Douchebag Dominoes Topple Towards Dow's Doomsday

"Visionary" founders once praised during market euphoria are being exposed as hucksters. Next, entire sectors will start collapsing.

Those that have been reading me over the last year know that it is my strongly held belief that—even if the market does eventually wind up moving higher over time—we must experience a swift and shocking move lower in equity markets that, I believe, we are due for at any point now.

My reasoning has been simple, and, as I have noted in numerous other articles, basically comes down to simple math. You can't push fiscal deficits to highs, run up monstrous debt, blow up the largest liquidity bubble in the history of the world, and then jack interest rates higher at breakneck speed and expect nothing to break.

How's that for a PhD-level economics course?

But seriously, the math behind my reasoning is starting to play out. Zero Hedge put up a few great Tweets towards the end of the day on Tuesday, with charts showing exactly how bad things are getting.

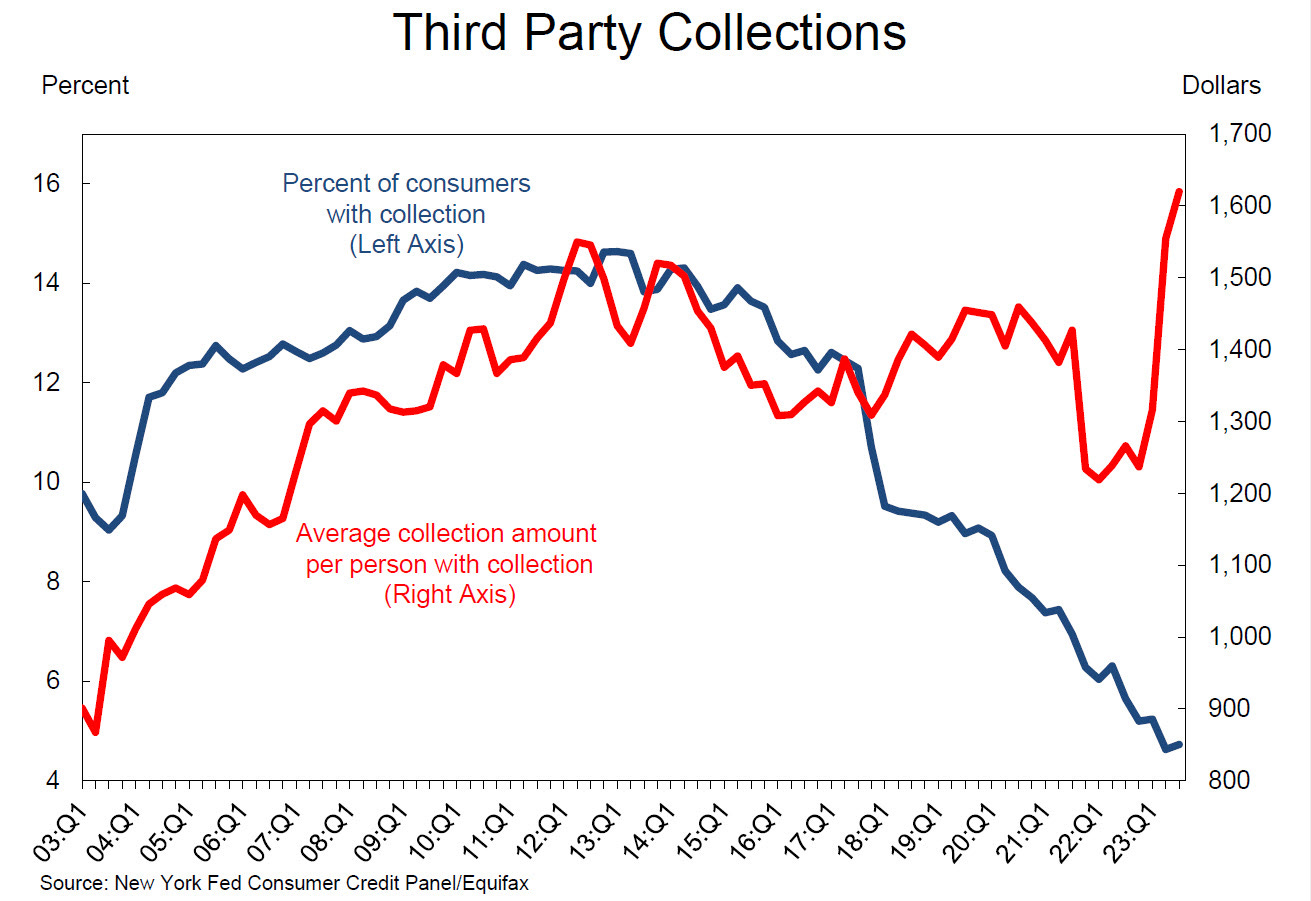

“US consumers decided they want to be the US government: max out every possible form of credit and go for it,” they wrote.

