Bitcoin Thrashed: Weekend Crypto Sentiment May Carry Over To Stocks On Monday

Tough start to the weekend for bitcoin, so far. By Saturday morning on the east coast, bitcoin had already tapped 24 hour lows of $34,064.90.

While the bleeding in the equity markets was finally cauterized after market close on Friday, the deleveraging, de-risking and panic continued into the crypto markets, which trade 24 hours a day, 7 days a week, as soon as the weekend started.

By Saturday morning on the east coast, bitcoin had already tapped 24 hour lows of $34,064.90 and was hovering around $35,713 per coin. It looks as though it may want to test its 52 week low of $28,825.76.

The next leg down for bitcoin came just hours after it was reported that El Salvador had purchased more than 410 additional bitcoins, according to Coindesk.

For kicks, El Salvador President Nayib Bukele said in several tweets on Friday that “Some guys are selling really cheap.”

I wonder if anyone asked to see his DCF, NPV or intrinsic value models for what constitutes “cheap”.

While panicked hodlers tried on Friday to figure out ways to justify holding on to an asset with zero tangible value, zero intrinsic value and zero utility, the Securities and Exchange Commission also delivered a wonderful reality check, informing MicroStrategy’s Michael Saylor that his wonderful non-GAAP reporting idea of simply ignoring the price of bitcoin when reporting MSTR’s financials wouldn’t be acceptable.

Cue The Price is Right losing horn sound.

I’m not sure if the SEC used the term “batshit insane”, when commenting on the proposed change - which would have essentially allowed MSTR to show what its income would have been if it didn’t have to impair its bitcoin holdings - but that’s exactly what the idea was.

Today’s blog post has been published without a paywall because I believe the content to be far too important. However, if you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off for 2022:

Since when do you simply get to ignore the value of financial assets you hold falling in value? You know, unless you’re Allied Capital?

