The Economy Is A Powder Keg, Boiling Over And Ready To Blow

Since March, five major banks have collapsed. Pressure is building up in the economic system while our government crosses the Rubicon with how they handle policy. Something's going to blow.

A long time ago, in a different lifetime, I used to work at an industrial plant that operated several 20-ton chemical processes. Our processes operated using a closed-loop system, in the absence of oxygen, and were not pressurized.

We monitored each aspect of our processes using an array of gauges, pressure sensors, thermocouples, and other devices to make sure things were running smoothly at any given point.

Near the midpoint of each process, we had a blowoff valve — a long piece of piping that led to the outside of the building, fitted with a seal that was set to blow out when it reached a certain pounds per square inch (PSI) threshold. The valve was meant to be a safety mechanism so that if, inadvertently, pressure started to build up inside of the process, it would “blow off” outside the building, instead of turning our process into a 20-ton pressure bomb waiting to explode. It’s the same principle that causes a kettle to scream when the steam reaches a certain pressure inside: the whistle only goes off once the water gets hot enough to create enough steam.

Our economy nowadays is similarly a process with lots of variables — though far more toxic than our green process used to be. Regarding our economy, you could throw a dart and pick any variable to monitor: CPI, GDP, the money supply, the price of equities, the price of commodities, or even things like average number of potato chips contained in a $0.99 bag. Just like the economy is trillions of transactions taking place every day, there are similarly an endless number of variables that one could monitor to try and forecast the health of our financial closed loop process.

Two “variables” that happened to catch my eye on Friday were (1) another regional bank collapsing, and being put into receivership and (2) the price of equities continuing to move higher as though nothing is wrong. Each of these effects had their causes: the bank collapsed because, like Silicon Valley Bank, it lost confidence when it announced it would likely need to sell billions in assets, and the price of equities moved higher because of skewed behavioral market psychology that’s a residual effect of 15 years of horrifically arrogant monetary policy and easy money policies.

The juxtaposition of these two variables — the fact that markets didn’t care and/or notice that another bank had just collapsed — is tough to overlook.

It’s especially tough when put into context. Since March, five major banks have collapsed: Silicon Valley, Silvergate, Signature Bank, Credit Suisse and now First Republic.

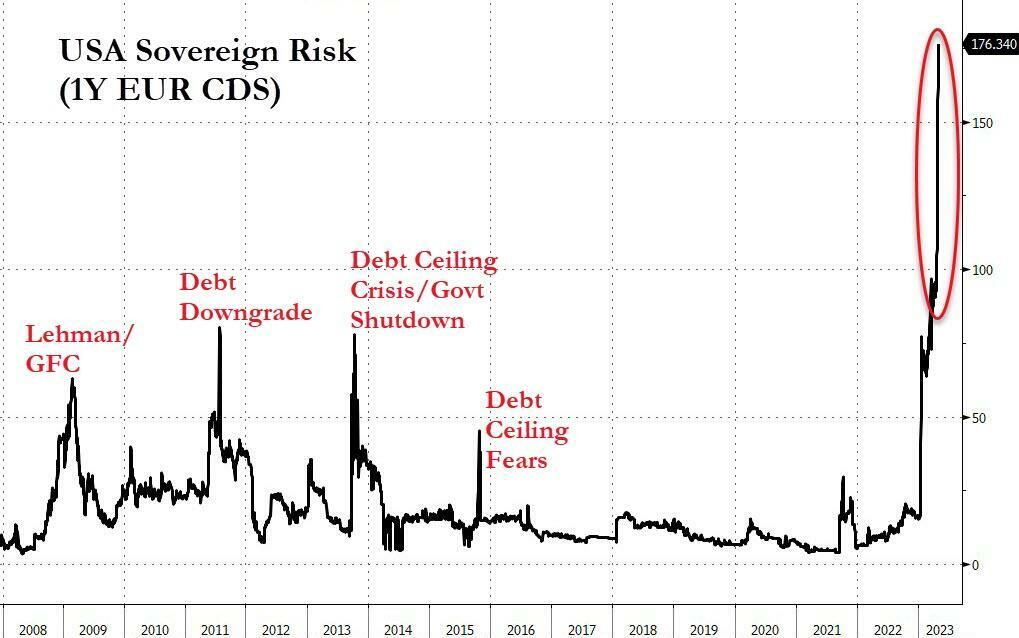

For 10 years, I’ve been ranting about how the stock market isn’t the economy, and laying out why one can move without affecting the other, but this odd relationship between equity markets and economic reality just seems like an insult to the natural laws of economics and free markets. The CDS market seems to understand this.