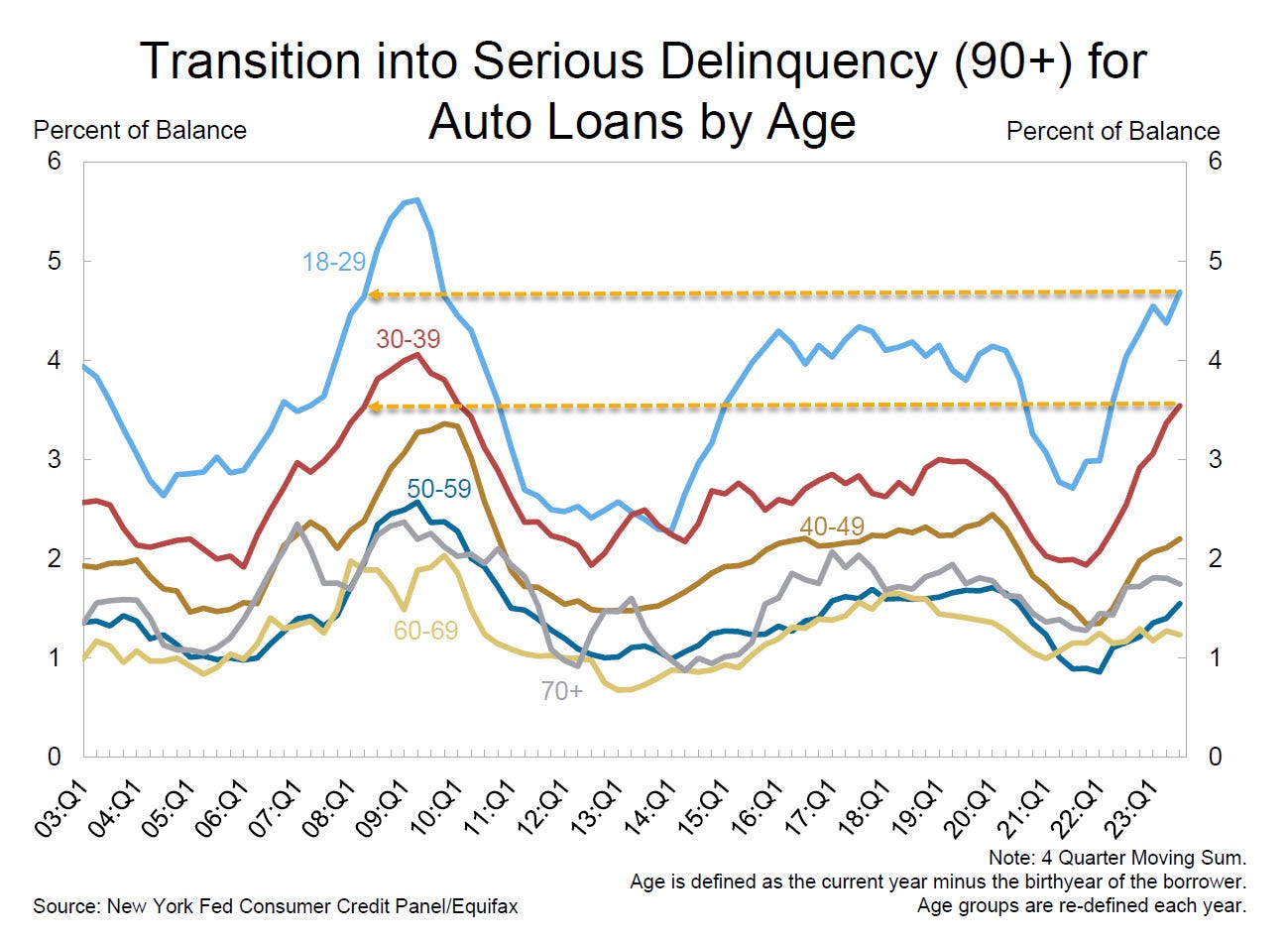

Pointing out auto loans, they noted: “For Millennials and Gen Z, it's as bad as the [global financial crisis]”.