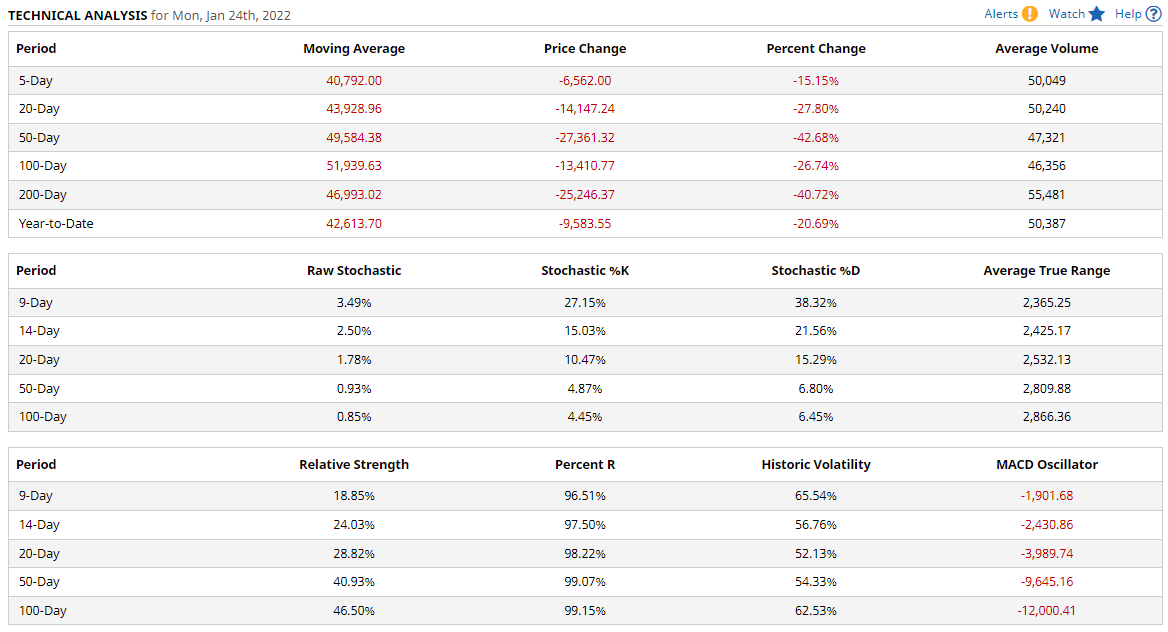

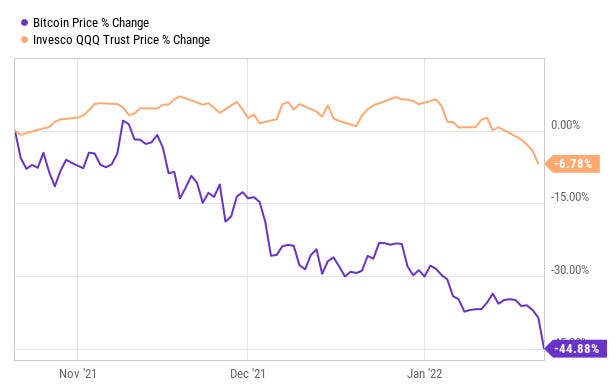

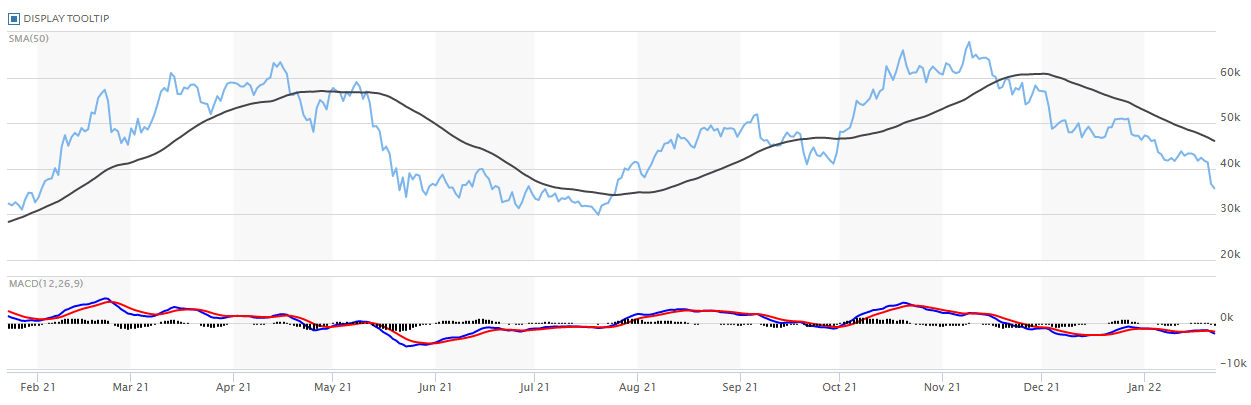

Saylor is likely going through numerous stages of denial in trying to deal with the cold hard reality that bitcoin has been torched relative to tech benchmarks since the volatility over the last 3 months started. In the last 3 months, bitcoin has plunged -44.8% while the NASDAQ has dropped only -6.78%. This chart doesn’t even include Friday’s overnight rout.

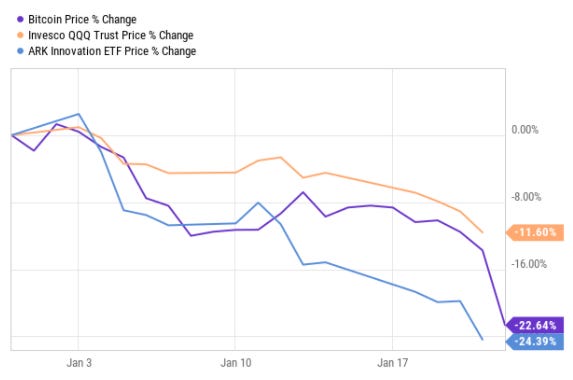

In fact, the only steaming turd that has performed worse than bitcoin since the beginning of 2022, relative to the NASDAQ benchmark, has been the ARK Innovation Fund - much of which is tied to the price of bitcoin.

Bitcoin was probably not helped along last week when Russia’s central bank reaffirmed that mining of crypto should be illegal in the country. In addition to making sure that crypto doesn’t compete with their own fiat (sorry, bitcoin ideologues, you really don’t have the power to overthrow central banks if they don’t want it), this could also be part of a plan to make sure their country isn’t standing on the tracks if a crypto cataclysm train ever comes rolling through.

This is an idea I first wrote about last year - suggesting that the U.S.’s blind adoption of crypto while countries like China sidestep it, could further the precarious financial position our country is already in.

