'Brink of Catastrophe' As Federal Interest Payments Reach $750 Billion

Peter Schiff says we have already entered the 'fiscal danger zone'.

Jerome Powell’s 60 Minutes portrayal of the national debt crisis as a distant concern starkly contrasts with the urgent reality we face. Peter Schiff doesn’t mince words in his most recent podcast when he highlights the immediate threat:

It’s not a problem for the future. This is not a long-term problem anymore; this is a short-term problem that could blow up any minute. It’s this generation that’s going to pay the piper, not some future generation. It’s happening right now.”

In his last podcast, Peter pointed out that the US is on the hook for over $1 trillion in debt payments every year.

We are not merely approaching a fiscal danger zone; we have already entered it:

Jerome Powell shouldn’t be worried about it because we’re on an unsustainable path; he should be worried that we’ve already arrived at an unsustainable destination.”

Despite Powell’s soothing assurances, Schiff points out the grim outlook for future generations. The Fed’s monetary policy will also cost your grandkids:

It’s going to be a problem for the future generations. We’re taxing, borrowing from the future generations. It’s unsustainable and it’s going to be a problem in the future… That’s basically a way of saying it’s not a problem right now, so none of you who are watching 60 Minutes tonight have to worry. It’s your grandkids right that they have to worry. So who cares, right? They’ll figure out.”

Schiff warns that we’re teetering on the edge of a fiscal abyss, challenging the optimistic economic narrative:

We are on the brink of a fiscal catastrophe…Contrary to Powell’s optimistic assessments, I see an economy built on shaky foundations of debt-fueled spending and artificially low interest rates.”

Peter explains that we need immediate, proactive measures, like putting out a wildfire before it spreads:

We can’t wait for the crisis; we have to preempt the crisis. As bad as it’s going to be, waiting for the market to cause it is going to be even worse. We have to bring the crisis about under our own terms, kind of like a controlled burn, to the extent you can even control it, rather than waiting for an uncontrollable wildfire to just develop.”

Schiff accuses Powell of playing politics, particularly in the run-up to an election, painting a rosy picture of the economy to avoid making tough decisions that might jeopardize Biden:

[Powell is] a politician; he wants to pretend that everything is great, to let the politicians off the hook from having to actually make any of the difficult political choices. And it’s only difficult because it jeopardizes their reelection…Powell is basically doing an infomercial for the Biden Administration, talking about how great the economy is… claiming victory over inflation.”

As we stand at the crossroads of fiscal responsibility and economic fantasy, the choice is clear yet daunting. Ignoring the clarion call for immediate action in favor of complacency and political convenience not only jeopardizes our current economic stability but also mortgages the future of generations yet unborn.

The Federal Government publishes the spending and revenue numbers every month. The charts and tables below give an in-depth review of the Federal Budget, showing where the money is coming from, where it is going, and the surplus or deficit.

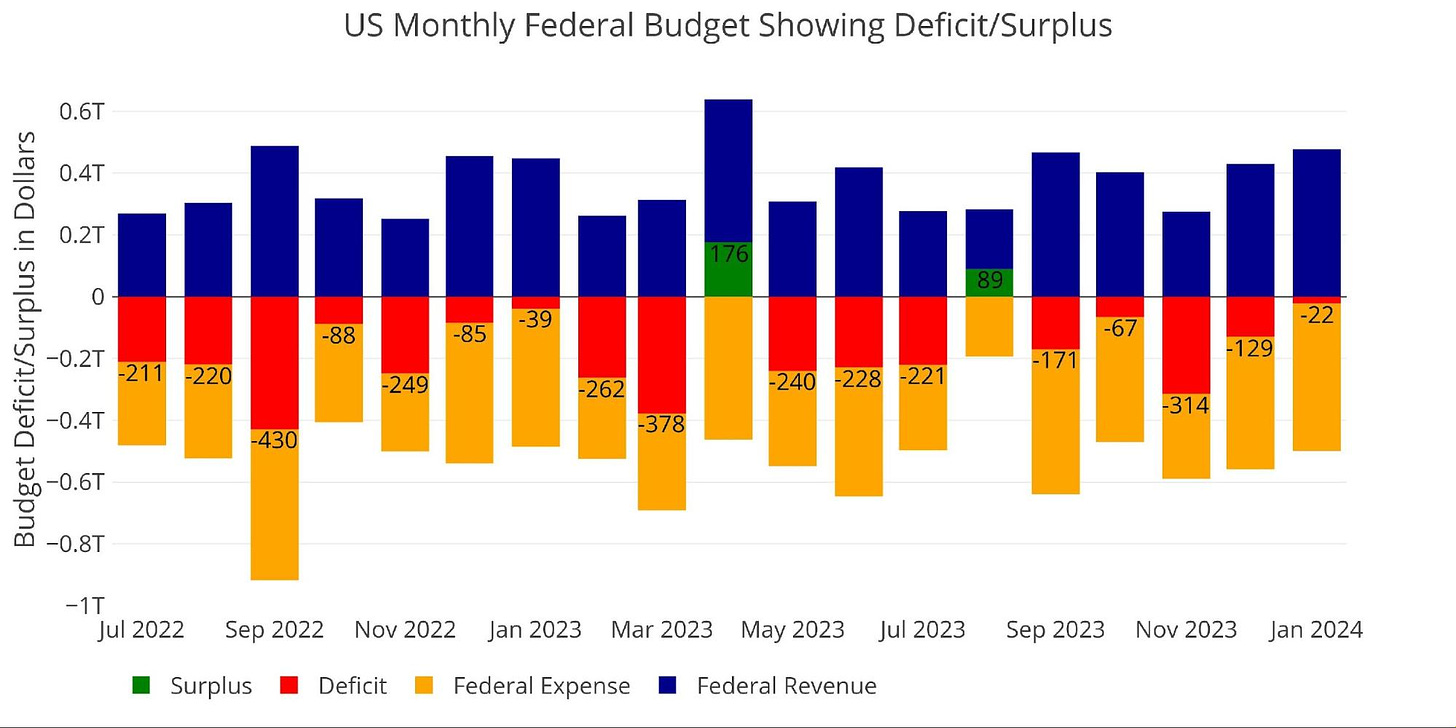

This month saw a $22B deficit.

