"Change Is Afoot": Home Buyers "Shocked" By Rates, Sellers Lament Price Plunges

My kind friend and award-winning realtor Kira Mason has her pulse on the real estate market. She offers up her no bullshit, on-the-ground take on the industry for my readers.

Since Fringe Finance has started, I’ve scoured the Earth far and wide to try and bring a perspective on real estate to the blog that is going to be both no bullshit and an unfiltered on-the-ground opinion that I know and trust (and could add value to my readers). After all, it’s an asset class that I am not nearly as in-tune with as I am with equities and, well…beer.

And to be honest, I didn’t have to scour much, as a good friend of mine is a brilliant up and comer in the world of real estate in Philadelphia. I’ve worked with her several times and have known her for years - she’s insightful, pragmatic, conscientious and has a serious pulse on the industry. I know for a fact that she works her ass off, eating, sleeping and breathing real estate on the daily.

As such, my kind friend, award-winning realtor Kira Mason, has agreed to drop in once in a while to offer up her take on the pulse of the industry for benefit of my readers. Kira runs the Substack Gritty City Real Estate, which you can read & follow free here and she is @kmasonrealtor on Twitter. Her posts for Fringe Finance subscribers are exclusive and can’t be found anywhere else.

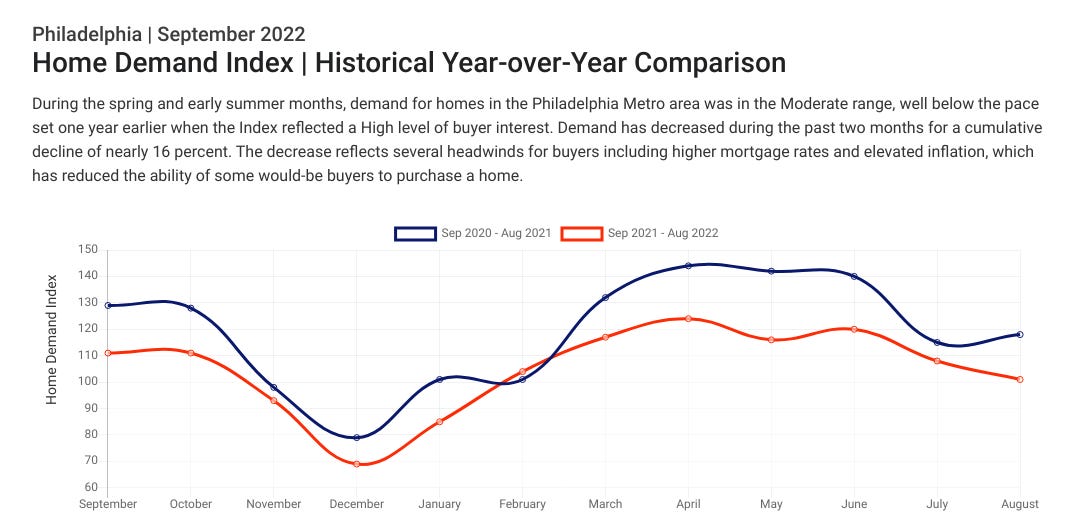

Though I’ve watched the Philadelphia housing market mirror national trends by slowing from a sprint to a trot to a crawl over the course of the last six months, nothing could have prepared me for the suddenness of this most recent shift. Within the last two weeks, even real estate professionals who have been hysterically waving the “it’s deceleration, not depreciation” flag have started to change their tune. With what we’re seeing on the ground, the old narratives just aren’t holding up without an intolerable degree of cognitive dissonance.

Allow me to illustrate: On Monday, an agent reached out to me with a “reverse offer” on her West Philly listing that’s been sitting on the market for 117 days. On Thursday, the developer of a gorgeous rehab in the $400k’s that had caught my buyer's attention said to me point-blank: “Not to negotiate against myself, but I’m not talking to anyone else. Bring me the best your buyer can do and we’ll make it work”. So, just this rainy Sunday morning, I was crunching numbers with my buyer’s lender to shoehorn this home into her conservative budget using devices nobody talked about a month ago: adjustable rate mortgages, seller assists to help decrease the loan-to-value ratio, seller-funded discount points, and so on. We hope to have an offer for the developer by tomorrow. With the way things are looking, if he’s smart, he’ll take it.

I currently have two nearly identical, move-in-ready, fully rehabbed listings on the same block in South Philly. They’re great first time buyer options listed in the high $300k’s. A year ago, they would have been under contract within a week with multiple offers and likely would have each sold at about 105% of asking price. The first of these homes was listed in mid-August. In its first two weeks on the market, it was shown ten times. It went under contract in just under a month at slightly below asking price. Fast forward one month to mid-September when house number two was put on the market at the exact same price as house number one. Within that same two-week period, the listing was shown only five times. It is still on the market.

