Comex: Physical Silver Demand Keeps the Market in Backwardation

"Heading into January, demand is staying very strong."

The CME Comex is the Exchange where futures are traded for gold, silver, and other commodities. The CME also allows futures buyers to turn their contracts into physical metal through delivery. You can find more detail on the CME here (e.g., vault types, major/minor months, delivery explanation, historical data, etc.).

The data below looks at contract delivery where the ownership of physical metal changes hands within CME vaults. It also shows data that details the movement of metal in and out of CME vaults. It is very possible that if there is a run on the dollar, and a flight into gold, this is the data that will show early warning signs.

Gold

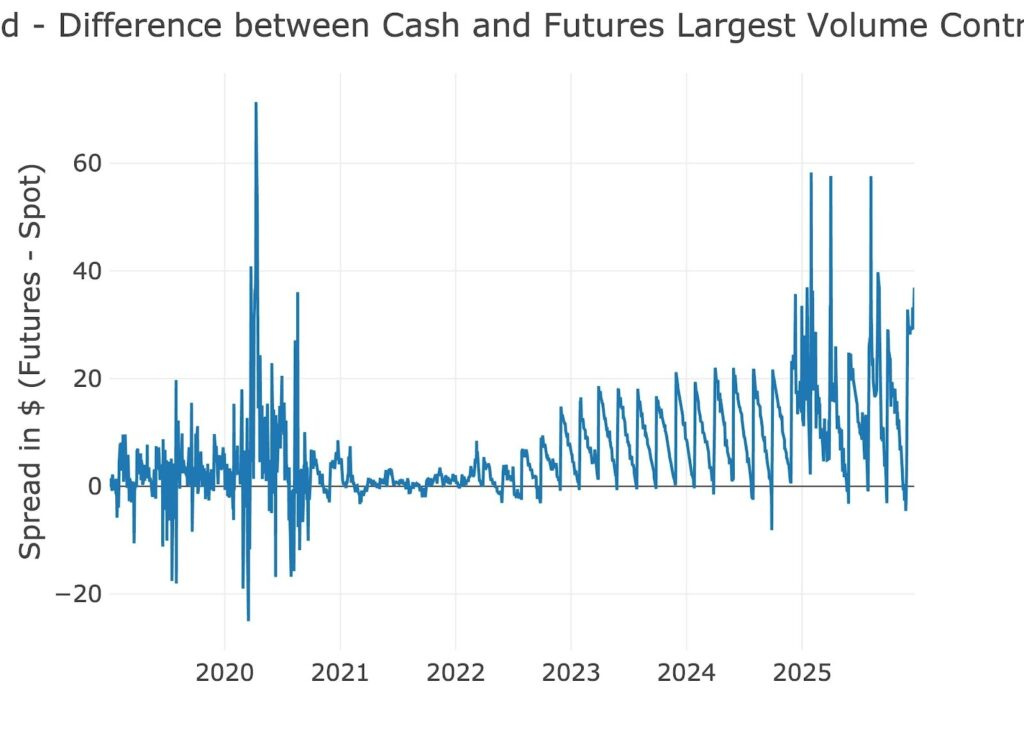

The chart below shows the spread between the spot price of gold and the futures contract pricing. As you can see, it blew out earlier this year (increasing contango). This created the massive arbitrage that resulted in gold traveling from London to New York. When the spread between futures and spot gets distorted, it suggests there is dis-location in the market. The spread normalized some between August and early December, but has started to blow out again. It’s possible this could lead to increased delivery volume again, but we have not seen that yet this month.

