Blowing Ourselves

Enjoy the brew. Just don’t forget the hangover’s already on the bar tab.

Paul Tudor Jones said it best this week on CNBC: “My guess is that I think all the ingredients are in place for some kind of a blow off… If anything, now is so much more potentially explosive than 1999.”

I couldn’t agree more. The setup is likely screaming for a final speculative frenzy — a face-melting melt-up before the inevitable crash. The dot-com playbook is alive and well, only this time with passive flows and options gamma on steroids.

Here’s the quick version of my endgame view: the economy is already grinding to a halt (BLS revisions confirm it), and we’re maybe in inning 2 of 9 of a real recession.

Positive real rates finally bit, but the lag and COVID cash delayed the pain. Now credit card delinquencies, auto loans, student loans, and CRE are all flashing red, while banks are stuffed with underwater Treasuries and private credit marks are completely askew.

Consumers are tapped, the “E” in P/E is about to shrink, but stocks are still at record-high valuations. The Magnificent Seven have hijacked the S&P, propped up by trillions in passive flows. Crypto adds another $4 trillion in leverage-fueled fantasy. When deleveraging hits, the trap door opens. The Fed will panic-print, inflation will roar back, and Powell will get a victory lap while the middle class gets hollowed out. Classic end-of-empire vibes, as I described to Bitcoin News last week:

But before that destruction comes more euphoria. As Jones reminded: “If you just think about bull markets, the greatest price appreciations always [occurs] the 12 months preceding the top… if you don’t play it, you’re missing out on the juice; if you do play it, you have to have really happy feet, because there will be a really, really bad end to it.”

