Beijing Backs Off Didi: Are Chinese Stocks Now Investable?

Beijing appears to be loosening their grip on technology companies for the first time in over a year. Is this the time to dive into Chinese names?

The story to start the week was China reportedly starting to ease up its scrutiny on ridesharing company Didi (DIDI), marking what could be the beginning of the end of several years of Beijing clamping down on its own technology sector.

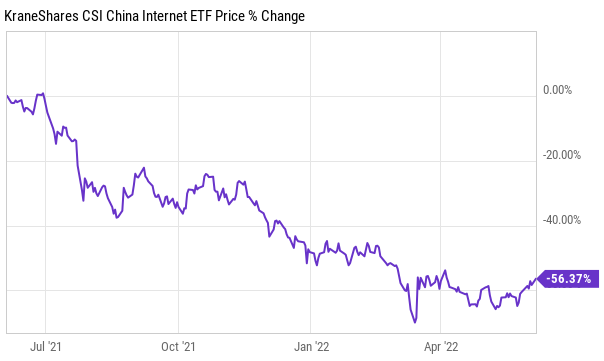

It was a clamp down that resulted in U.S. listed China based technology stocks getting pummeled over the last year.

As a result of the news on Monday, Didi shares scorched higher by about 50% as investors considered the idea of whether or not Chinese ADRs were once again investable.

“Experts” are once again suggesting it’s okay to pile into China:

Which raises the question of whether or not these investments are an oasis in a volatile ocean of investing right now, or simply a mirage.

First off, I’d love to sit back and claim that I saw this coming and that I was right when I dabbled in Chinese stocks over the last year, but the fact is that I wasn’t right. Though I predicted that China would eventually loosen its grip on its technology companies and Didi, I owned it at much higher prices and took a loss on it, along with other Chinese stocks, like Tencent Music (TME), that I liked.

I look at the sector now completely differently than I did a year ago and thought this would be a great time to update my readers as to why.