Bitcoin: One Hubris-Laden Interview Closer To A Day Of Reckoning

The Bitcoin bull case still appears to be full of past performance statistics, hollow comparisons to gold, ad hominem attacks, double-speak and ignoring key questions.

Pride goeth before destruction, and an haughty spirit before a fall.

- Proverbs 16:18

Many people already know some of my controversial takes on bitcoin, not the least of which is the idea that I believe a crypto cataclysm could be coming, and that China could be side-stepping a global economic crisis by bowing out of the crypto world.

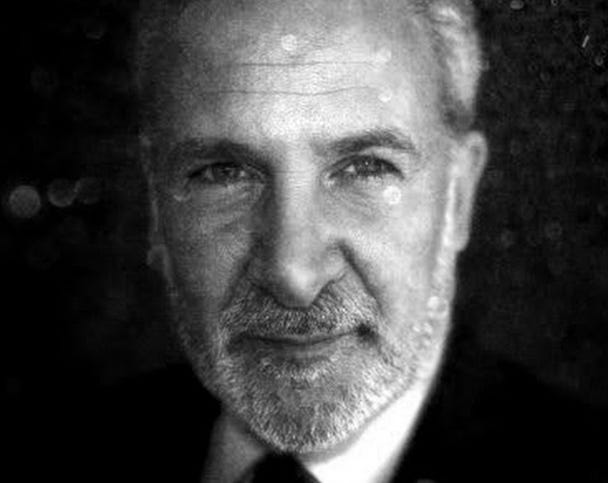

So I was very interested when, last week, Kitco posted a debate between Peter Schiff and Alex Mashinsky on the merits of bitcoin versus gold.

Schiff is CEO and chief global strategist of Euro Pacific Capital and a large proponent for buying gold as a safe heaven to preserve wealth.

Mashinsky is the CEO of Celsius, a CeFi lending platform operated by use of blockchain technologies, and a proponent for bitcoin and cryptos as assets.

I want to start this piece off by saying two things.

First, just know I’m going to get a lot of shit from bitcoin bulls about it. If you’re one of those bulls already thinking about giving me shit, I encourage you to read some of the points I’m going to make here and not immediately try and throw a wet blanket over this entire article.

Second, I want to make the points that (i) there are some things about bitcoin that I like and (ii) that I have exposure to some crypto related names. I like the idea of bitcoin, I just don’t know if it is going to stand up, long-term, in practice. Like many people, for a preservation of wealth and store of value, I am much more comfortable holding gold.

Furthermore, I agree with the problem that a lot of bitcoiners are trying to solve: that the central banks are completely out of control and are doing more harm than good. So hopefully, if you are a crypto advocate, you don’t see this article as me widening the gap between us, but rather trying to identify some nonsense in the space that I think can help inform both bitcoin skeptics and those who are bullish.

When I first saw that Peter Schiff was debating Alex Mashinsky on Kitco news, I knew it was a debate that I wanted to watch. Before I even started watching the interview, I saw a disclaimer on Twitter written by Peter himself, where he apologized for losing his temper.

I couldn’t help but wonder what, exactly, took place during the interview, as I have watched hundreds of Schiff interviews and have never seen him lose his temper. In fact, sometimes, I lose my temper watching the videos and get mad at Peter for not losing his temper because of how stupid some of the guests are that he is routinely pinned against when discussing things like the merits of capitalism versus socialism.

But it wasn’t more than a couple of minutes into Kitco’s debate that I started to understand exactly why Peter was getting frustrated. The guy that he was “debating” against was throwing a slew of logical fallacies against the wall and just seeing what stuck.

Mashinsky led the debate by suggesting a classic fallacy: that bitcoin’s past performance was going to always be indicative of its future results. This is akin to betting “black” at the roulette table after “red” comes out fifty times in a row because it is “due” to come out when, in fact, “black” still has the same 50% chance of coming out as it did on all of the prior spins.

