23 Stocks I'm Watching For 2023: Part 2

Here's my Part 2 to the 23 stocks I'm watching for what should be a wild year.

(Please read my full disclaimer at the end of this post. This is not a solicitation to buy any stocks, I am not a financial advisor.)

You can read Part 1 of this series here.

It’s that time again. And by “that time”, I mean several hours hunkering down in a basement chugging red wine while I furiously write about the 23 most interesting stocks I can think of for the upcoming year. And by “again”, I mean only for the second time ever.

But behold, I am now ready to offer up the 23 names that I am most interested in watching for the new year. We did this same type of post last year and 2022’s picks were a wild mix of big wins with some losses. It was tough in the beginning of the year to figure out the inflationary environment we’d be in for over the next 11 months, not to mention 400 bps of rate hikes and Russia invading Ukraine - none of those catalysts were full borne out while I was writing my stocks to watch - though they did serve to help several positions.

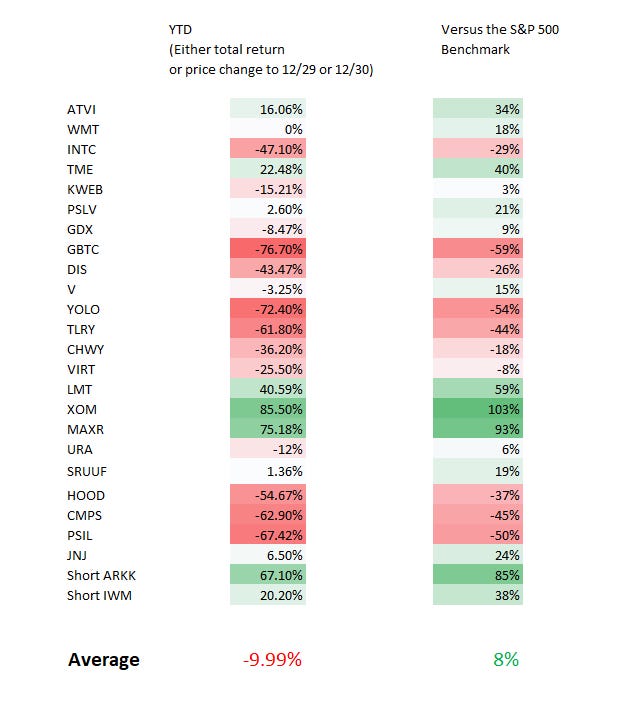

There were definitely some winners: for example, my idea to short ARKK for the year would have returned about 66%. Two names saw buyouts: Maxar was bought out at a more than 100% premium to end the year and Activision was taken over by Microsoft, posting a 14% gain for the year. Names like Lockheed Martin finished the year up about 35-40% benefitting from the conflict in Ukraine and Exxon was an absolute steamroller, finishing the year up ~72% and spitting out cash dividends every quarter.

I also beefed several calls: names like Robinhood underperformed or simply didn’t move much at all over the course of the year. Names like Disney, which was down about -44% for the year and the AdvisorShares Pure Cannabis ETF, which was down about -70% for the year, turned out to not go the way I had thought they would. The GDX finished the year -14% and Virtu Financial, stung just in the last few days by new SEC rules about payment for order flow, will finish the year down about -31%.

You can view all my picks from 2022 here: Part 1 is here, Part 2 is here and Part 3 is here.

I also whipped up this very quick, unscientific, very loose spreadsheet of my picks from 2022 (subject to below disclaimers), which, on average and estimate were down about 10%, but beat the S&P by about 8% for the year.

(Disclaimer: I am terrible at math, didn’t double check these numbers at all, used both close price and total return figures where applicable, and took YE figures from either 12/29 or 12/30 depending on which day I worked on it, and don’t even know why I write a financial blog to begin with).

Now let’s move on to the 23 stocks I’m watching for the year ahead. First, if I had to guess and try to sum up what 2023’s key macro investing theme would be, here’s what I’d say.

I strongly believe markets in 2023 are going to be driven by both a residual crash coming from this year’s rate hikes and then an eventual Fed pivot, with a fair amount of geopolitical risk on the side.

The year is in no way going to be a cakewalk for markets, in my opinion. And that’s because, no matter how much people wish it to be, things simply aren’t all right.

The economy is grinding to a halt, interest rates are at a point where the Fed has overshot the mark and the BRICS nations have forged a global alliance that looks slated to take on the US dollar as global reserve currency.

Some of the stocks I’m watching for this year reflect that view, while there are also a couple of speculative growth stocks because, despite the fact that I think markets will move lower, I still believe that there will be outlier opportunities in individual names, and this is where active management should have the upper hand. Remember: this is what people actually used to pay hedge fund managers for before the Fed stuck a cannon up the ass of the market and blasted it with $10 trillion, forcing every corporate corpse and lingering piece of detritus to skyrocket higher regardless of fundamentals.

My list for 2023 reflects these sentiments. Below is Part 2 of the 23 names I am watching for 2023. Part 1 with the first 13 stocks can be found here. Most of these names (especially the more speculative/growth ones) will likely get clipped if the market has a panic-sell off. Such capitulation, which would likely immediately precede a Fed pivot announcement, would be spots where I am personally looking to take larger swings in adding to positions.