3 Reasons A "Nasty Recession" Will Soon Arrive

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter on August 31, 2023, with his updated take on the market’s valuation and Tesla.

Friend of Fringe Finance Mark B. Spiegel of Stanphyl Capital released his most recent investor letter on August 31, 2023, with his updated take on the market’s valuation and Tesla.

Mark is a recurring guest on my podcast and definitely one of Wall Street’s iconoclasts. I read every letter he publishes and only recently thought it would be a great idea to share them with my readers.

Like many of my friends/guests, he’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Mark was kind enough to allow me to share his thoughts from his March 2023 investor letter (edited slightly for length and grammar by QTR). This letter also contains positions his fund has on, both long and short.

Mark on Markets

Stocks sold off pretty hard during the first half of August (and this currently very net short fund was up a lot more when they did!), but then bounced back during the month’s second half as weaker macro data came in and equity (and bond) investors adopted a “bad news is good news” mentality, believing that a slightly weaker economy would engender a looser Fed, and perhaps a new bull market.

Yet while mildly “bad news” may be “good news” (or may not be, as stocks are expensive and Core PCE, the Fed’s most important inflation metric, is still > 100% above its 2% target), very bad news is just “bad news,” and I think we’re headed for very bad news. As I’ve written here many times before:

There’s no way an “everything bubble” built on over a decade of 0% interest rates and trillions of dollars of worldwide “quantitative easing” can not implode when confronted with 5%+ rates and $95 billion/month in U.S. quantitative tightening plus increasingly tight money from the ECB, BOJ and other central banks.

Contrary to the belief of equity bulls, bubbles don’t unwind gently, and once they burst and the economy takes a dive it takes a long time before lower inflation and lower rates help stock prices. When the 2000 bubble burst and the Nasdaq was down 83% through its 2002 low and the S&P 500 was down 50%, the rates of CPI inflation were just 3.4% in 2000, 2.8% in 2001 and 1.6% in 2002, and the Fed was cutting rates almost the entire time.

Yes, a nasty recession has been delayed due to a combination of “interest rate lag effects,” leftover “Covid cash” and (as The Wall Street Journal noted in July) “labor hoarding,” but it will soon arrive for the following reasons:

Although the excess savings built up during the Covid pandemic is still putting somewhat of a floor under consumer spending, those funds should be fully depleted by October, and consumer credit card delinquencies are now rapidly increasing while personal savings have collapsed.

Business lending data, shipping container traffic, an inverted 2-10 yield curve, bankruptcy filings, declining job openings and other leading indicators say that a nasty recession is imminent.

The cost of servicing the Federal debt is soaring (as is the liquidity-draining rate of its issuance) thereby making extra fiscal stimulus unaffordable.

On October 1 student loan repayments will finally resume (although admittedly, many debtors will undoubtedly utilize the Biden administration’s one-year ”grace period“).

We thus continue to be short a large amount of SPY (as well as Tesla, covered later in this letter), as the Fed’s (perhaps final) July interest hike to around 5.3% makes current stock market valuations unsustainable, as stocks are still expensive. According to Standard & Poor’s, Q2 2023 annualized run-rate operating earnings for the S&P 500 came in at around $220. A 16x multiple on those earnings (generous for the current environment) would put that index at only around 3520 vs. its August close of 4508, while 15x would put it at just 3300. And remember, these earnings are pre-recessionary (i.e., they may soon get considerably worse), and just as in bull markets PE multiples usually overshoot to the upside, in bear markets they often overshoot to the downside. Thus, a bottom formed at a lower multiple of lower earnings is not unfathomable.

Meanwhile, although the high current rates of 4.7% core CPI and 4.2% core PCE are slowly trending down, I believe we’re in for a new core “inflation floor” of 3% to 4% as China is forced to stimulate its sluggish economy, Biden continues his war on fossil fuels, the U.S. government continues to rack up massive deficits, and substantial wage increases continue due to fewer available workers combined with “onshoring” jobs previously sent overseas. And even as inflation gradually declines, the Fed does not want to reverse rates too soon and repeat the 1970s.