Figure: 1 Spot vs Futures

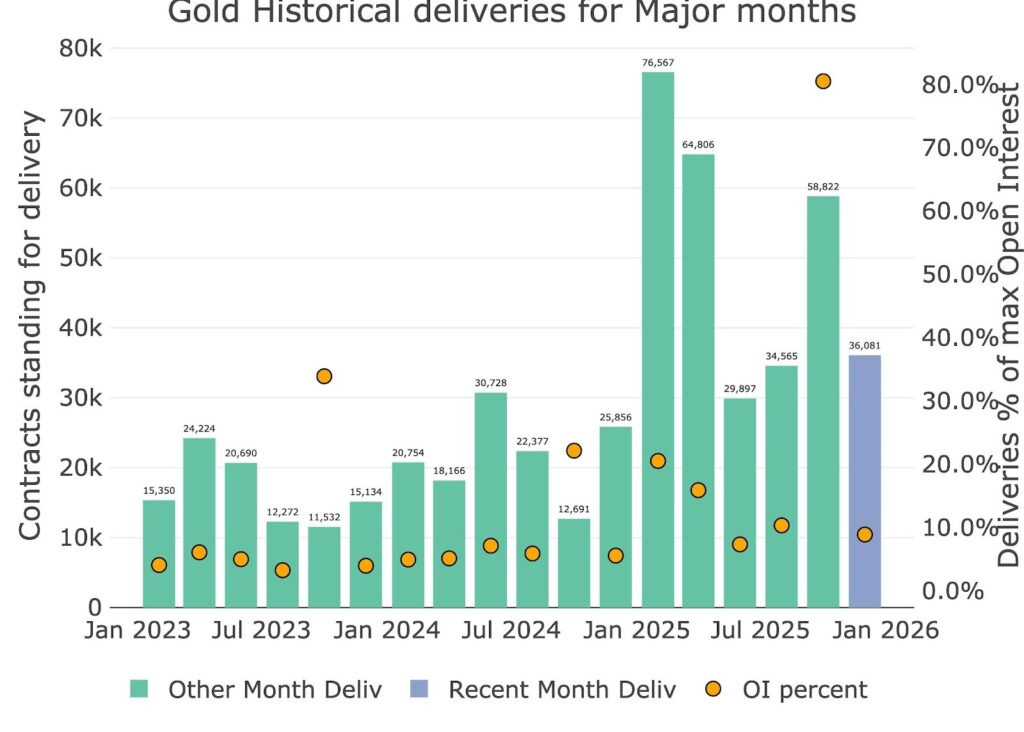

As shown below, while gold delivery volume is elevated on a historical basis, it is below the three massive delivery months earlier this year (Feb, Apr, and Oct). If spreads continue to blow out, then Jan and Feb could show large delivery volume again.

Figure: 2 Recent like-month delivery volume

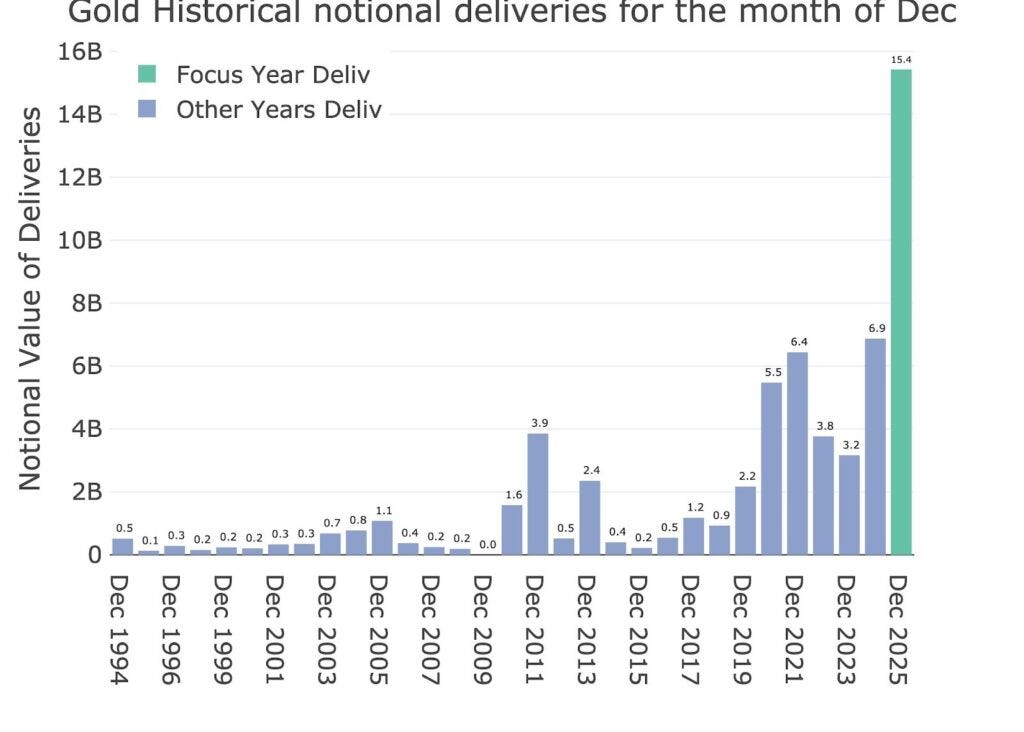

Below is a chart that isolates the month of December going back 30 years. We can see that on a notional level, this December is absolutely smashing historical records. While this is heavily impacted by the surging price (notional is price x volume), it still shows that the appetite for gold in dollars is increasing dramatically.