Figure: 1 Monthly Federal Budget

$22B may not seem like a lot, but January is historically a month with a surplus. That said, four of the last five years have seen January realize a deficit.

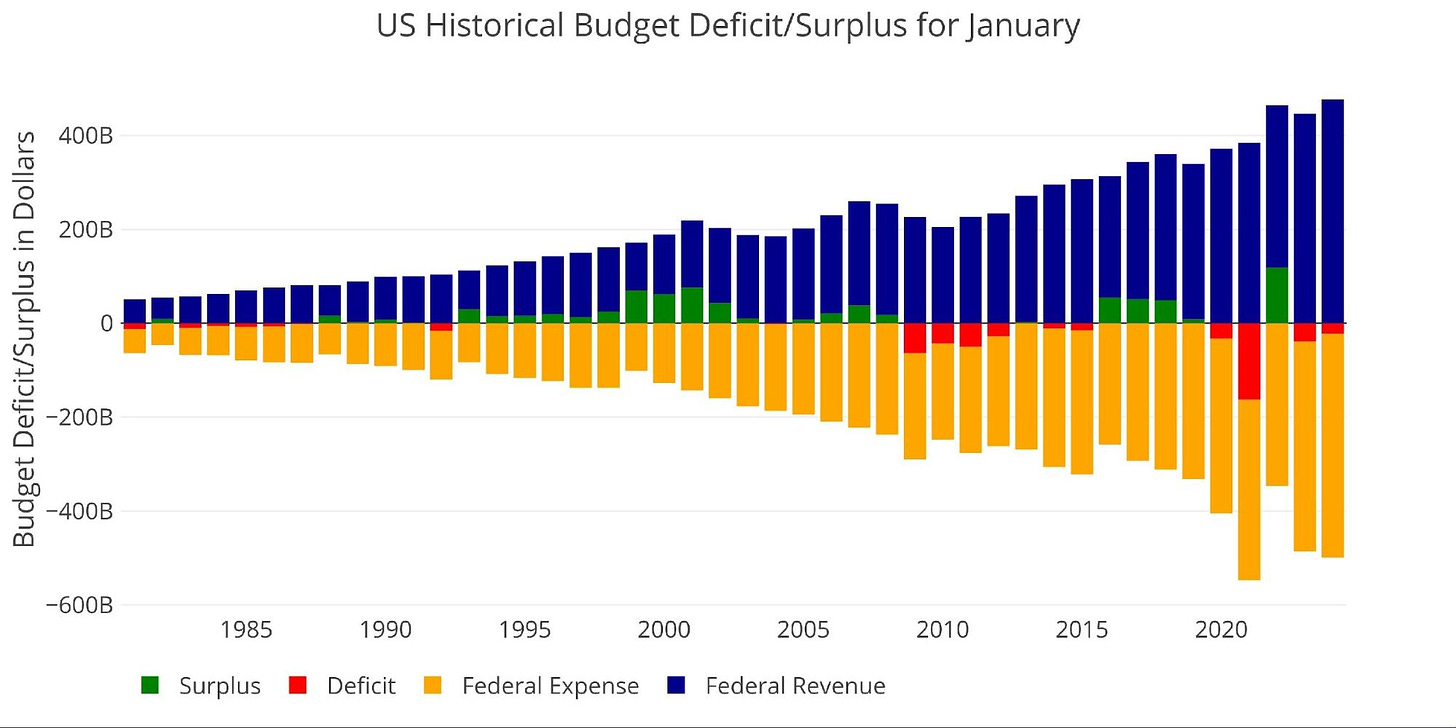

Figure: 2 Historical Deficit/Surplus for January

January is the only month other than April that has historically averaged a surplus.