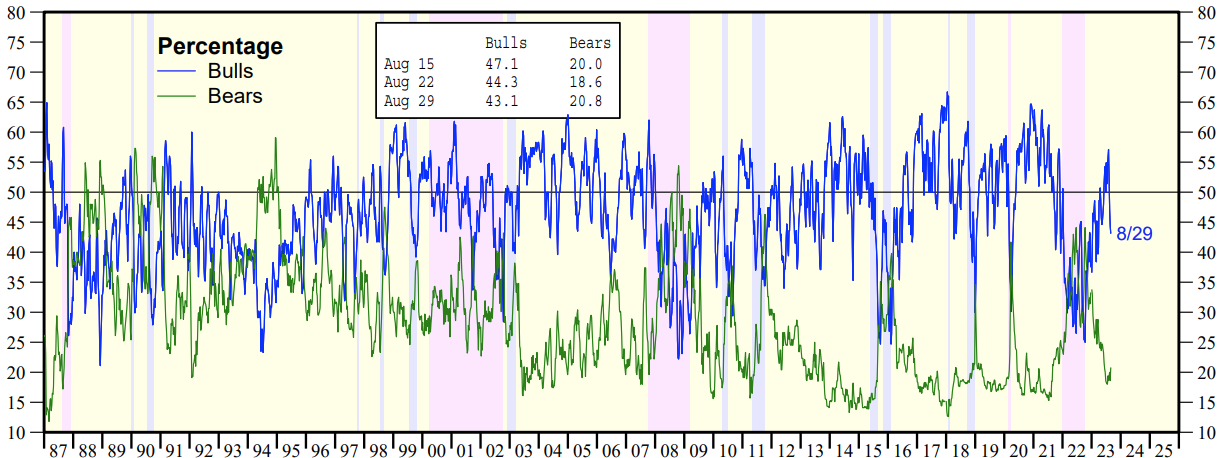

Regarding sentiment, we can see from Ed Yardeni that in the Investors Intelligence poll the highest the “bear percentage” got so far in the current market was only around 45% (in the most recent poll it was just 20.8%!), yet there were multiple times during the 1980s, 1990s and 2008 that it climbed much higher:

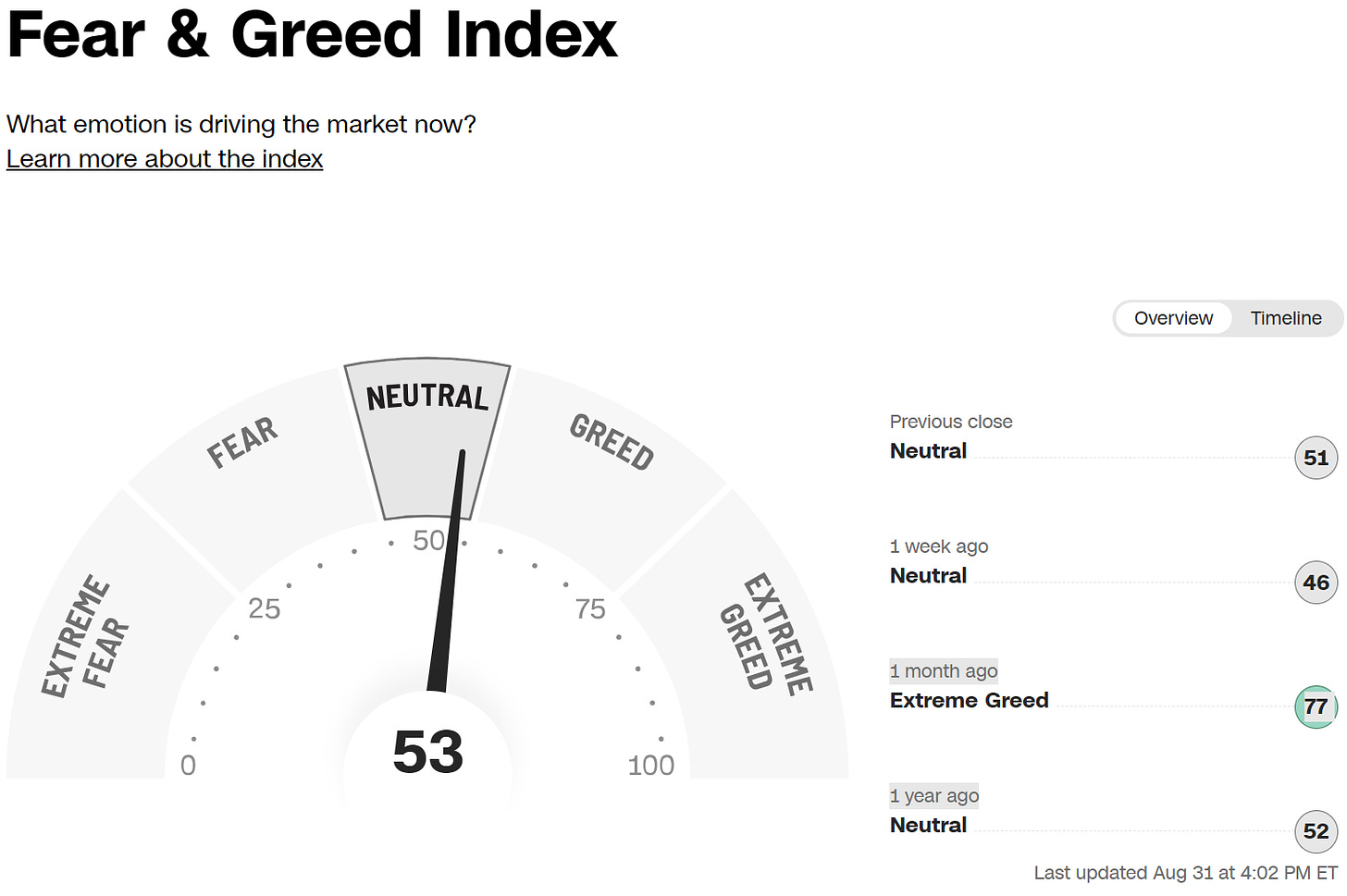

And although CNN’s “Fear & Greed Index” has dropped out of the “greed” zone, it still shows no fear:

Here then is some commentary on some of our additional positions; please note that we may add to or reduce them at any time…