Cracks In The World Economy Are Starting To Show

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week, with his updated take on the monetary miasma spreading across the globe.

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week, with his updated take on the monetary miasma spreading across the globe.

For those that missed it, Larry also talked with me on my podcast just days ago. I believe him to truly be one of the muted voices that the investing community would be better off for considering. He’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q4 2022. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is Part 1 of his letter.

In the third quarter, virtually all asset classes went for a roller coaster ride – a sharp bear market rally in July and August, followed by a vicious sell off in September as the Fed continued its Hawkish tone at Jackson Hole in late August and then raised the Fed Funds rate in September to 3.00-3.25%. Recall that as recently as February 2022 Fed Funds was at 0.0-0.25%.

Year to date through 9/30/22, the S&P 500 and Nasdaq are down -24% and - 33%, respectively. Gold and Gold Miners (GDXJ) are down -9% and -30% year to date, respectively. Bloomberg’s US Aggregate Bond Index is down -15%. Only the Bloomberg Commodity Index (broad commodities like oil that are benefiting from inflation) is up year to date (+13.5%).

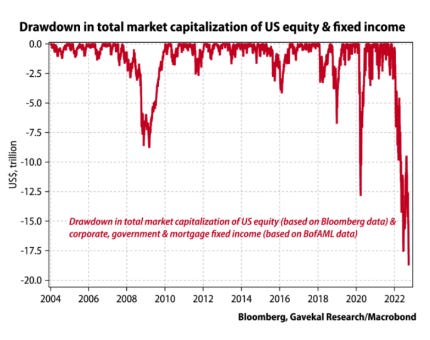

The Fed’s hawkishness has caused an enormous amount of wealth destruction. As the chart below shows, US stocks and bonds have created a drawdown of $18 Trillion in the US equity and fixed income markets, far worse than 2008 and 2020’s market value destruction. Yet, despite this the Fed maintains that a “soft landing” is still attainable in this downturn. We believe this “soft landing” will be about as accurate as their prior contention that “inflation is transitory”.

CENTRAL BANK HAWKS

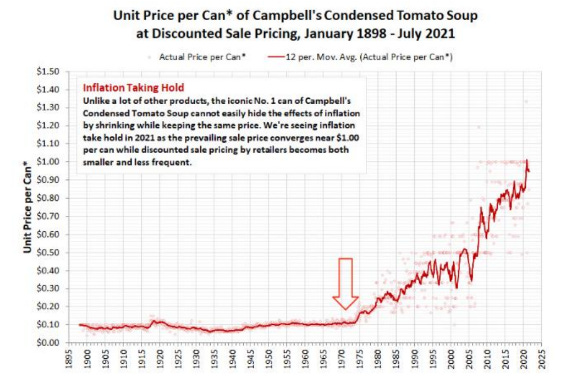

Throughout the 20th century, bouts of inflation tended to be modest (with the exception of short periods where externalities drove much higher inflation – e.g., WWII or Vietnam). However, once the pure fiat economy emerged post 1971, inflation and credit cycles became more the norm with a periodic crisis about every decade. Notice in the chart below how rapid the price of a can of Campbell’s Soup inflated once we went off the gold standard (see arrow at 1971).

With inflation, growing fiscal deficits and the Fed’s increasing intervention in controlling interest rates and money supply, various crises often popped up as the chart below shows.