Cathie Wood And The Definition Of Investing Insanity

Wood appears to be one of the only people in the industry - maybe even on Earth - that doesn’t understand the gravy train is fucking over.

Ask anybody what the definition of insanity is and they are likely to repeat back to you the age old adage, attributable to Albert Einstein, that insanity is doing the same thing over and over and expecting different results.

Putting aside the fact that Einstein never actually said this, it’s still an apt definition of how to drive oneself crazy. I’m writing about it today because it also appears to be Cathie Wood’s investment philosophy. Let me explain my reasoning.

I have been critical of ARK Invest, and their flagship ARKK “Innovation” ETF since the inception of this blog, noting last November - before inflation became an issue, before the war in Ukraine and before the market decided to take a king-sized shit - that Wood’s success seemed superficial and based on temporary trade-winds that were bound to change direction.

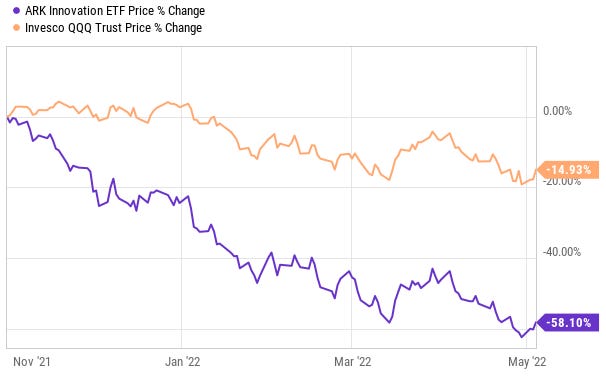

Since November 2021, ARK’s “Innovation” ETF has put in a performance for the ages, plunging -58.1% compared to its benchmark, the NASDAQ QQQ ETF, which has fallen only -14.93% in the same period of time.

But through all the turmoil, ARK’s Cathie Wood seems bafflingly content to hold her ground on her “investment thesis”.

After ARKK finished 2021 down 19%, Wood claimed in December 2021 that she was “soul searching” but that she "liked" the period her stocks were going through because "many people [were] saying those stocks were in a bubble” and that was a cue to Wood that her stocks were “nowhere near a bubble."

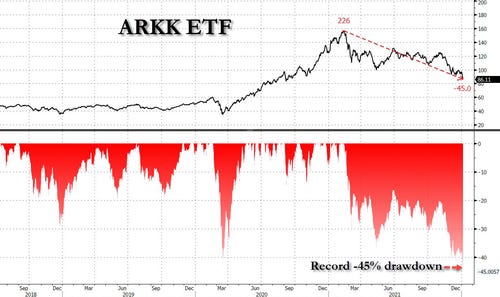

The market disagreed. By January 2022, the ETF had posted a record drawdown of 45% at the time.

In February 2022, with her fund already down about 26% year-to-date (on top of the drubbing it received in 2021), Wood called the losses in her fund “temporary” and told the lot over at CNBC’s Halftime Report that she once again thought her fund’s holdings were undervalued.

“We do believe innovation is in the bargain basement territory. ... Our technology stocks are way undervalued relative to their potential. ... Give us five years, we’re running a deep value portfolio,” Wood said.

By April 2022, Wood’s “undervalued” stocks from January 2022, which got more “undervalued-er” by February, had become even more “undervalued-er-er”.

One of Wood’s top holdings in Teladoc (TDOC) was slammed on earnings and closed near $30 per share after all time highs less than 18 months earlier over $300 per share.

Wood once again took to CNBC to “double down” (which was more like quadrupling down at this point) on Teladoc, making a vague reference to it being the next Amazon, and again peddling the “5 year investment horizon” idea.

"Our five-year thesis for Teladoc is built around the company's transition from a general telehealth provider to a B2B enterprise solution for whole-person healthcare," Wood wrote to investors in April.

ARKK then went on to have its worst month ever in April 2022, falling 27% just for the month, putting the fund’s year to date return close to an abysmal -50%.

Cathie appeared to celebrate the milestone by partying in the Bahamas during (of course) a crypto conference.

And now, in May 2022, the bleeding just isn’t stopping, no matter how much Cathie closes her eyes and tries to hope it away by repeating her same talking points.