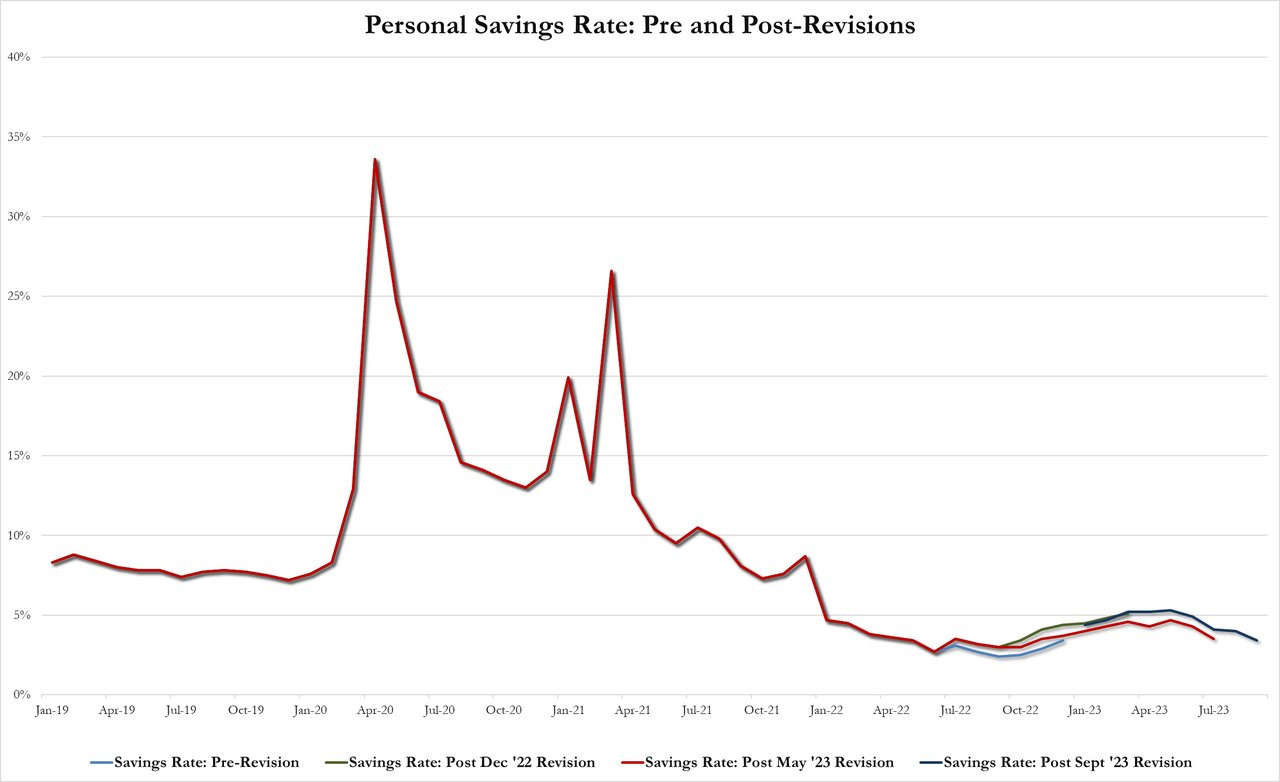

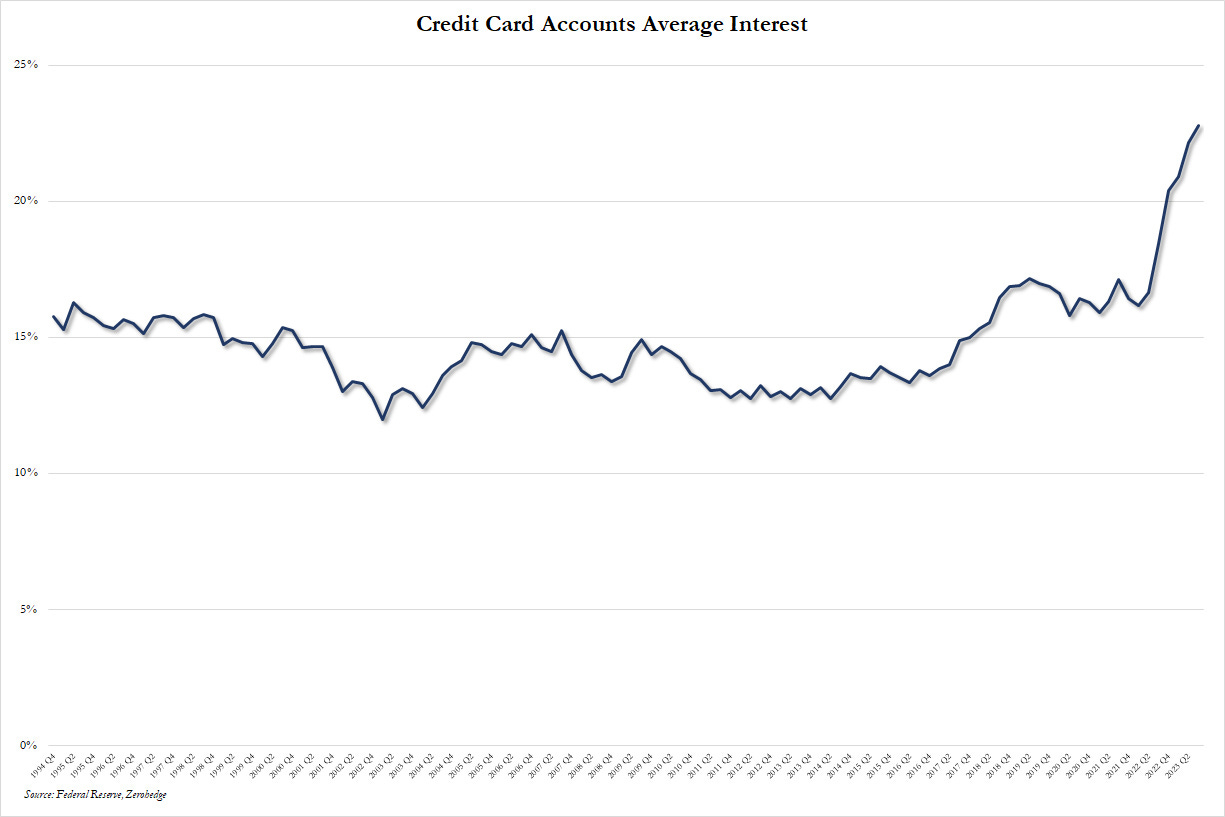

Zero Hedge also noted that personal savings is near all time lows with credit card interest rates at record highs:

So, these charts all just mean that things are heading in the direction that I have predicted, but we haven't hit that point of no return yet, or in my parlance, the "oh shit" moment, that is going to spook the rest of the market and eventually cause a self-fulfilling prophecy of relentless selling as a result of both deleveraging and panic.

And while I haven't really been specific about what the catalyst could be that pushes us over the line, certainly a couple of new examples presented themselves this week.