I give kudos to the Kitco moderator for trying to put a stop to this argument before it started, but this is always the first arrow in the quiver for bitcoin bulls. I have pointed out over and over, there is a reason that the first disclaimer you always see when buying a financial product is: “past performance is not indicative of future results.”

Because it isn’t.

Mashinsky then continues hopping from one logical fallacy and inaccuracy to the next. During a discussion about whether or not all bitcoin margin debt (key word: all) was liquidated during the last bitcoin crash, Peter Schiff points out that the amount of leverage people are using to buy bitcoin is likely still significant and dangerous. Mashinsky argues that he believes all margin debt had been liquidated during the last bitcoin plunge, a ridiculous assertion that had Peter fuming.

The absolute worst and most irresponsible of all of the arguments from Mashinsky came when he suggested to viewers of the debate - many of whom likely lack financial sophistication - that both bitcoin and gold pay a yield.

Of course, what he meant was that they pay a yield on his Celsius platform, but he failed to qualify his statements to make that clear. Neither asset pays a yield in general and Mashinsky knows that.

As Peter noted, the capital to pay a yield has to come from somewhere. In dividend paying companies, it comes from their retained earnings. Bitcoin and gold don’t earn anything on their own, so there’s nowhere to draw from to pay a yield, let alone an astronomical 5% yield that Mashinsky claims during this debate.

When Mashinsky claims bitcoin pays 5%, Peter hones in on the fallacy and immediately asks him repeatedly where the yield comes from. Mashinsky has no answer. Peter then takes a guess and asks if Celsius trades the crypto in order to come up with the proceeds to be able to pay the yield, but Mashinsky never gives him a clear answer. This is an extremely dangerous thing to suggest by Mashinsky without explaining in full - and I think even bitcoin bulls can understand why this is dangerous. You can’t get a 5% yield anywhere, let alone from a speculative new asset class. And if you are getting 5% somewhere, chances are you may not be getting it consistently or for a long period of time.

Understanding how a yield is paid is one of the most important concepts in value investing, which is of course why Peter honed right in on the Achilles’ Heel and why Mashinsky refused to answer questions about it.

Hilariously, there are also several times during the debate where Mashinsky refers to bitcoin as “gold” or the “gold standard”. Perhaps Mashinsky should take a step back and understand why things are labeled the gold standard to begin with.

In the words of Peter Schiff: “Gold mines are literally gold mines!”

Mashinsky spends parts of the debate trying to juxtapose bitcoin and gold, like many others have done while advocating for bitcoin. But at some point, it’s going to become very apparent that the two are not the same and bitcoin bulls will one day wonder why they hadn’t made the distinction clearer to begin with.

Mashinsky then contradicts himself several times when speaking about where the price of bitcoin is going to go. When questioned about where the price of both gold and bitcoin are going, he predicts that gold will go to between $2300 and $2500 over the next year. He then predicts that bitcoin will reach $150,000 next year. That prediction comes just moments after Mashinsky himself says that we have no idea where the price of either asset is going to go. The fact that he is replete with double talk like this should alarm prospective investors in bitcoin.

There’s also a point in the middle of the debate where Mashinsky admits that psychological buy-in is the one thing that’s driving the price of bitcoin. Schiff then tries to ask several times what happens if people stop believing in it. Mashinsky admits that if people stop believing in it, it means that they have started believing in something else. This point should be fleshed out as a major risk factor and not just dashed over quickly after being avoided, as it was done in this interview.

Showing off pure ignorance of where value comes from, Mashinsky even claims gold “has no value” during the interview, telling Peter:

"Gold has zero value. Yes you can use it in jewelry and you can use it to build high fidelity electronic equipment, but that doesn't mean it has any value."

Mashinsky also advocates for “borrowing against your fiat” to buy bitcoin. Make no doubt about it, this is asking people to borrow against their houses, credit cards and everything they own to pour money into bitcoin. It’s an idea that’s as irresponsible to suggest as it inverse to the idea of “protecting” your wealth.