But I digress, I’m not here to fight the trend of markets or claim that I’m right when the market is clearly proving me wrong. Rather, what I reminded myself of on Friday, is that there are an infinite number of other economic “blow off valves” that can bear the dire reality of the economic disaster that is unfolding, and that equity prices seem to be eluding.

What I mean is that equity prices could remain high, but something else is going to have to give if that’s going to be the case, as I’ve written about in the past.

Put it this way: if interest rates and equity prices were the only two economic variables in the entire macro system, the market would be down 80% off its highs by now, at least. But they’re not. Instead, we have to contend with things like the money supply and market psychology, not to mention commodities, Fed bond buying (and selling), and numerous other “wild cards”. This never-ending list of things we must contend with also means there is a never-ending list of alternate items where the turmoil that should be showing up in equity markets will be diverted to.

The most likely candidates to “blowoff” are precious metals, in my opinion (and maybe even bitcoin).

Right now, the Federal Reserve is the person at the party who is so drunk, they’re the only one that thinks they’re in control. The rest of the party is just looking on in horror and embarrassment.

It is beyond disturbing that the government right now is bailing out banks left and right, with a ho hum attitude, as if it’s no big deal. That attitude has grown on the Treasury Secretary and Fed like a mold, left over from the damp blanket of hubris-laden monetary policy we draped the economy with over the last 15 years.

Remember in 2008 when we actually had to have a debate about whether or not to bail out the global economic system because of — oh, you know, moral hazard and the general idea that maybe we don’t want to walk a path that could lead to the collapse of our currency?

Well that bailout set a nasty precedent. If we were faced with the same type of decision to make today, it would be signed, sealed, delivered and finished with Powell and Yellen smiling as though they saved the world, in under an hour. There is no moral hazard debate. There is no U.S. dollar debate. There is no debate about abusing our “privilege” of being able to print money. There’s no debate at all. Bailouts and printing are simply an assumption now. Like Caesar, we may now be in for massive consequences for crossing a small rubicon.

As an investor, this setup continues to point me toward owning gold and miners.

I can sit back and watch those investments hopefully flourish, as confidence erodes in the sanctity of the U.S. as global reserve currency. And even if the dollar holds up as reserve currency, I don’t understand how it can be taken seriously for much longer. The BRICS nations are mounting a challenge and when the world is ultimately forced to choose between a debt based U.S. system and a commodity/gold backed BRICS system, the choice is going to be obvious. When the dollar becomes the “fix all” for the U.S. economy in coming quarters — for markets crashing, banks collapsing and, eventually, the bond market failing — precious metals will officially become the blowoff valve.

Our cavalier attitude toward bailouts and money printing, under the guise of “maintaining a stable economy”, is one of the most perverse and arrogant cons ever perpetrated — and gold, with its 5,000 year track record of demand and limited supply, remains the great equalizer.

And if the abuse of the dollar was the only thing we had to worry about, that would be one thing. But it isn’t — this lackadaisical attitude about simply bailing out whoever needs it, at any time, with no limits — comes at a time when the rest of the world is openly challenging the U.S. dollar in a way they never have before. The impetus for this challenge, as I have noted before, was the seizing of Russian reserves and weaponizing the U.S. dollar.

Guys like Brent Johnson may wind up being right: the dollar may survive as global reserve currency, and it may even wind up maintaining its value against a basket of other DXY currencies. But given the unique and precarious nature of the global economy and the fact that BRICS nations are all but guaranteed to start their own commodity/gold based system, means that the dollar will for certain depreciate against gold.

Hence, personally, I continue to consistently buy miners and add to positions in GDX and SIL. As I’ve said on Palisades Gold Radio before, the one thing that concerns me is the idea of nationalizing the miners if my thesis plays out and the economic system starts to collapse. As Jeff Clark said in this excellent episode out days ago, there will be a “sweet spot” to sell — after catching the upswing of this cycle and when mania kicks in — but before government decides to nationalize miners.