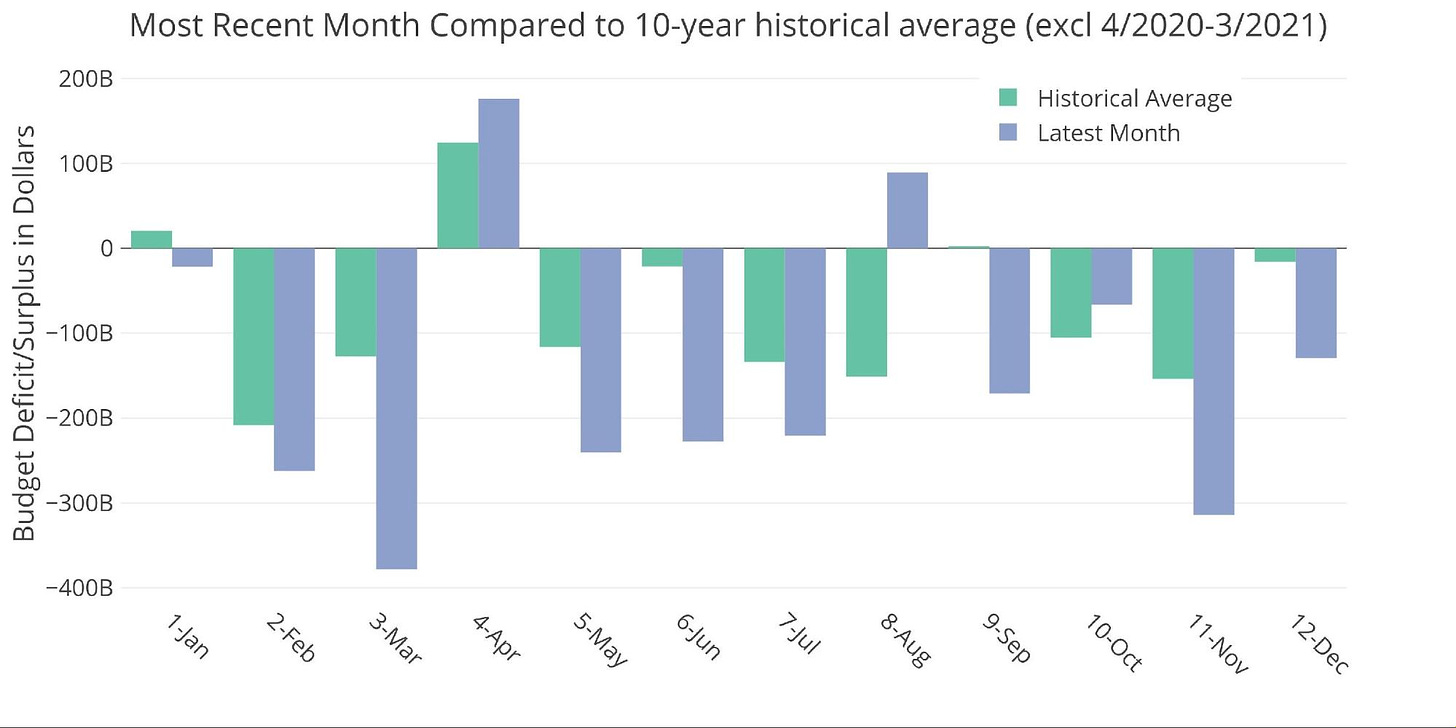

Figure: 3 Current vs Historical

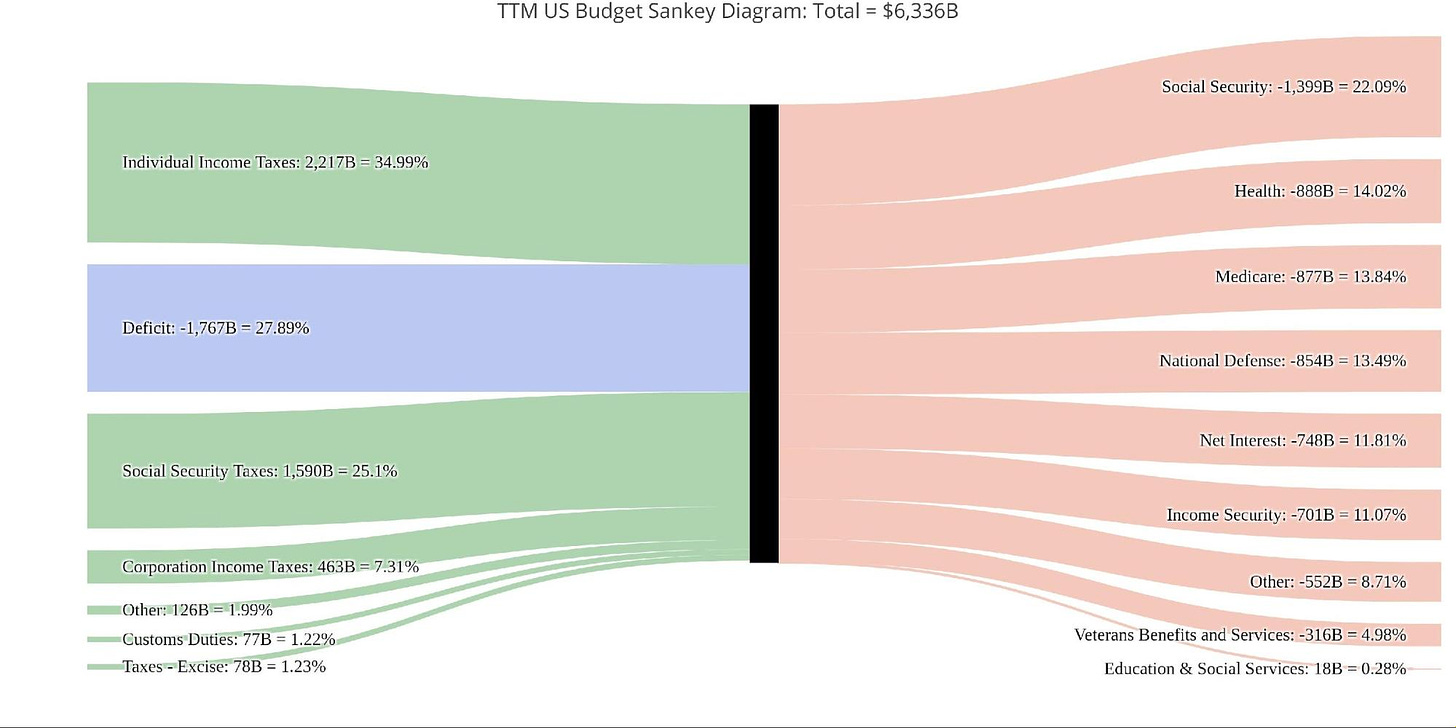

The two Sankey diagrams below show the distribution of spending and revenue for the month and the trailing twelve months.