Mashinsky’s debate tactics also included ad hominem attacks, like when attempts to make fun of Peter for being a dinosaur, suggesting he is using a dial-up modem after his connection drops during the debate. These jokes, especially about Peter, often come up in the bitcoin community and while they are relatively harmless, it is important to understand that they are creating a climate of cognitive dissonance and confirmation bias that reaffirms the notion that bitcoin bulls have some super tech-savvy understanding of bitcoin that guys like Schiff and myself do not.

Bitcoiners better hope they’re right.

As I’ve argued several times before, sometimes it isn’t the fact that people don’t understand bitcoin that makes them skeptical, it’s the fact that they do.

Finally, later in the debate, Mashinsky is also challenged on bitcoin’s need for a power source and the threat of quantum computing, both of which he doesn’t really seem to have a great answer for.

People laugh at me when I bring up the idea of solar flares and coronal mass ejections rendering their bitcoin temporarily useless, but it is a real world scenario that could happen. In fact, we had solar storms just over the last week. When asked about the need for power, Mashinsky is forced to reply that all bitcoiners will be able to do in that instance is “wait for the power to come back on”.

Since I have been paying attention to bitcoin over the last couple years, no one has been able to give a good answer for what to do when the power goes out. It looks like your bitcoin is simply rendered useless in that case. Yes, you could say the same thing about the banking system because a lot of it is digital, but people that own gold own it as a hedge against those systems.

Wouldn’t it be safe to say that gold could be a hedge against bitcoin, too?

When talking about quantum computing, Mashinsky admits that bitcoin is going to have to be modified over the next decade as quantum computing advances. No one knows what those advancements or changes will look like and who is to say whether the bitcoin you buy today will adhere to the same rules and same mathematical certainties it will after such a modification is made.

Gold, on the other hand, has had the exact same properties and has been the exact same metal for thousands of years, which is specifically why people like it and why it works as a store of value.

What are the two key points I’m trying to make in this article?

First, bitcoin bulls can do better than Alex Mashinsky. The guy obviously spent a majority of the debate pitching his own service and not trying to legitimately deconstruct counter-arguments against bitcoin. I’ve met too many people who are too smart in the bitcoin community to let this guy be the person that represents you as a whole. Personally, I wouldn’t wanna do business with the guy either, but that’s just me.

The second key point is to always remember that hubris comes before the fall. This is an old saying, but Mashinsky’s tone of arrogance and bragging about his business while not being able to answer key questions about how it functions, to me, looks like a great deal of hubris.

The more interviews I watch like this, the more the hubris ramps up towards a fever pitch. Over time, nature and karma have a way of correcting these things. Admittedly, I’ve been saying the same thing about Tesla for years and its reckoning hasn’t happened yet, but that doesn’t mean that it won’t.

Past performance is not indicative of future results.

You can watch the entire debate here:

Schiff did a great job, thanks for posting the interview link. I feel the fed will smack down all the HODLERS, whatever that means. I won't hold any position I can't bail on on a mement's notice

A few concerning points that I've arrived at after reading a few pieces here on crypto and btc. 1. the fraudsters and con artists have flocked to these unregulated areas in order to stalk their next victims. 2. While the decentralized nature of all this makes it attractive in all sorts of ways, it also means the any government can kill it instantly by making it illegal like China did, and there's nothing you can do to stop them if they move that way. 3. There doesn't seem to be any disincentive to the con artists that lie endlessly, and their lies will ultimately only be self serving. Nobody is going to make a dime of real money based on these criminal operators, and how would one go about holding these people accountable for their misleading comments and outright falsehoods? These are the scary things I see attached to the movement. A complete lack of understanding by the patrons, and Wall street is involved. That means the experts at separating "investors" from their money are in the game, and there is no regulation. How long until the I-banks destroy the retail investor in the space because they can?