Figure: 3 Notional Deliveries

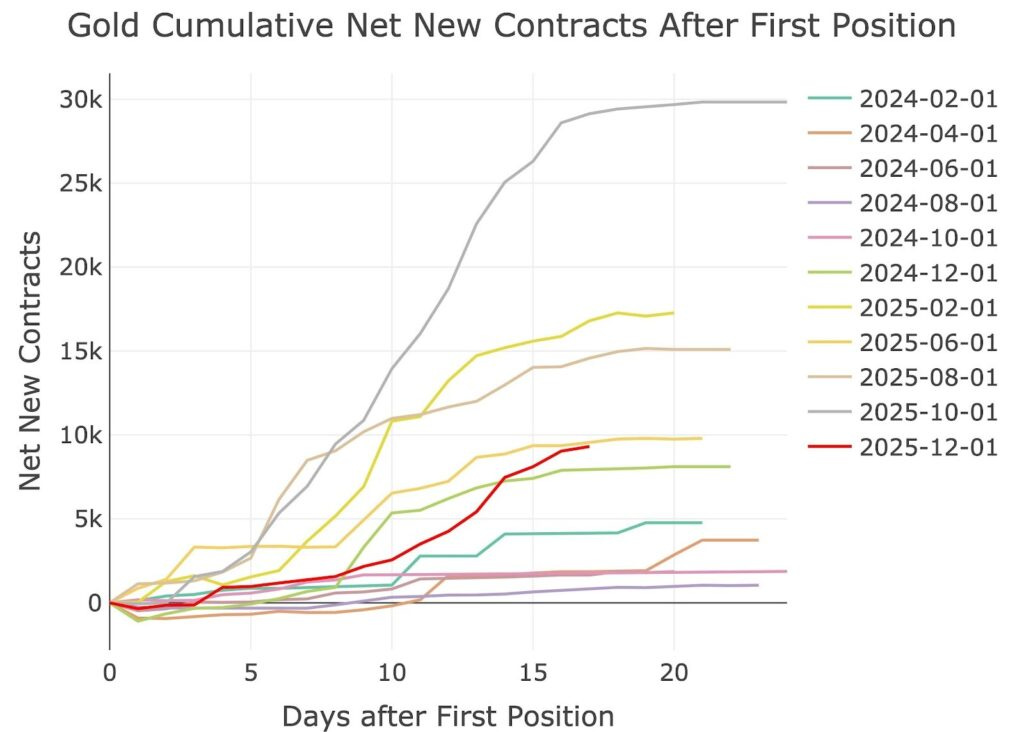

Net new contracts (contracts that open and settle for immediate delivery) was a modest driver. Not as large as other months, but also a late surge that is not usually seen. That surge came as the spread started to widen (Figure 1). It’s likely that these are related.

Figure: 4 Cumulative Net New Contracts

Perhaps the most important data point is the actual metal leaving Comex vaults. When metal is “delivered” it does not mean it’s leaving the Comex. It means that Registered ownership is moving from one party to another. When the metal leaves the vault, that is where things get interesting. As shown, this year saw a major influx as the arbitrage trade took hold, but that metal was flowing back out. In the latest month, a lot of Eligible was converted to Registered to satisfy delivery demand. The Comex is not (yet?) bringing in any new metal.

Figure: 5 Inventory Data

Looking ahead to the December delivery period, we see a contract that is hovering near the middle range of all minor months.

Figure: 6 Open Interest Countdown

With the massive surge in inventory, the open interest relative to physical stocks is actually lower. This shows how much metal has been added to Comex vaults this year.