Figure: 4 Monthly Federal Budget Sankey

Figure: 5 TTM Federal Budget Sankey

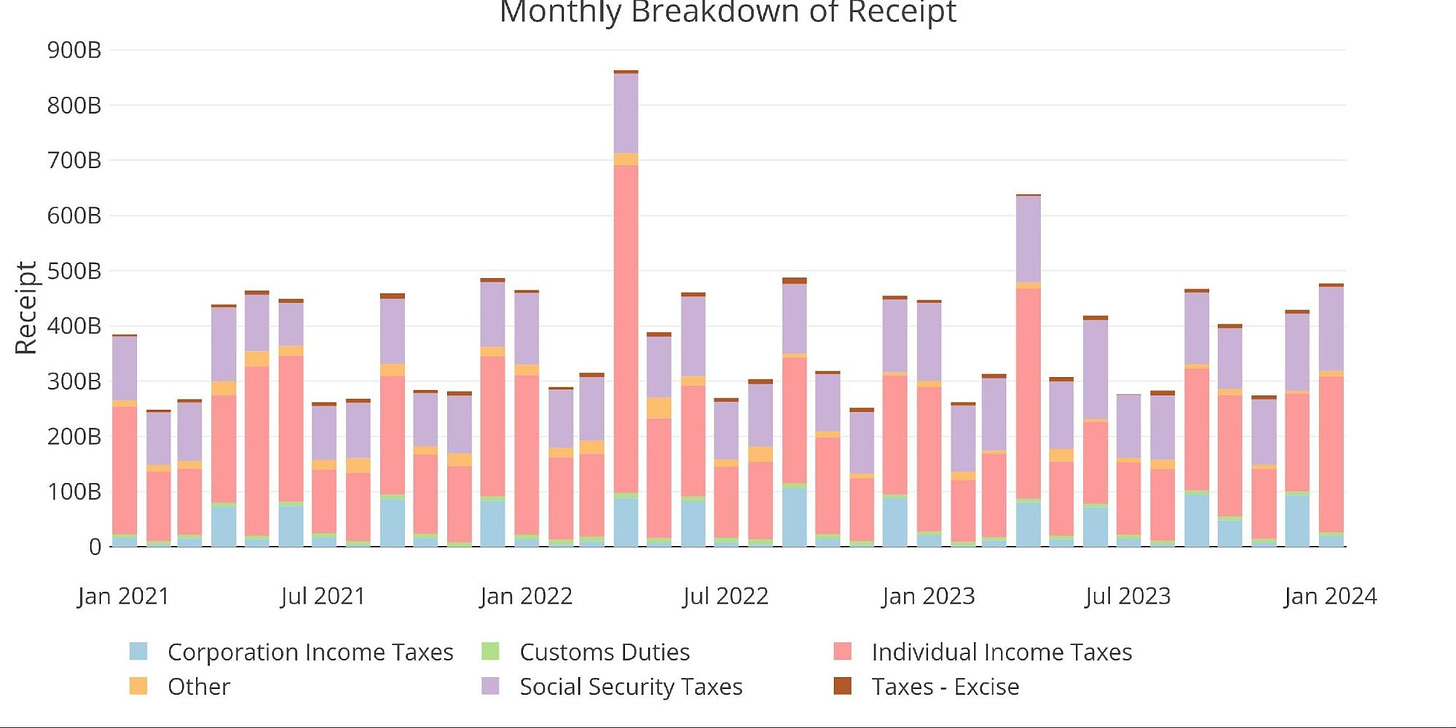

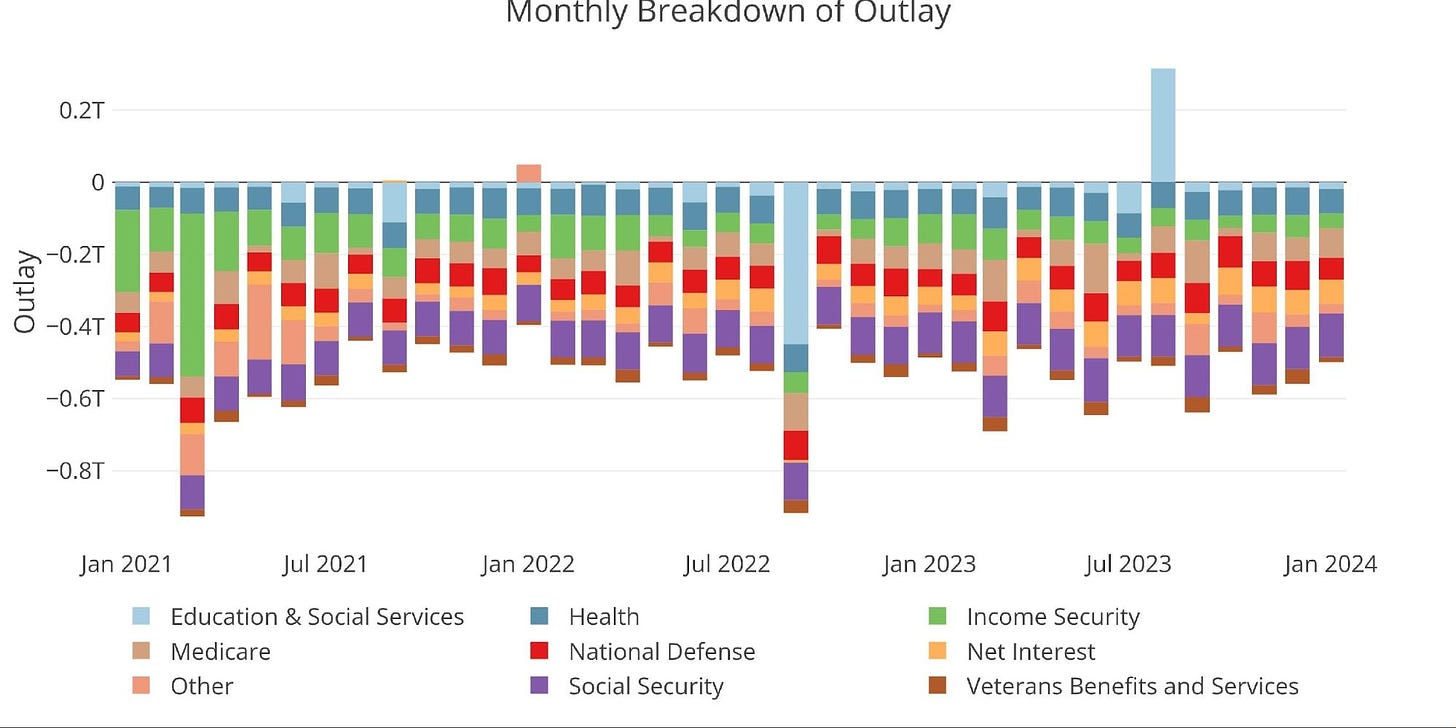

The next two charts show the monthly revenue and costs broken down by expense type.

