By Peter Schiff, Schiff Gold

Chinese gold demand improved on multiple fronts in August.

China ranks as the world’s biggest gold market.

While the price of gold declined in dollar terms last month, it was up 1.8% in yuan due to Chinese currency weakness.

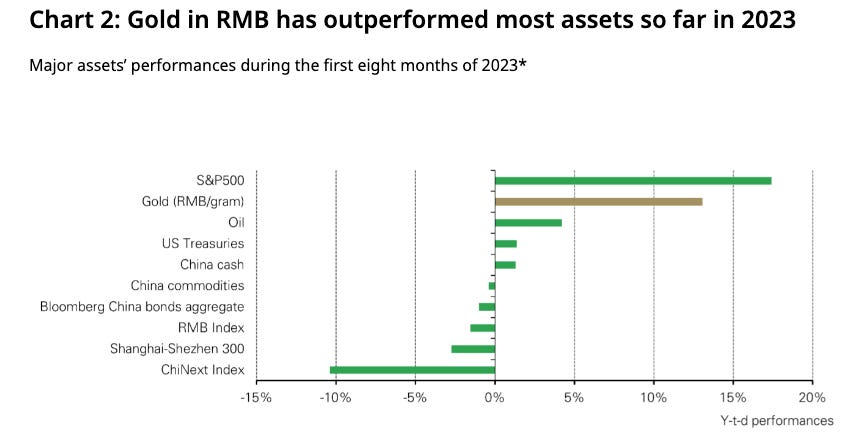

With prices rising, gold has outperformed most other assets in China, according to data from the World Gold Council.

Gold withdrawals from the Shanghai Gold Exchange (SGE) totaled 161 tons last month, reflecting strong wholesale demand for gold. This represented a 46-ton month-on-month increase.

Year-on-year, withdrawals from the SGE were down a modest 5 tons. According to the World Gold Council, this was “mainly due to 2022’s distorted seasonality amid COVID-related restrictions and a lower local gold price.”

Chinese Valentine’s Day and various jewelry fairs are scheduled in September. This will likely boost retail demand this month.

Also reflecting strong domestic gold demand, the Shanghai-London gold price spread averaged $40/oz in August, a new record high. This was a $23 per ounce month-on-month increase. According to the WGC, “We believe improving gold demand and relatively tepid imports in recent months may have led to local demand and supply conditions tightening, pushing up the local gold price premium.”

Chinese gold import data lags by one month, so the July data is the most recent. China imported 107 tons of gold in July, 9 tons higher than June’s total. Compared to last year, imports were down 69 tons.

Chinese investors appear to be turning to gold. Metal flowed into Chinese gold-backed ETFs for the third straight month in August. Funds based in the country added 4.6 tons of metal, raising the total AUM to $3.6 billion.

During the month, poor equity market performance (CSI300: -6%) and continued local currency weakness drove many to safe-haven assets such as gold, which has delivered attractive returns so far in 2023.”

Meanwhile, the People’s Bank of China added more gold to its reserves in August. It was the 10th straight month of gold buying for the Chinese central bank with an addition of 29 tons. The PBoC now officially holds 2,165 tons of gold. You can read more about central bank gold buying HERE.

Looking ahead, the World Gold Council said an improved outlook for China’s economy could provide some support for local gold demand.

Also, various jewelry fairs and industry events may spur both manufacturers’ and retailers’ replenishing demand. Furthermore, with the National Day Holiday and Mid-Autumn Festival approaching, retailers’ inventory restocking is likely to continue.”

However, high gold prices could create some headwinds for the Chinese gold market.

Schiff Gold: Interested in learning how to buy gold and buy silver? Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I do not fact check contributor material that I aggregate from other sources. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

Is China lying about how much gold they have? I thought they had more than the US.

Tom Luongo had some fascinating information on this in his last podcast. Turns out Chinese gold never leaves China. https://tomluongo.me/2023/09/21/podcast-episode-154-vince-lanci-and-why-gold-is-the-new-black/