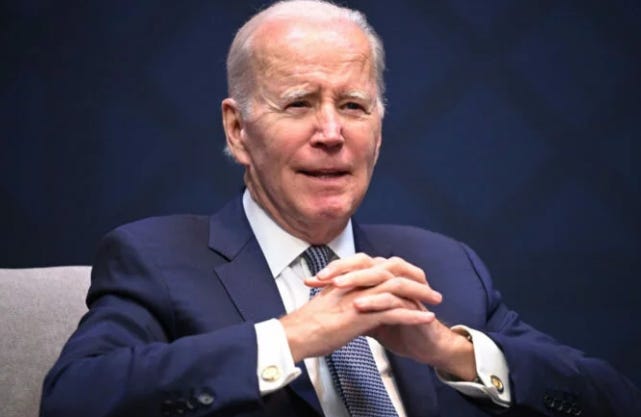

A Repeat of the Housing Crisis: The Biden Administration’s Loan Level Price Adjustment

The Biden Administration is back to its usual shenanigans

By Nikolai G. Wenzel & H. Shelton Weeks, the American Institute For Economic Research

The Biden Administration is back to its usual shenanigans. Just a month ago, it proposed an outrageous budget of almost $7 trillion of unconstitutional spending, complete with an obfuscatory smoke-and-mirrors spin about reducing the annual deficit, while increasing the national debt, punitive taxes, and more hubristic industrial policy.

This time, the Biden Administration is attempting to play with mortgages, in an effort reminiscent of the pre-2007 federal follies that gave us the housing crisis and the Great Recession. The rule violates the federal government’s constitutional powers; it violates the dictates of fairness; and it violates the most basic tenets of financial prudence. At best, it would punish those who have saved diligently and managed their money carefully. At worst, it would place the individuals it is designed to help in a precarious position, saddling them with mortgages that many will not be able to service. Then, of course, there are potential unintended consequences for the economy.

The LLPA Rule

The Biden Administration promulgated the Loan Level Price Adjustment (LLPA) rule in January 2023, through Freddie Mac and Fannie Mae. Because of the operations of those agencies, the rule will come into effect on May 1, 2023, barring congressional action that would block it.

Simply stated, the LLPA rule would subsidize riskier borrowers by levying additional fees on more prudent and less risky borrowers.

The rule would result in lower monthly mortgage payments for riskier buyers, those with credit scores below 680, and those with smaller downpayments. In order to pay for these subsidies, the Biden Administration would impose penalties on home buyers with good credit scores and larger downpayments.

The Federal Housing Finance Agency (FHFA), which is in charge of enforcing the rule, has promised even more punitive redistributions in August 2023. We confess that we had not, prior to writing this article, even heard of the FHFA. Surely, we knew of the FHA, HUD, Freddie Mac, and Fannie Mae. But FHFA? Sadly, we are reminded of Milton Friedman’s lament: “Pick at random any three letters from the alphabet, put them in any order, and you will have an acronym designating a federal agency we can do without.”

There are three fundamental problems with the LLPA Rule: (1) constitutionality; (2) fairness and incentives; and (3) macroeconomic instability.

Problem #1: The LLPA is Not Authorized by the Constitution

In a spirit of generosity, we have once again parsed the US Constitution, and especially the enumerated powers of Article I, Section 8, to find federal authority to meddle in mortgages. To paraphrase James Madison, we cannot undertake to lay our finger on that Article of the Constitution which granted a right to Congress (and much less the President!) to regulate private contracts. There is none, and we defy any reader to find it. If anything, the federal government would do well to respect the injunction (in Article I, section 10) against states impairing contracts. Then again, while the states have assumed powers, the federal government has enumerated powers.

Problem #2: The LLPA is Unfair and Imprudent

The second problem with the LLPA rule is one of fairness and common sense. The rule incentivizes exactly the wrong behavior and turns traditional risk-based pricing in the mortgage application process on its head. The rule — in its attempt to advance home ownership by poorer Americans, or those who have made bad decisions — focuses on achieving equal outcomes, without addressing the underlying causes of the observed differences in access to credit. The program is directly counter to the efforts of states such as Florida that are developing programs to require financial literacy education for high school students.