Figure: 6 Monthly Receipts

Figure: 7 Monthly Outlays

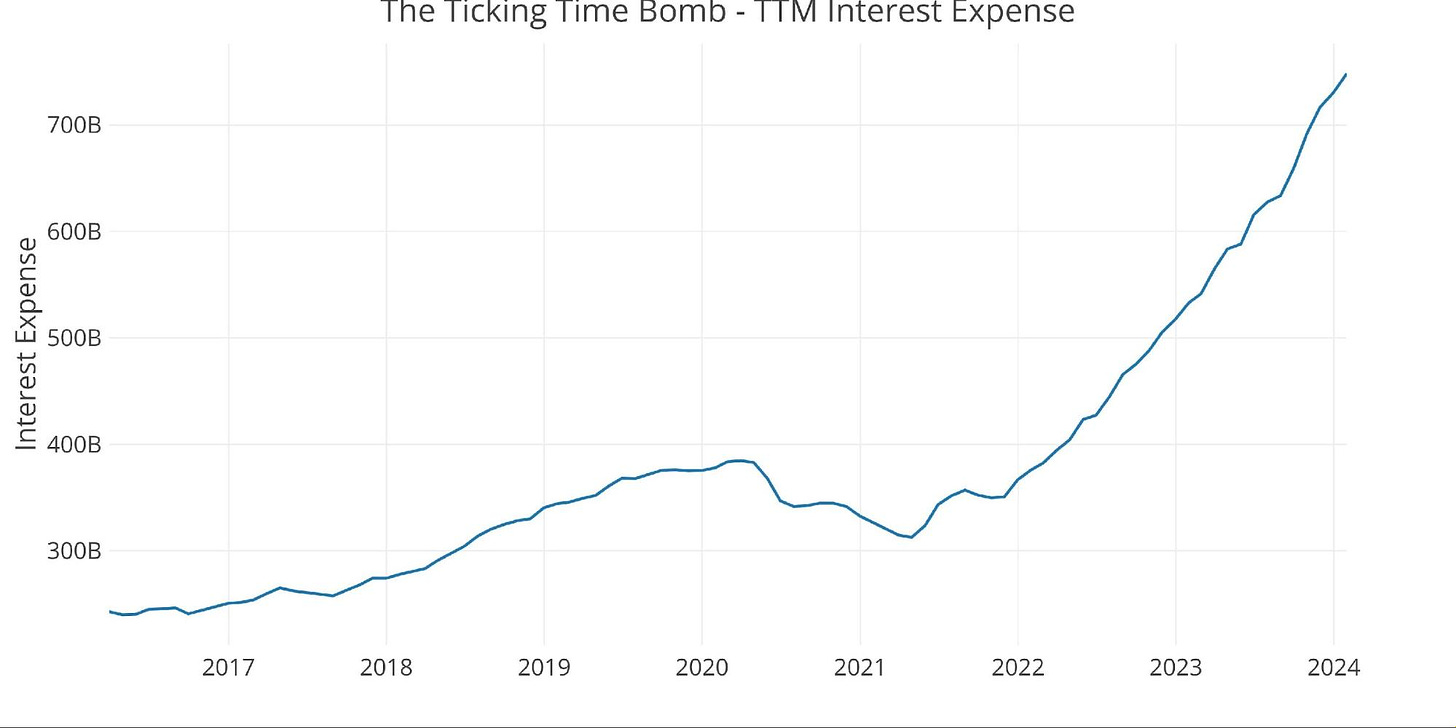

Interest Expense has ballooned higher with the Fed’s push to raise rates.

