Biden's Oil Polices Are "Bat-Shit Crazy", Creating "Turmoil" In Markets: USF Geology Professor Dr. Marc Defant

"...perhaps the most irrational decision ever made by a President is Biden’s pursuit of the Iranian (and Venezuelan) nuclear deal to get access to Iran’s oil."

America’s energy policies, specifically those centered around oil and gas, are “bat shit crazy” and the Biden administration is doing nothing but creating “turmoil” in the oil markets, according to geologist and fossil fuel expert Dr. Marc J. Defant.

I’m excited to be welcoming my friend Marc back to the podcast in early April. But for now, his expertise in the world of oil and gas is so deep, I thought my readers would benefit from a preview of his takes on the current state of energy globally, the oil crisis that Europe and the U.S. are heading toward, the effects of Ukraine/Russia and the dollar on oil prices and the effects of Biden Administration policies on the price of oil.

Dr. Marc J. Defant is a professor of geology/geochemistry at the University of South Florida. He worked for Schlumberger Well Services and Shell Oil for three years, with two years at Shell working as an exploration geologist.

He has been funded by the National Science Foundation, National Geographic, the American Chemical Society, and the National Academy of Sciences, and has published in many internationally renowned scientific journals including Nature. He has written a book entitled Voyage of Discovery: From the Big Bang to the Ice Age and published several articles for general readership magazines such as Skeptic and Popular Science and appeared on the Joe Rogan Experience podcast. You can reach him via this contact form.

I had a chance to pick Dr. Defant’s brain this week about the rising cost of energy and his thoughts on what is exacerbating the situation. What follows is Dr. Defant’s take on our country’s oil crisis.

Q: Hi, Marc. Can you start by giving a primer on how oil at the pump is priced and address the claims of “price gouging” by oil companies?

A: Oil is traded in US dollars and the price of oil is highly sensitive to the value of the dollar. Gasoline sold at the pump is made in refineries from crude oil. Therefore, the price of gasoline is directly impacted by the price of oil. Oil prices are set on the futures market, so speculation becomes very important in what we pay at the pump. It is a highly volatile market, as we have recently seen.

Oil prices increase when supply is negatively impacted. That is, demand by traders, not the oil companies, forces price fluctuations. Traders are highly influenced by what they perceive the future availability of oil will be. No sense selling oil today for low prices if they can wait and get higher prices. In other words, sellers ask higher prices when they perceive the supply will be low and the demand high.

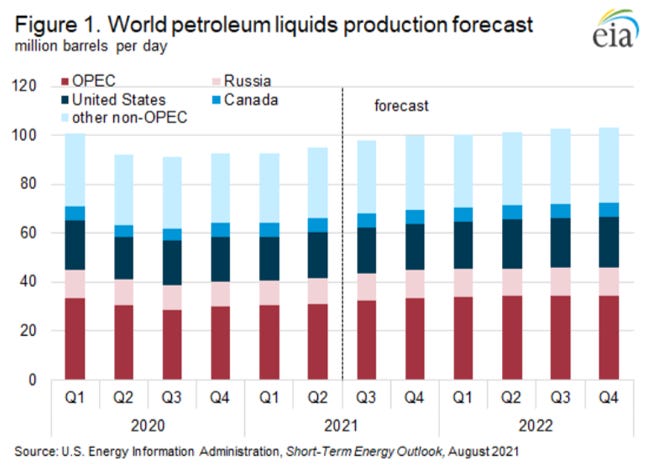

The Organization of the Petroleum Exporting Countries (OPEC) consists of 13 countries and produces about 40 percent of the world’s oil. They are considered by many to be a cartel because of their important influence on the price of oil and gas. In other words, they can impact supply which moves the price of oil. A few notable members are Iran, Kuwait, Saudi Arabia, the UAE, and Venezuela. Russia has worked on and off with OPEC to control supply particularly when oil prices were low.

There are two types of futures buyers – those that wish to hedge their bets and those that speculate in pricing. Hedgers are usually oil companies that buy futures to make sure they will not be negatively impacted by the volatile fluctuations in oil prices. On the other hand, oil speculators are traders that hope to make money on the change in oil price fluctuations.

Let’s take a look at an example.