Do Look Down

Our country and our markets have forgotten about the "problem underneath the problem" and why stocks are still likely to plunge lower.

And just like that, we’re back with the NASDAQ pushing 14,000 again and the S&P 500 back over 4,450. The S&P ripped higher by 6.2% last week and the NASDAQ tore higher by almost 8% last week.

In fact, last week’s rip higher put both of the indexes into positive territory for the last month, with the S&P now up 2.6% and the NASDAQ up 2.55% over that time period. “BTFD” investors for the last month are likely patting themselves on the back and reassuring themselves that everything is going to be alright.

I’m here to ruin that fantasy with my opinion.

All told, markets staged rallies last week that could have (and likely did, and will) fool newer or unsophisticated market participants, many of the “BTFD” school of investing, into thinking that the worst of the 4 month sell-off is over.

While longer-term focused investors will stick to the adage of “stocks always go up” in the very long term (they are likely right), this isn’t a time for the expression “don’t look down”. In fact, it’s the opposite. Every time people fool themselves into thinking we have “corrected” enough or reverted to some kind of historical mean, it’s time to look at the macroeconomic picture, zoom out, and welcome the expression “do look down”.

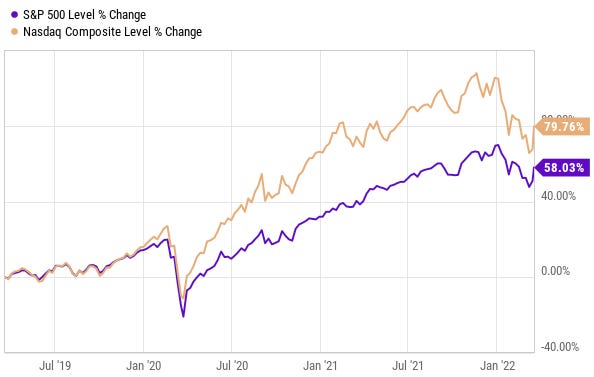

Over a 1 year period, the S&P is still up a blinding 14.6% and the NASDAQ is up 5.1%.

Over a 3 year period (which literally only takes us back to just 2019), the S&P has returned 58% and the NASDAQ has returned 79.76%.

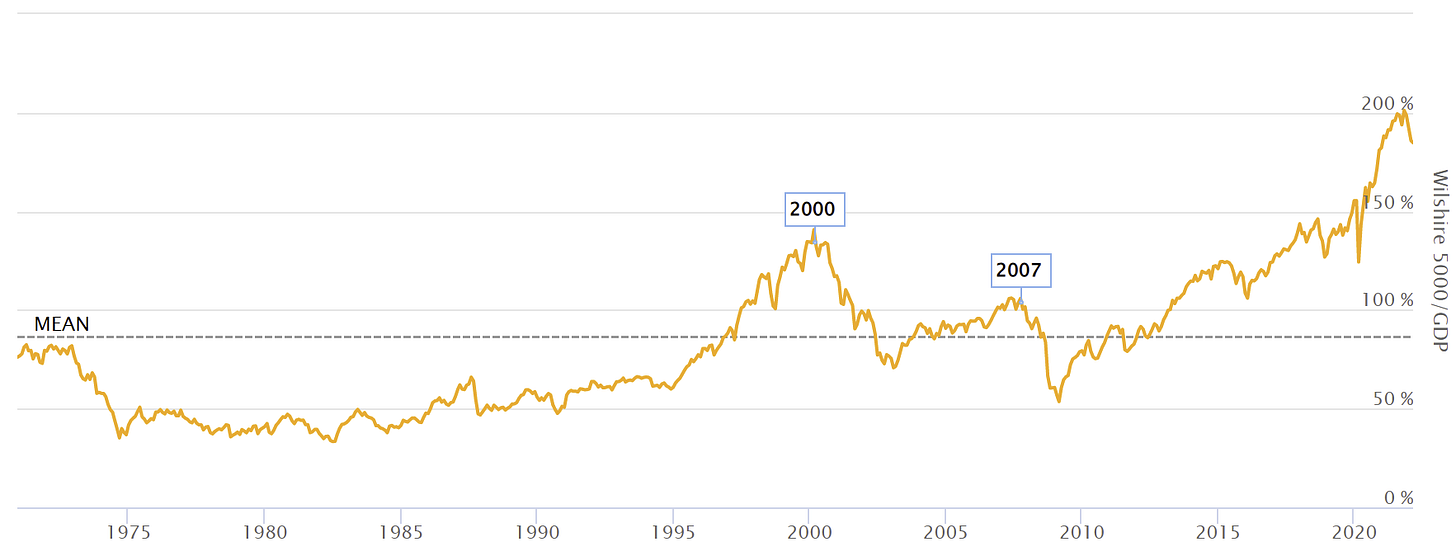

And historically, market cap/GDP remains about 60% higher than its historical mean, about 40% higher than it was prior to the 2008 crash, and about 25% higher than the previous top it had made prior to the tech wreck of 2000.

In other words, no matter how you slice it and dice it, there is still a long way lower to go and market participants would do well to remind themselves of this by “looking down” at exactly how much ground this insane bull market has covered over the last 14 years.

Not only have many unsophisticated “investors” of the last decade or two not seen a classic bear market rally, many don’t know how to recognize them and don’t understand that positive weeks during a longer term downtrend can suck in more cash than Mega Maid sucked air from Druidia in Spaceballs.

If you can’t confidently say you have experienced a longer term bear market rally before, chances are you likely haven’t. If you’re under the age of 30, chances are you definitely haven’t. But, in my opinion, that is exactly what we are staring down the barrel of right now.

Let’s examine the climate for stocks and let me lay out my argument for why we’re probably heading lower. I don’t think people are seeing the big picture through a realistic lens and I believe judgement has been clouded thanks to a decade of pure euphoria.

First, let’s look at why I think stocks rallied last week, and then I’ll explain why I think they have nowhere to go but lower in the mid-term.