Figure: 8 TTM Interest Expense

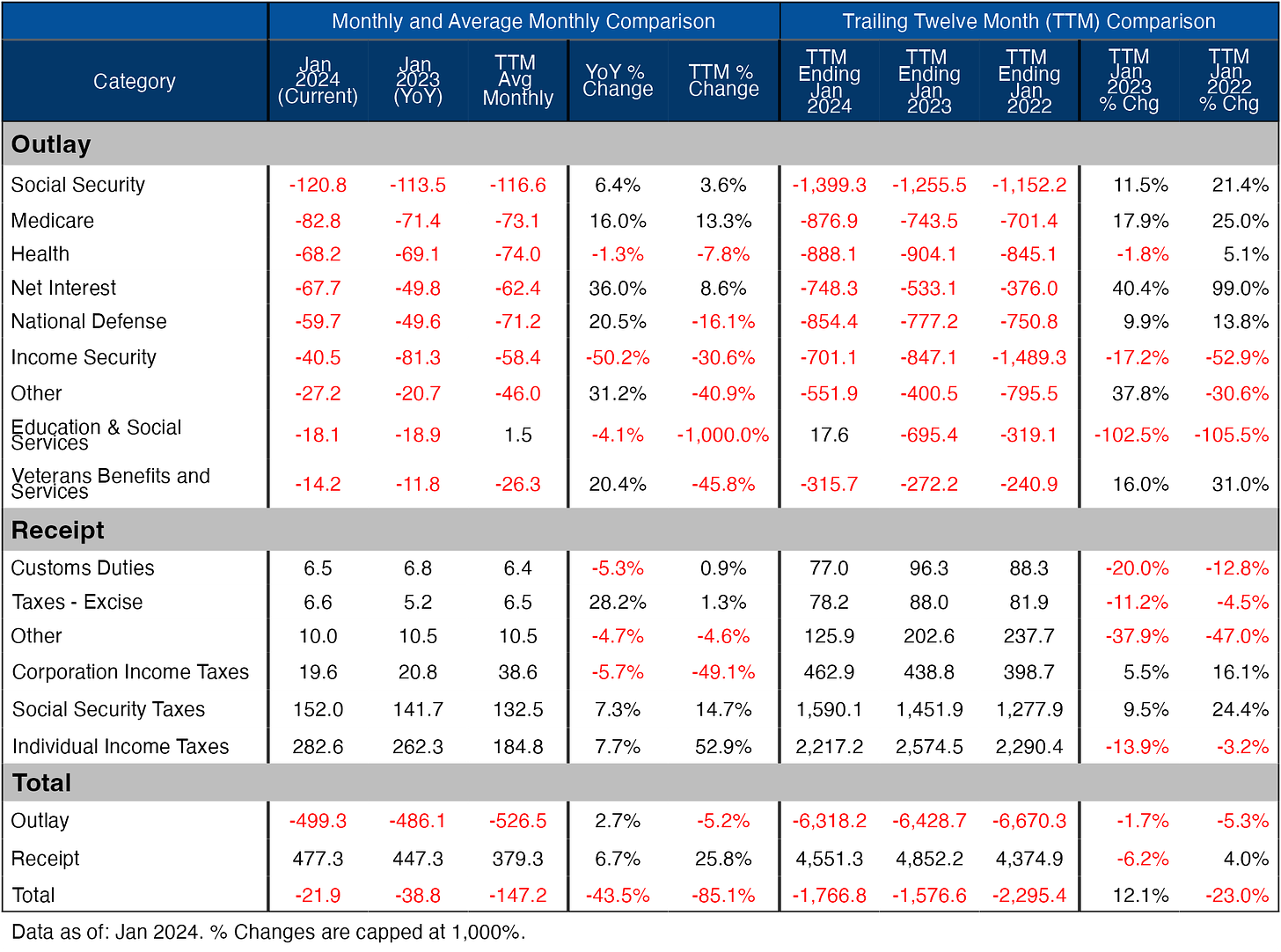

The table below goes deeper into the numbers of each category.

Figure: 9 US Budget Detail

Historical Perspective

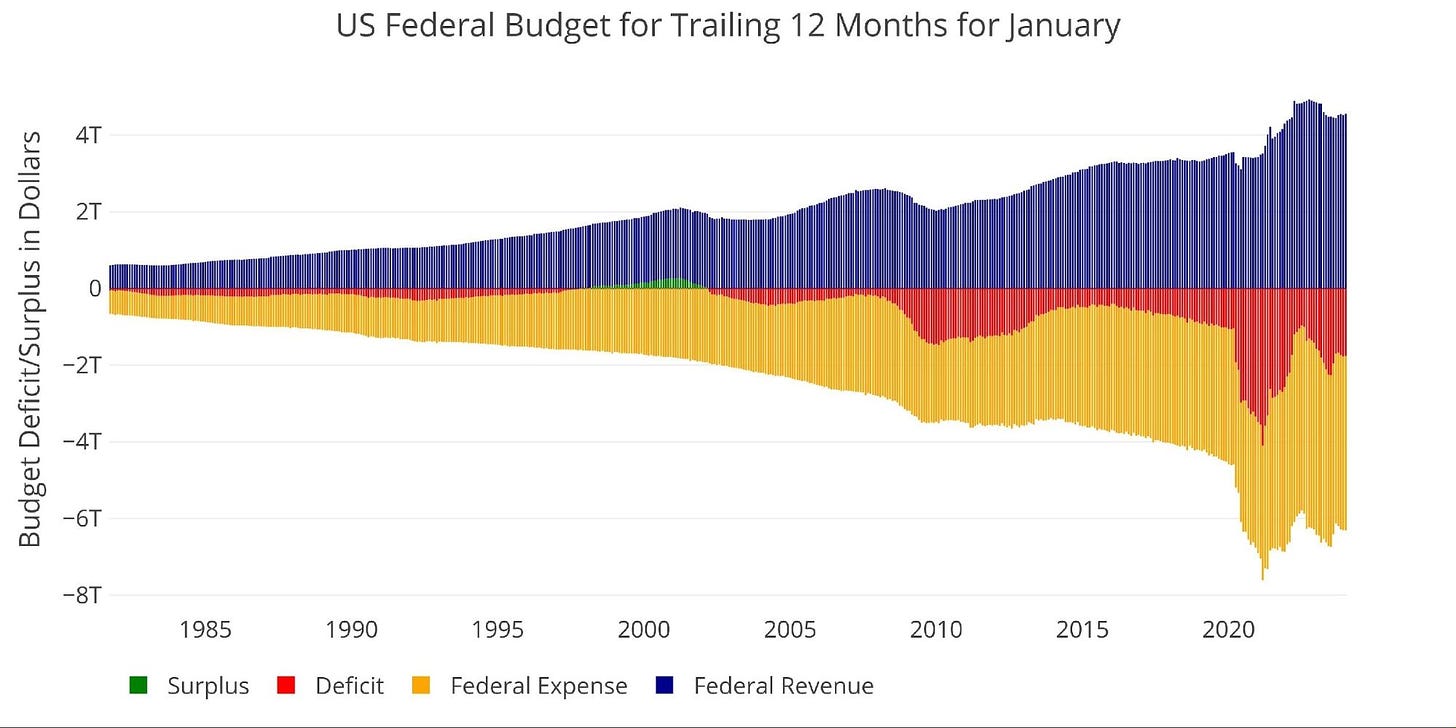

Zooming out and looking over the history of the budget back to 1980 shows a complete picture. The change since Covid has been quite dramatic.