Banking is necessarily a cautious business. No bank manager wants to say to a depositor: “I’m so sorry, Dr. Weeks, that your checking account funds are not available. You see, we lent them to Dr. Wenzel without running due diligence, or a credit check, or asking the right questions. It turns out he has a history of bad financial decisions, and he just defaulted on his mortgage. We really should have looked at his credit score.” Such imprudence leads to bank failures and dismal career prospects for sloppy bank managers.

The LLPA is a no-win program. It hurts borrowers who have done the “right” thing and, as a result, have higher credit scores and larger downpayments. While it may facilitate some less-qualified borrowers in obtaining financing, this does not necessarily help them to be successful homeowners. There is a reason these borrowers have lower credit scores and downpayments. These two economic outcomes reflect the cumulative impact of financial decisions made by the individuals over time. These factors are proven measures of the risk of a borrower defaulting on the mortgage; simply masking them does not eliminate the risk of default. In fact, obtaining a home loan before the individuals are in a financial position to successfully face the many obligations of home ownership may simply set first-time homebuyers up for failure, and could potentially prevent them from ever achieving the dream of home ownership.

Problem #3: The LLPA Sows the Seeds of Macroeconomic Instability

The Biden Administration seems to have lost its short-term memory. Just 30 years ago, the federal government started playing with mortgages in an effort to increase home ownership. This program was a great success… if only in the short run. As a result of the post-1992 bipartisan interventions, under Presidents Clinton and Bush, home ownership increased in the US, including for poor and minority Americans. Americans in general, however, and poor and minority Americans in particular, were sold a false bill of goods. Their unsustainable mortgages — based on artificially low standards, much like the LLPA — were a house of cards. When the dust settled from the housing boom and bust and the Great Recession, the home ownership levels of poor and minority Americans had fallen back to pre-intervention levels, with disproportionate harm to those very groups. The Biden Administration seems to have forgotten this, along with the Great Financial Crisis of 2007, which occurred just 15 years ago.

The LLPA’s fundamental flaw is shared by many previous programs designed to increase home ownership. Surprise outflows for emergency repairs, or increases in the cost of recurring items such as insurance costs or property taxes, can push borrowers with marginal credit and low downpayments into financial distress. Programs to increase home ownership frequently focus only on getting the individual qualified for a loan and into a home — ignoring the fact that buyers must have funds to meet these expenses. This situation is directly analogous to a firm’s expanding its operations without adding working capital to support the larger scale operations. Setting up risky buyers for failure presents the risk of unintended consequences for the macroeconomy.

Conclusion: More Hubristic Industrial Policy from the Biden Administration

Sadly, the Biden Administration is at it again, somehow thinking it can engage in central planning of the economy from Washington, DC. The LLPA is just the latest example. It is unconstitutional. If that weren’t enough, it’s also unfair. It establishes perverse incentives. And it sows the seeds of financial ruin for the very individuals it is designed to help.

The LLPA would be immediately damaging to all Americans who have done the right thing, established solid credit and saved for an adequate down payment. It would be eventually damaging to those who are given unsustainable mortgages. As a result, the LLPA should not be considered a win for one party over another…. but simply a loss for the country.

So, a good summary of the issues. But it ignores the actual elephant in the room. The punishment of (what are essentially) mostly middle class borrowers, predominantly leaning more conservative, for doing all the right things, is a feature and not a flaw. Just a further extension of the weaponization of government against those who don’t support the regime.

Although the issues are different, in the end the punishment is te same. Palestine OH got ignored because of the political tenor of the people who lived here. Middle class borrowers with good credit scores are being punished for similar reasons.

It would seem at this point that the government has been incentivized to create crises so that, in its response, it can justify its existence and increase its power.