Figure: 7 Open Interest Countdown Percent

Bottom line, December saw elevated deliveries on a historical level, but well below the 2025 highs. The Comex vaults saw little metal arrive or leave this month, it was mainly a conversion of Eligible into Registered.

Silver

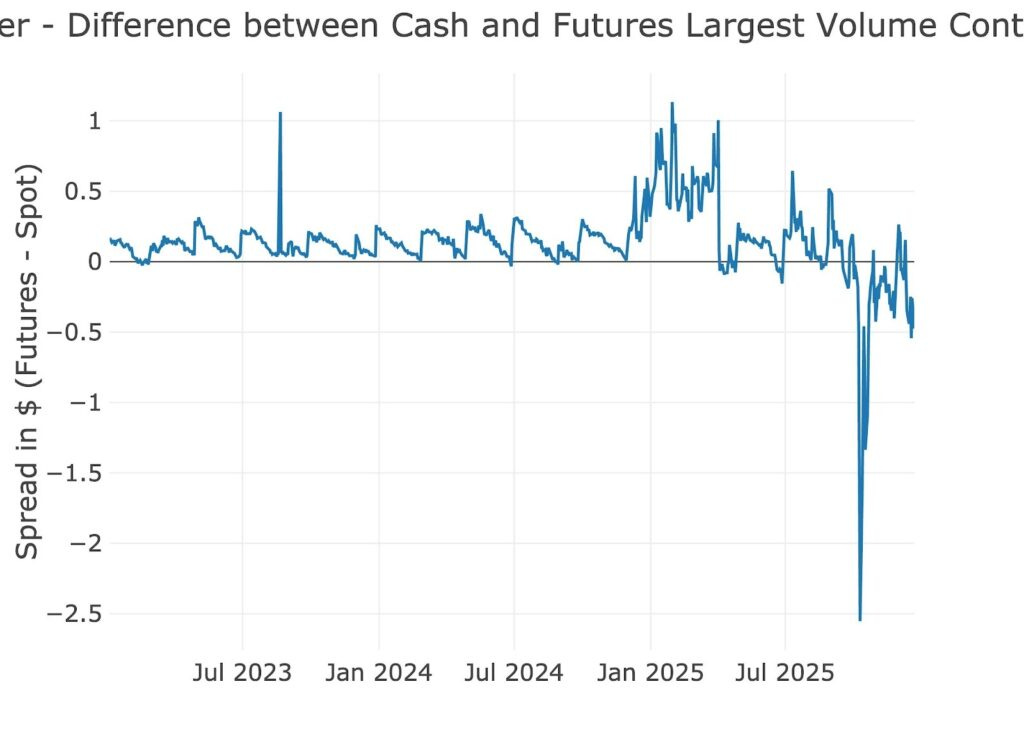

While the gold market is showing a futures price that is getting higher above the spot rate (which caused metal to move from London to New York), the silver market is experiencing the opposite problem, backwardation. The spot price is above the futures price. This is actually a bigger warning sign because it highlights the pressure being put on the physical spot market.

Market Signal: Backwardation often signals a strong immediate demand or a supply shortage in the current spot market. The market is willing to pay a premium for the asset now, as the shortage is typically expected to resolve over the long term.