Already we’ve seen bitcoin become the target of government under the guise of protecting investors after blowups like FTX. But everyone knows there is a thread under Democrats’ new push to ban crypto that simply doesn’t want competition for the (digital, soon) U.S. dollar. Crypto is the low hanging fruit to go after now – gold will be a much more difficult challenge down the road – but that doesn’t mean that it won’t happen.

I’d be interested in hearing from my readers what they believe will be the coming blowoff valve for the economy, should equity prices decide to hold up with rates nearing 5%. Here is my April portfolio review and the names I continue to like, buy, own and dislike.

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

Have you ever considered that the stock market now references its value as increasing due to the investment money that enters the market daily, the product of retirement and pension funds?

The stawk market is nothing more than a massive psychological operation (psyop) used as control mechanism for the sheeple. Your article supports that premise if you just summarize what you said.

Summary: In the face of glaring facts and indicators that everything is wrong, the market just keeps holding its on or goes even higher.

There is no "market." To think that the common stock exchanges of our day represent people buying and selling as they research and learn about companies that are making profits due to their product line, management teams, advantage over competition, cash flows, debt to asset ratios, PE, price to sales ratios, etc is a demonstration of an inability to think. Not saying you fall into that category. I am talking about the populace as a whole. 98.4% of the sheeple in this country have no idea what is going on around them.

Anyone with any sophistication of market mechanism knows that a handful of companies like FAANGS, the VIX, or S&P futures can single handedly move the "markets" one way or the other. Everyone is familiar with the concept of the PPT......plunge protection team. Then when you factor in all the program buying and selling......algorithms.......and what I believe exist in the outright posting of numbers by manual manipulation, there is NO WAY what we see today is a "market" based on buying and selling of "supply and demand."

Just look at what is happening. Things are blowing up, melting down, coming unraveled..... So how do you get the sheeple to just ignore those events and keep on grazing? You run a flag.....called the stawk market....... up the pole they can all take a quick glance at and assume everything is awesome. There are a couple of generations out there right now that believe banks can go under, energy giants like ExxonMobil could go bankrupt, 50% of the country can go on welfare, and people can quit paying their mortgages, car loans, college loans, rent, utility bills, and be paid just to stay home.......and as long as AAPL, MSFT, GOOG, Meta, NFLX, AMZN, TSLA, NVDA are doing fine, then the world is fine.

Sheeple look at their retirement and 401k, and as long as they are going up, everything is awesome. They will be oblivious to everything else as long as they believe they are making money.....getting somewhere. Our entire society has been bought off. Money is a means of control. There is only a small portion of us that are "working" and trying to make our own way. Everyone else is on the take.....and in reality the money we "working" people are making is money we get from the people that have been bought off by "control money," therefore, we are caught up in benefiting from the "control money" indirectly. The day is quickly approaching where any money you "earn" or "make" will be earned or made from a source of government handout. We are close now. I have said multiple times that if the welfare was cut off, Walmart would be bankrupt in two weeks. Think of all the welfare that Walmart collects and calls it "capitalism."

We cannot look simply from the perspective of money and economy and understand what is going on in our world. If money is a control mechanism, what is the purpose of the control? Take a look around. Here's just one example. People are being forced.....by their government and employers......to agree that a man can be a woman or a woman can be a man. Why? So that the entire society can be conditioned to be told what to think.......no matter how fkg ridiculous it is. People can be told a LIE and made to go along with it. We are on a fast track of, "Agree with us, parrot what we tell you to say, never even think of disagreeing or dissenting........or we will cut your money off."

Freedom is the ability to make choices. In our society, money gives you the ability to make choices. Money is a medium of freedom. Build a society where 90% of the sheeple have to buy everything (food, water, clothing, energy, transportation, etc.), and the other 10 percent (the corporate oligarchy) are in control of all the production and sales.....and......they are part of the scheme to control and limit the freedom of the other 90%,.........and a small group can use the money to control millions. Money is the control mechanism of the military, the government, elections, foreign policy, etc.

When you can see that that scenario is playing out right before your eyes, then you will understand how the things we call "fundamentals of economy" can be non-existent, and the stawk market can hit another all-time high.