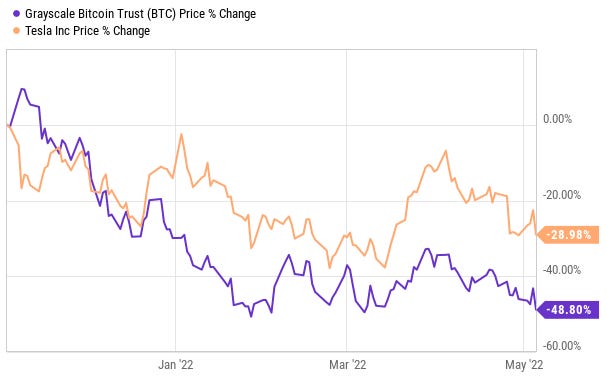

Finally, as I continue to warn on this blog, the number one weighting in the ARKK fund, Tesla (TSLA), is actually still up by 31.5% over the last year. This means that the rest of the components of the ARKK ETF are such hot garbage, the fund is underperforming its number one weighting by an astounding 89%.

Holy shit that’s bad!

With a “flagship” fund down as much as ARKK has been, now trading near multiple year lows and at a drawdown of almost 70%, Cathie Wood’s stubborn reluctance to accept reality is starting to look less and less like an investment advisor and more and more like me betting the midnight Arkansas-Pine Bluff versus Hawaii college basketball game to chase my losses from whatever the early games were that night.

Wood "has crashed spectacularly due to a combination of hubris and very poor stock selection." said hedge fund manager Doug Kass, days ago.

It is clear to me that Wood has become a victim of her own confirmation bias. She is obviously a believer in both the nonsense that she spouts on television and the praise she is constantly showered with by the lobotomized financial media.

Against the backdrop of a Federal Reserve that was doing literally everything it could to encourage speculation and risk-taking over the last 10 years, Wood became a star. As the very first shred of financial reason creeps its way into the picture in the form of rates that are still far under the neutral rate, Wood has immediately given back all of the gains that made her a phenom. From here, if the Fed holds course, there’s only one way Wood’s fund will continue to head - and it’s not up.

During the course of Wood’s success, her analysts or her PR director or…somebody…came up with the idea of a five-year investment horizon for her to pitch her “innovation” stocks. But Wood’s carefully selected “innovation” stocks appear to me to be nothing more than mostly pre-profitable revenue growth stories that are trading at pornographic multiples. These names were, and continue to be, the first companies in line to be castrated now that the Fed’s easy money mandate has ended.

“We truly believe that our portfolio is full of the next Tesla, the next bitcoin. I think that the algorithmic dismissal of our kind of strategy, saying, ‘Oh, it was just a stay-at-home strategy,’ is going to be proven false,” the Wall Street Journal quoted Wood as saying recently. Perhaps someone should inform her Tesla and bitcoin have been getting smoked over the last 6 months. In that regard, her portfolio already is full of the next Tesla and the next bitcoin.

Everybody in the investment world is starting to understand that the Fed has zero choice but to keep hiking rates because inflation is completely out of control. This is a unique situation and one that isn’t like the past because the Fed doesn’t have the option to revert back to a dovish policy as soon as the stock market is spooked.

I have been doing my damnedest to try to convey to people that this time it’s different: there is no Fed put. I have laid this argument out in several articles including:

But Cathie Wood appears to be one of the only people in the industry - maybe even on Earth - that doesn’t understand the gravy train is fucking over.

Which leads me to the point of this story. I can’t believe there’s still people that need to hear this - but Cathie Wood isn’t anything special as an investment manager.

She picked the riskiest, most speculative stocks at the top of a 15 year bubble and got lucky on one: Tesla. When Tesla had its mysterious 10x run up, it made Cathie Wood, along with her bizzaro mimbo equivalent, Ross Gerber, into stars. And now, because she was made popular for the wrong reason and celebrated for having zero valuation acumen, she is sticking to her guns under the guise that she is some type of investment visionary.

Unless Wood adopts a new attitude with the macroeconomic picture continuing to worsen, and as long as the Fed holds course, I literally expect Wood’s investment “strategy” to drive her, and her investors, to the definition of insanity.

"Never confuse brains with a bull market"

There's a whole generation of fund managers never lived through 2000 or 2007... some who did but don't realise, as you say, and as it is always "this time is fuckin different"... each time is fuckin different... this time is similar simply 80% of all USD were printed the last 2 years and a lot of it is in utter shite like TSLA.