Figure: 10 Trailing 12 Months (TTM)

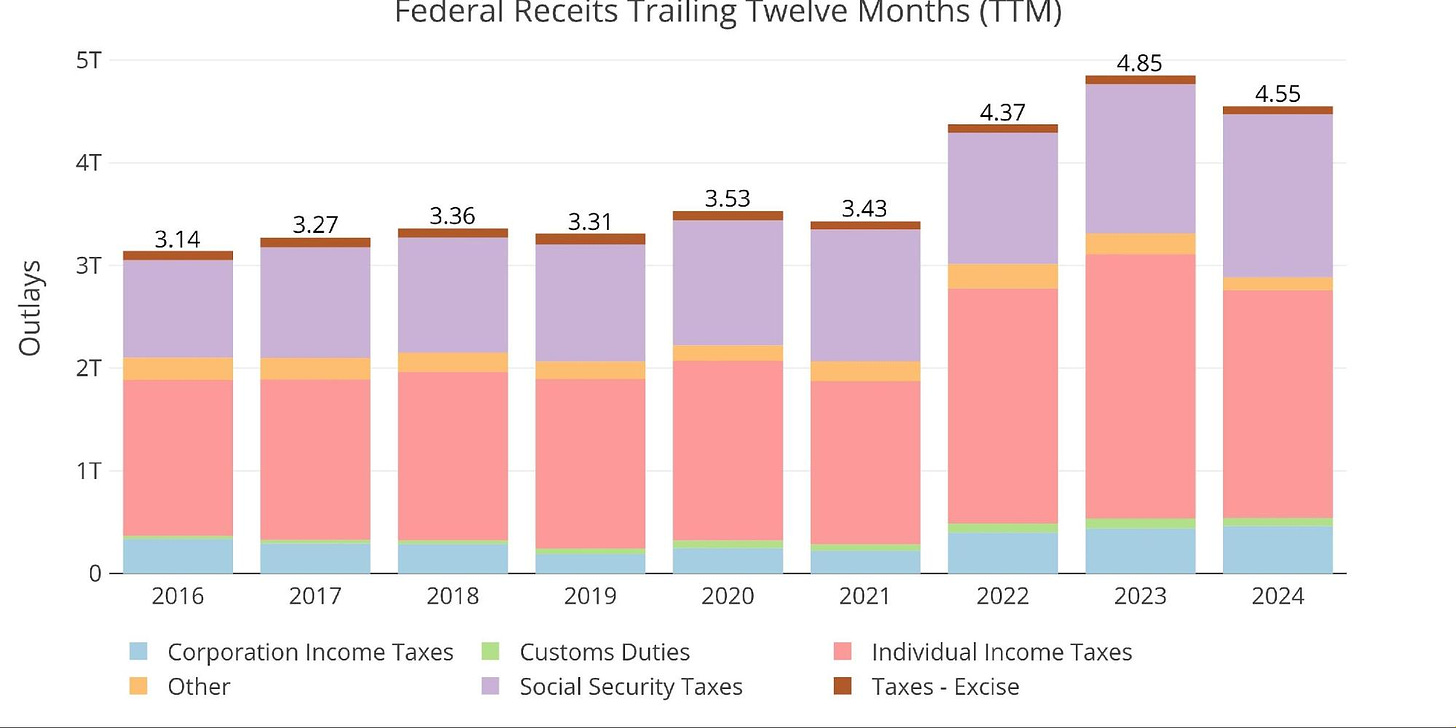

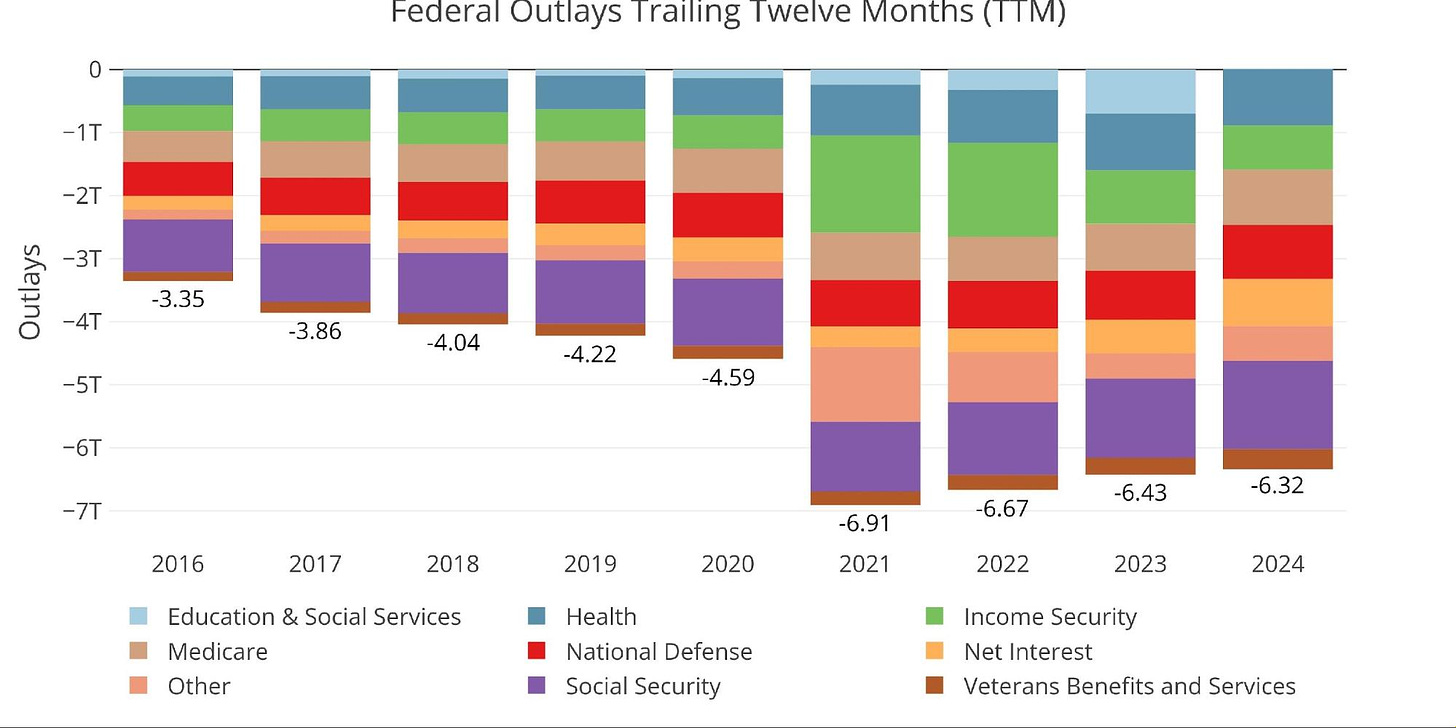

The next two charts zoom in on the recent periods to show the change when compared to pre-Covid. These charts show spending and revenue on a trailing 12-month basis period over period.

Figure: 11 Annual Federal Receipts

Figure: 12 Annual Federal Expenses

When To Sell Gold: $2k, $5k, Higher?

Joel Bauman, Schiff Gold

When clients ask about the timing of selling their gold, I generally respond to their question with a question: “Do you have upcoming liquidity needs?” or “Is there a productive investment opportunity to deploy your capital?”

Understandably, clients will find these responses unsatisfactory, as I failed to delve into the core of what they’re asking.

Especially with gold hovering slightly above or below the $2,000 price level, many clients seek guidance on the ideal ‘exit’ point quoted in dollars—a holy grail that promises certainty in the decision-making process.

This is where I tend to challenge clients to view gold differently.

Fixating solely on a USD perspective, I argue, is the wrong mindset. Physical gold isn’t just a speculative tool for market timing.

Gold eliminates counterparty risk and acts as a true safe-haven piggy bank. Gold is money.

Charles Vollum from pricedingold.com has it right, emphasizing the importance of viewing gold not in terms of dollars but having dollars measured in gold. It’s the ruler against which to measure the value of all other assets.

The tempting aspect is to perceive gold through the lens of the USD. One might argue this is understandable, considering the adage ‘The borrower is servant to the lender.’ If someone has USD liabilities, it’s likely that they are contemplating everything in terms of USD.

However, despite societal norms to measure wealth and financial plans in USD, the glaring issue arises when examining the price chart of any asset or commodity quoted in USD over the last 50 years—the dollar ‘value’ is almost certainly higher.

This is because of systemic inflation, and it calls into question the dollar’s merit for assessing productivity and growth through dollars instead of gold. (I touched on this point in an older post here).

To illustrate, it’s like measuring a mountain peak’s height through the point of view of a driver’s car window while driving and approaching a mountain. The apparent size grows not because the mountain is rising, but due to the dynamic perspective.

Going back to the question of selling gold for dollars, asking ‘When should I sell gold based on its dollar price?’ is akin to asking when the mountain is at its largest size—it’s not the correct perspective.