Figure: 8 Spot vs Futures

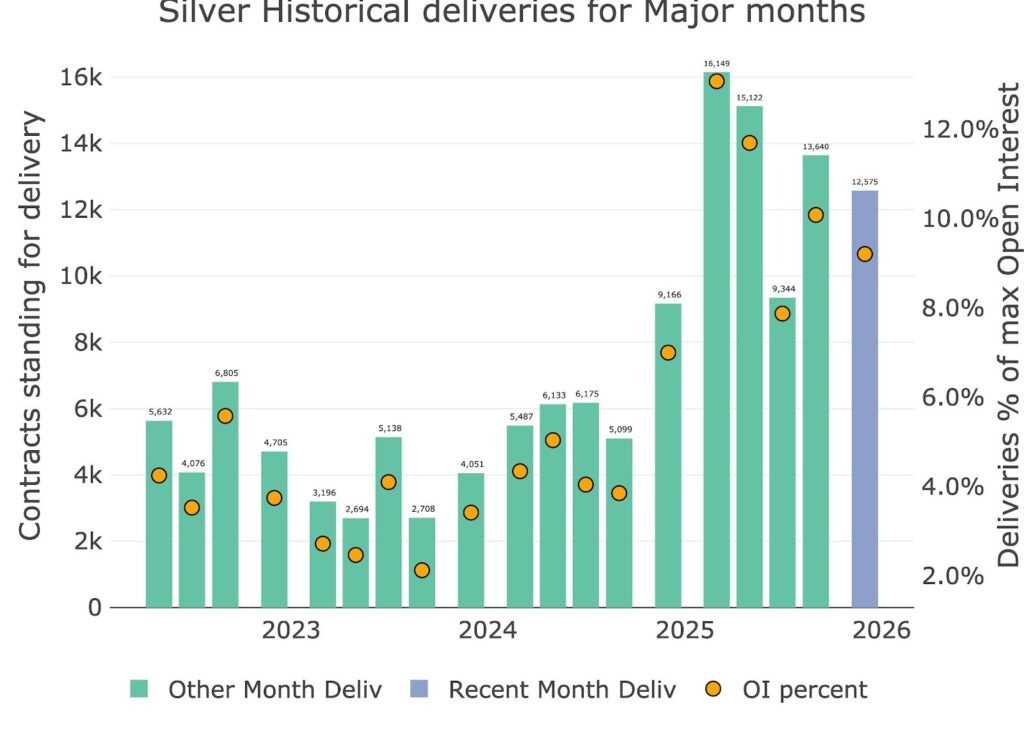

While gold delivery volume has cooled some, the silver delivery volume remains elevated.

Figure: 9 Recent like-month delivery volume

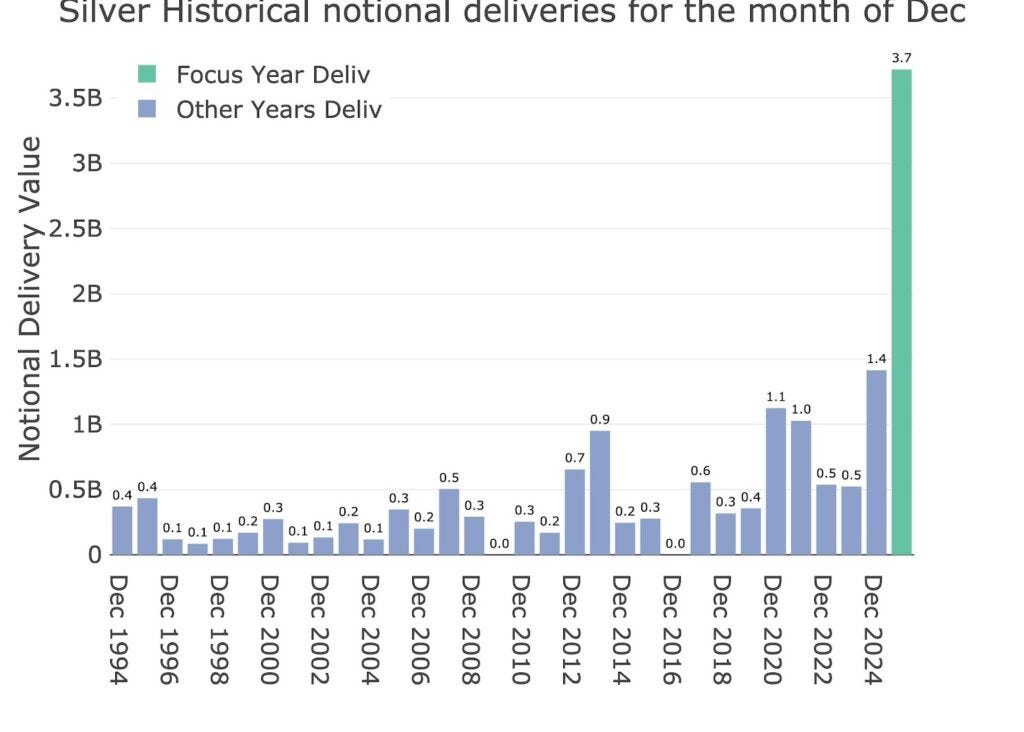

Switching to notional values, and focusing on the month of December, produces the chart below. Again, some of this is price appreciation, but it is also an increased appetite for deliveries. In 30 years of delivery data, the notional amount is almost 2.5x higher than any previous December on record. The price appreciation is not denting the demand for physical.