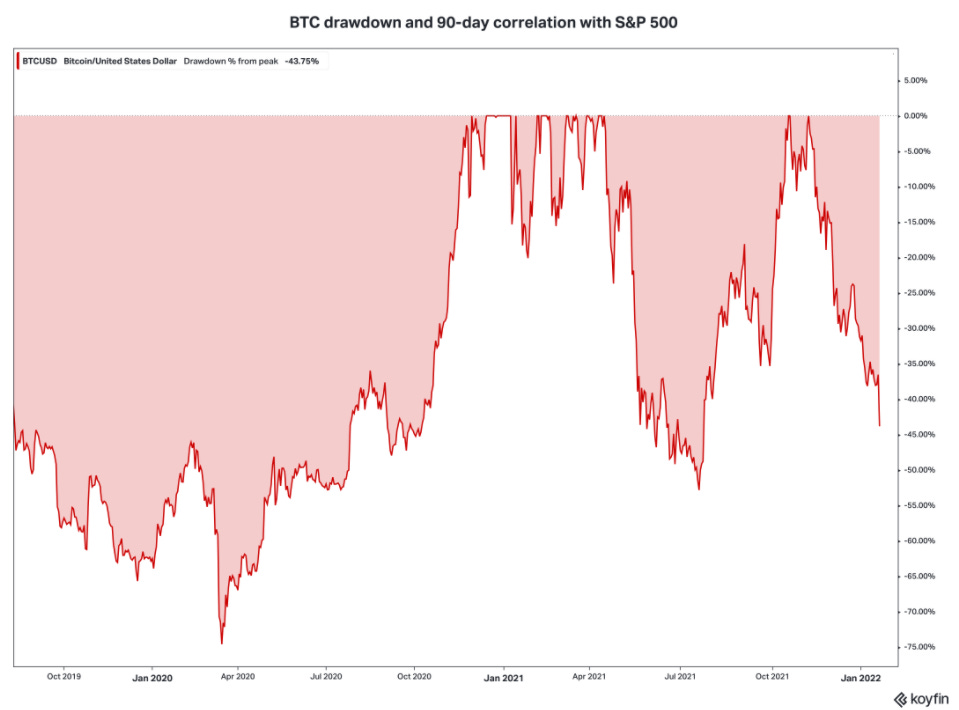

Regardless, it should come as no surprise to my readers that bitcoin has been trading like a risk asset for the better part of the last few weeks, tumbling alongside the broader markets and plunging disproportionately with the tech heavy NASDAQ index, which has led the way in selling.

As a reminder, back in December I wrote about why the wild swings in bitcoin’s spot price helped prove that it is a risk asset.

The appending of bitcoin’s risk to individual traders’ portfolios has been helped along by what can only be described as cultish behavior when defending bitcoin and the crypto space. One of my favorite traders recently said in an interview with me:

In the last few years market participants have adopted a pseudo-religious attitude towards Bitcoin, Ethereum, and a whole host of crypto currencies. People have come to either ‘believe’ or ‘not believe’ in the asset class and its prospects.

Part of this “belief” comes from the idea that crypto is some type of store of value. Traders think they are going to side-step the Fed losing all control of monetary policy by owning bitcoin and other cryptos.

While I agree that the Fed is close to losing all control of monetary policy - I have written that either equity markets have to crash, or the dollar has to - I fail to believe that bitcoin is going to be the “safe haven” that something like gold would be in that circumstance. Even if bitcoin turns out, over a 100 year period, to gain adoption as a store of value, the consensus simply isn’t large enough now for people to rush to bitcoin as a safe haven if the shit really hits the proverbial deleveraging fan.

All eyes are going to be on the crypto heading back toward the cash open on Monday. Friday’s equity market trading was nothing short of totally pessimistic. Whether or not sentiment has a chance to shift heading into the new week could be the key as to whether bitcoin finally consolidates a bit.

I recently interviewed Harris Kupperman of Praetorian Capital, who said he believes that “crypto has had its bubble” and that it “now needs to consolidate”. He also spoke about why he prefers Monero to bitcoin.

For perspective, the crypto hasn’t hit its largest drawdown of recent, which occurred in summer 2021, yet. However, the equity market environment then was far more friendly: there was no talk of a taper and the market was roaring to new highs what seemed like every other day.

Key levels in bitcoin worth watching heading into Sunday:

24 hour low: $34,064.90

52 week low: $28,825.76

The entire "store of value" and "digital gold" thing was misguided from the start. BTC was never intended to be anything like that. The whole crypto ecosystem has been corrupted by the usual suspects and they deserve what they get.

Bitcoin will be to central banks and the nation state as the printing press was to the Catholic Church. Nobody thinks the dominant institution of their time can be disrupted until all of the sudden it is.