While not entirely dismissing the use of a dollar level to time an exit, recognizing big psychological dollar levels (e.g. $2000 gold) as self-fulfilling support/resistance levels, the exclusive focus on a specific dollar level is limiting and incorrect in the long run.

Instead, consider gold as the ultimate ‘cash,’ a reserve in turbulent financial markets—a sanctuary for savers amidst economic uncertainties. True money.

Adopting this perspective prompts a shift in evaluating ownership in any asset– whether a bond, stock, real estate, or other, the crucial question becomes whether the principal growth and yield, measured in ounces of gold, have been positive.

The ability to confidently answer this question reflects the soundness of the investment as an alternative to holding wealth in gold.

Therefore, understanding when to ‘sell’ gold becomes intertwined with recognizing an opportunity to acquire something else (another productive asset) with confidence in a proper return relative to risk, rather than a simple dollar price level.

So going back to the common client question on when to exit gold. I recommend only doing so for liquidity needs or when a productive investment opportunity arises.

If possible, engage in self-evaluation and pose questions such as, ‘Will this alternative opportunity, on a risk-adjusted basis, enable me to accumulate more ounces of gold in the long run?'”

Thinking this way shifts the focus from fixating on an ideal dollar exit point to a mindset centered on a total number of ounces.

This not only aligns with the core principles of genuine wealth preservation but also empowers individuals to make judicious decisions within the dynamic ebb and flow of global markets. Underscoring the lasting significance of gold as true money—the steadfast financial sanctuary during times of uncertainty.

Schiff Gold: Interested in learning how to buy gold and buy silver? Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I do not fact check contributor material that I aggregate from other sources. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

My 7th grade social studies teacher assigned us to cover the 1980 election.

Long story made short I remember Reagan talking about the 1 trillion debt and here we are decades later at 34 trillion

They can’t stop …they’re won’t stop until forced to stop.

It’s coming soon.

Paul Krugman, Nobel Prize-winning economist: “…as Fatas puts it, one person’s debt is another person’s asset; or as I equivalently put it, debt is money we owe to ourselves…” Ergo, apparently, it’s not a problem.

I didn’t know there was a Nobel Prize awarded for comedy.