Figure: 10 Notional Deliveries

Unlike gold, net new contracts were a major driver this month, reaching the second highest behind only September.

Figure: 11 Cumulative Net New Contracts

Silver eligible inventories are seeing some modest inflows this month, but this is not new metal… it is metal coming from Registered as we are about to see.

Figure: 12 Inventory Data

Registered metal (metal available for delivery) is seeing major outflows. Since September, there has been a massive draw down in Registered supplies. This is further evidence of strain in the physical market. Investors are taking delivery and moving it to Eligible this month. In prior months it was coming straight out of the vault. This will be the chart to watch as we head into 2026.

Figure: 13 Inventory Data

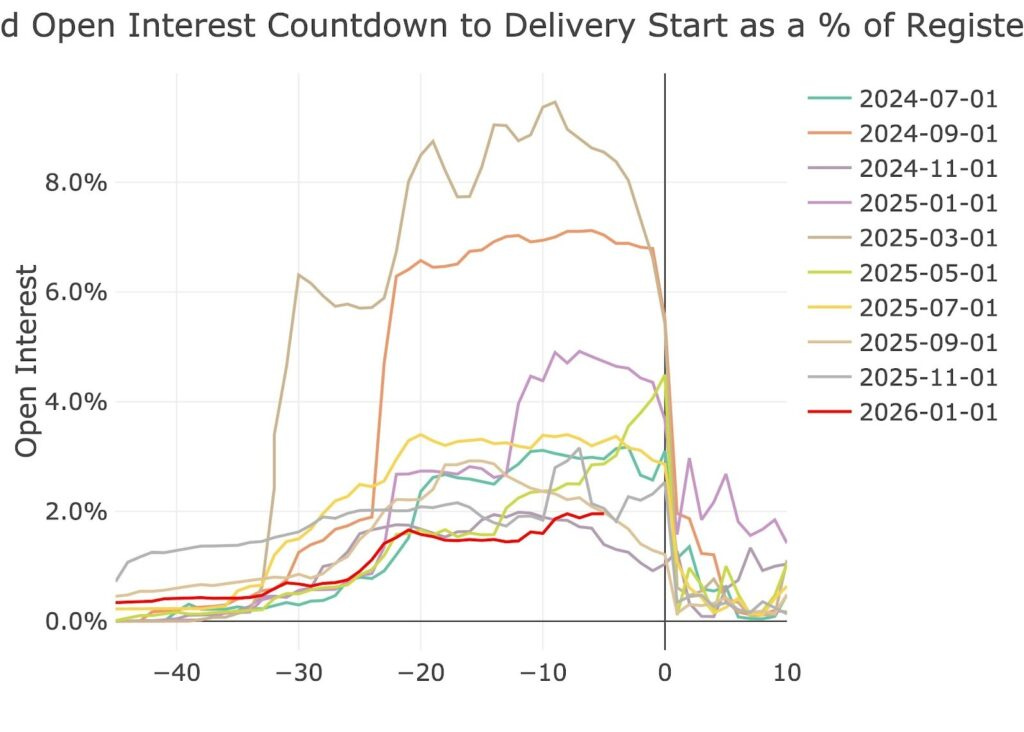

As we approach January delivery, the silver contract is now at the highest open interest when compared to all prior minor months. The deviation from trend is stark.

Figure: 14 Open Interest Countdown

On a relative basis, open interest is still in record territory despite the elevated inventory levels.

Figure: 15 Open Interest Countdown Percent

Conclusion

The gold market has certainly calmed down when compared to the activity earlier this year. That said, with spreads widening, we may be in store for some more fireworks. Earlier this year metal flowed into Comex vaults to satisfy demand that was coming from traders looking to arbitrage.

Silver is showing opposite behavior with spot prices above futures. This is causing metal to flow out of the Comex vaults. Heading into January, demand is staying very strong. While silver prices have gotten extended to the upside, any pullback should be well supported by physical demand.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

I must confess, I have no idea what this means nor how it works. Simple me asks who would sign a contract for less than spot? Back to the Holiday Inn Express for me.

Time for new James Bond movie: Silverfinger.