacency. I like looking to write optionality when it is over 30 and to buy optionality when it is under 15. As of this writing it is at 14.91.

GMO forecasts 7-year asset class returns, most recently showing the categories most likely to perform badly are US small caps at -3.6% and US large caps at -6%. I don’t think of that as a prediction as much as a possibility that I want to be prepared for. But I want my preparation to at least keep up with inflation, which is currently running ~3% per year.

Subjectively, the mood among investors appears euphoric on average. In my portfolio, the most speculative positions are doing the best…