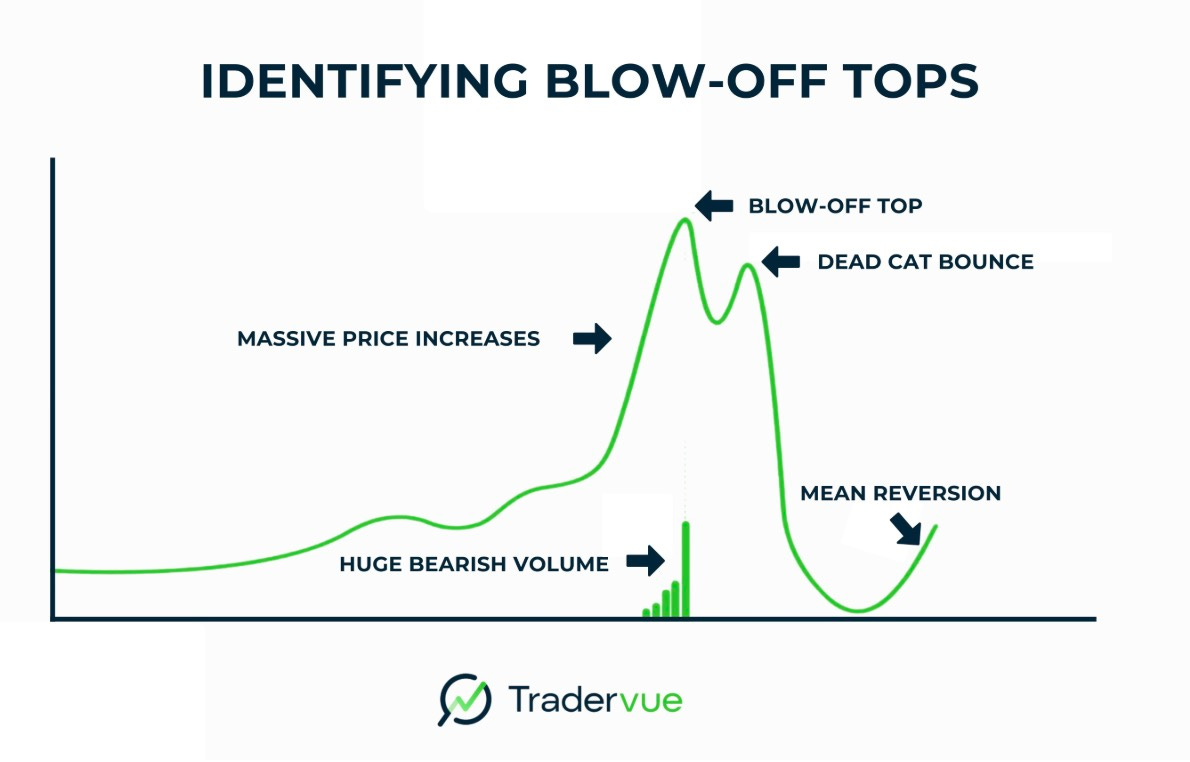

Translation: I agree with Jones. This bull could still have one last sprint left. Blowoff tops happen all the time — the higher it goes, the nastier the aftermath.

The easiest tell of a blowoff top is the chart itself. Prices stop grinding higher and start going vertical. Daily or weekly gains look so extreme they make previous rallies look boring. You’ll know it when you see it: markets that used to rise 1% a week suddenly start jumping 3–5% in a single session. It’s the kind of move where even long-time bulls start saying “this can’t be sustainable” — and then it still keeps going.

At a blowoff top, like would happen in meme stocks, the fear of missing out totally replaces rational investing. You’ll see retail investors pile in with both hands, CNBC panels getting nervously giddy, and social media feeds full of people bragging about their gains. Even more so than now.

Another classic sign: a handful of stocks carry the entire market. This has actually already happened. Right now, it’s the Magnificent Seven, just like it was Cisco and Qualcomm in 1999. Market breadth has collapsed, with the majority of stocks going sideways while a few megacaps drag the indexes higher.

Blowoff tops feed on leverage. Retail traders pile even further into options, hedge funds double down with borrowed money, and entire sectors like crypto offer insane 50–100x leverage.

Finally, a blowoff top is when markets totally stop caring about what’s actually happening in the economy. We’re on that doorstep right now with rising delinquencies, slowing growth, layoffs — none of it mattering as long as stocks keep climbing. The higher it goes, the more obvious the disconnect becomes. That’s the cruel joke of a blowoff top: the warning signs are all around, but no one cares until the selling starts.

As Jones said: “You have to get on and off the train pretty quick. If you just think about bull markets, the greatest price appreciations always [occurs] the 12 months preceding the top. It kind of doubles whatever the annual averages, and before then, if you don’t play it, you’re missing out on the juice; if you do play it, you have to have really happy feet, because there will be a really, really bad end to it.”

We’re the morbidly obese, sugar-addled, diabetic consumer — idiotically giddy and oblivious — teetering on the cliff’s edge with a selfie stick, grinning like tourists as we waddle through our last day at EPCOT. The ride still looks like it’s going higher, and right next to us is an attraction called “The Economy,” where the last batch of riders is coughing up blood in the corner. They make eye contact, but we just wave it off, point to the German Bratwurst stand, and ask, “Who’s up for a beer?”

OK fatty. Enjoy the brew. Just don’t forget the hangover’s already on the bar tab.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

This paragraph is both devastating and wonderfully written. I am such a word nerd, and the entire metaphor made me smile. Thank you for that.

"We’re the morbidly obese, sugar-addled, diabetic consumer — idiotically giddy and oblivious — teetering on the cliff’s edge with a selfie stick, grinning like tourists as we waddle through our last day at EPCOT. The ride still looks like it’s going higher, and right next to us is an attraction called “The Economy,” where the last batch of riders is coughing up blood in the corner. They make eye contact, but we just wave it off, point to the German Bratwurst stand, and ask, “Who’s up for a beer?”"

🤣 best title of the year.

I feel like an autumn squirrel playing in traffic over here w my finger on and off sell buttons....You just know it's coming.

To many fuckin nuts and no where to hide!!!!!!