If you enjoy this post, want to support Fringe Finance, and have the means, I would be humbled to have you as a subscriber:

Between the summer of 2020 and fall of 2021, buyers were nearly ready to crack open their IRAs to snag the home they fell in love with the day prior and couldn’t imagine living another day without. Even buyers who started out with the totally non-2020/2021 compatible refrain “I’m not going to participate in any bidding wars” were liable to, a few weeks or months down the line, violate their own limits. When designing an offer for a buyer, I’d send them a menu of techniques we could employ to help them get a leg up on the competition. This menu included devices like:

Inspection Deductibles- In which a buyer is limited to making requests for the remediation of defects above and beyond a certain predetermined dollar amount. I.e. the buyer can’t walk away from the deal because of a loose railing, or a leaky faucet that gave them a “bad feeling”.

Appraisal Gap Coverage- In which a buyer promises in advance to cover the difference between their offer amount and the appraised value of the home up to a certain dollar amount.

Free Leasebacks- In which a seller can live in the home they just sold, rent-free, for a predetermined period of time to help them close the gap between the sale of one home and the purchase of the next.

Home sale contingencies, seller assists, and below-asking offers have been off the table within most submarkets of Philadelphia for the better part of two years. Notable exceptions include condominiums and homes that were dramatically overpriced to begin with (causing sellers to miss out on potential buyers during that crucial first week on the market). I know that other cities across the US had it much worse, and buyers were liable to pounce on any home with a roof regardless of its price. Fortunately it wasn’t quite that dramatic in Philadelphia, but move-in ready homes at a reasonable price in the most desirable neighborhoods were attracting buyers in hordes. Of course, the definition of “reasonable” shifted upwards with every neighbor’s bidding war as new comps were created for future listings.

At one point in spring of 2021 I had twelve buyers under contract simultaneously. I was hosting open houses every weekend, managing lines around the block of infant-wielding couples as they began their searches for bigger, better homes. Many were first time buyers, tantalized not only by record-low interest rates, but also under the influence of a sort of fever that infected everyone below age 40 and which has only just begun to lift.

Buyers these days are extremely tentative. Their fear about the market is manifesting as pickiness, and the same individuals who one year ago would have enthusiastically purchased a home that didn’t have a main level half bath, for example, have since raised the bar. A home has to be just right for them to want to make a move. I’ve had buyers pussyfooting around the market for months, and they are now getting major sticker shock when I send them estimates with these new rates. Sellers, on the other hand, are slowly coming to terms with the new reality. Though they’re typically not listing their homes below comparables in the area, over 50% of homes in my local market have undergone price reductions, and they are frequently selling for even less than their reduced prices.

Change is clearly afoot, and I sense that this is only the beginning. As interest rates rise and more buyers decide to shelve their plans for plusher times, sellers will be forced to accept less and less for their real property. As they do so, they will be creating new, lower comps for future listings. And so it goes. It will be interesting to watch this thing play out in the same way that it’s interesting to watch somebody walk straight into a utility pole while looking in the other direction.

About Kira Mason

Kira is a realtor with Berkshire Hathaway Fox & Roach and The Kevin McGillicuddy Team, winner of the 2021 Chairman's Circle award and ranked within the top 1% of the national Berkshire Hathaway HomeServices network. She independently won Homesnap's "Fastest Growing Agent" award in 2021 and specializes in the purchase and sale of residential real estate in Philadelphia.

Kira runs the Substack Gritty City Real Estate, which you can read & follow free here and she is @kmasonrealtor on Twitter. She can be reached via e-mail at the address: contact@kiramasonrealtor.com.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

The NYC market is equally slow. Haven't seen it like this since the GFC. I recently ran comps for a client, and with the change in interest rates between just August of last year and today, prices would have to come down 35% to achieve mortgage payment parity between then and now. If rates persist like this, or god forbid go up, then we seem to be headed in that direction.

Definite value added post. The insights from Kira are illuminating. We are seeing a version of what she shared in coastal NC. Although we still have strong tailwinds in housing from the North to South migration….it’s clear that the winds have changed. We have less supply and prices have increased along with rates versus a year ago. Price or new construction and renovation are up as well. This is definitely an environment where I expect prices to stay elevated, but supply and value over time to to stay relatively low for the near term (12 months). Selling in this environment, as a zero sum game, means you can buy less home than what you sold….which is not good. We are fortunate that there is Federal Military Basing in the area creating sustained turnover and demand in home ownership / rentals, a business friendly environment, and mild climate near great beaches.