137 Trillion Reasons To Own Gold

Schiff Gold lays out the state of the global economic ponzi scheme heading into the weekend. And it's ugly.

By Peter Schiff’s Schiff Gold

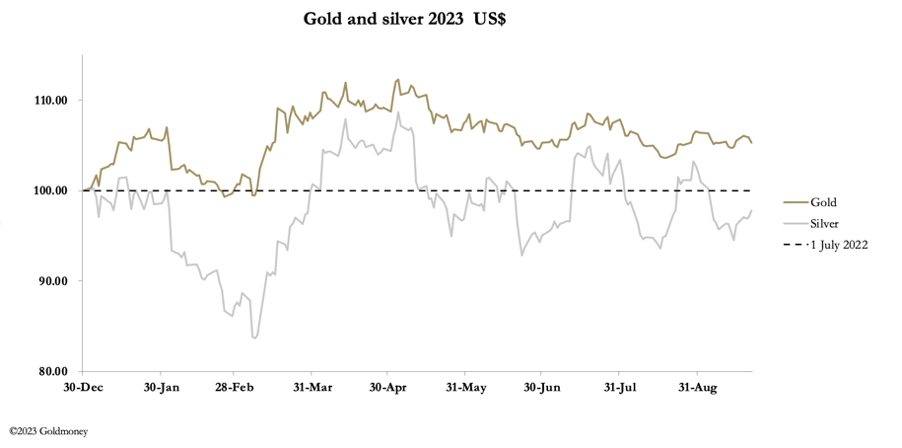

The FOMC and the Bank of England stood pat on interest rates this week. Following the FOMC’s decision, gold and silver fell on the back of its hawkish statement before recovering slightly. In Europe this morning, gold was $1926 up a net $2 from last Friday’s close. Silver fared much better at $23.68, up 65 cents. Silver is obviously in a bear squeeze, while hedge funds have become disinterested in gold.

Often, silver leads the way upwards and this may be the case today. The next chart shows how Open Interest on Comex remains low in both contracts, indicating that the downside is limited.

These are the sort of doldrums that can support a substantial bull leg, so on balance the danger is being short rather than long. But there is one big hurdle to overcome, and that is a firm dollar and rising T-bond yields. These are up next:

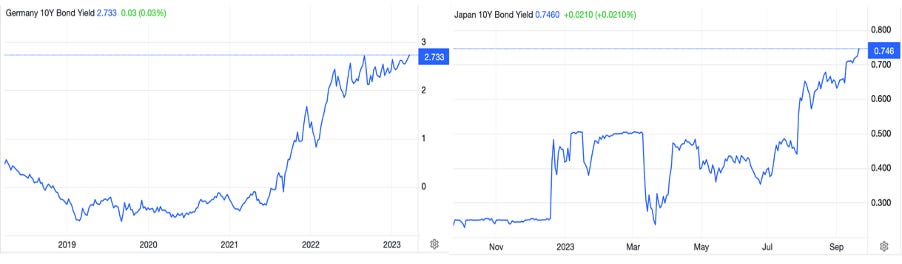

It is not just a problem facing dollar markets. The next two charts show 10-year bund and JGB yields.

Both yields are only beginning to reflect the transition from negative to positive interest rates, and their charts show they are on course to rise considerably higher. Yet we are clearly faced with a global economy which is no longer growing, and contracting bank credit is forcing a squeeze on borrowers who cannot afford their debt at these higher interest rates.

So far, hedge funds have believed that high interest rates and bond yields are bad for the gold price, and that is what has driven the relationship between the dollar and gold. More likely, we are going through a transition to fear of the economic and monetary outlook for fiat currencies.

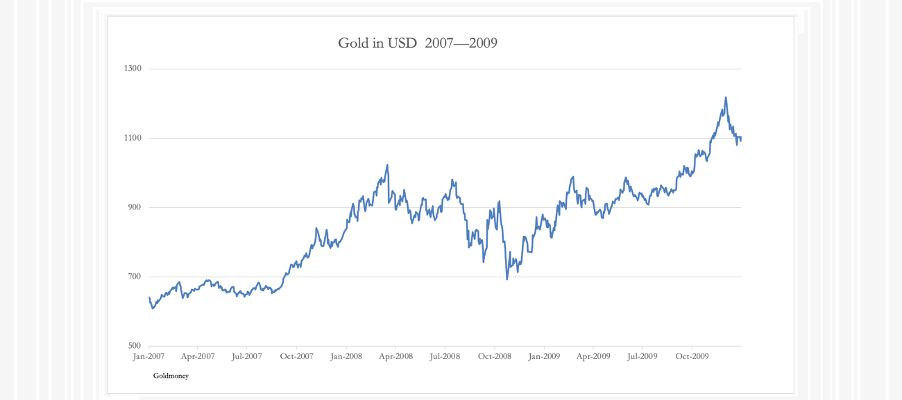

There is no doubt that these fears have led to dollar strength in recent months, because in a fiat currency world, the dollar is safety. We saw this thinking at the time of the Lehman crisis and the next chart is of gold during that period.

In the run up to the crisis, the gold price rose to $1023 in March 2008. The crisis then began to evolve, leading to the Lehman failure on 15 September 2008. The week before the event, gold was trading at $742, a fall of 27% from the March high. And after a brief rally on the news, it subsequently fell back to $692 on 24 October, before rallying to new highs against the dollar.

There are many other examples of an initial flight to the supposed safety of the dollar in a crisis, so much so that we should expect it as the contractionary phase of the bank credit cycle progresses. This time, it may be too early to rule out a further fall in the gold price, but clearly, investors should be looking through the current weakness at subsequent developments.

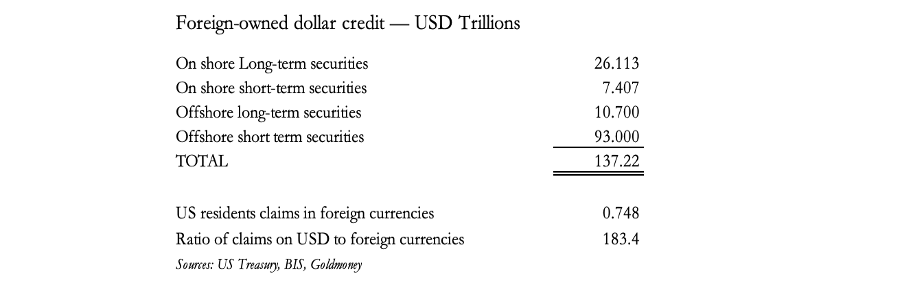

They could be very dramatic, and it behoves the reader to understand the following table.

It consists of all dollar investments and interests in foreign hands, both onshore and also in offshore eurodollars, totalling a staggering $137 trillion. Meanwhile, Americans have only $748 billion (with a B!) in foreign currency to absorb dollar liquidation. And it will be a miracle if rising interest rates and bond yields don’t cause initial liquidation of $26 trillion in onshore long-term assets, leading to a wider liquidation of dollar credit. There is simply next to nothing to absorb it.

Conclusion: higher interest rates will end up crashing the dollar. And it could be unexpectedly sudden.

Got gold?

Schiff Gold: Interested in learning how to buy gold and buy silver? Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I do not fact check contributor material that I aggregate from other sources. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

Read Tom Luongo, Gold Goats and Guns and his recent podcast on gold. But his “Theory of Everything” is essentially that Powell’s higher interest rates are targeted to kill the offshore “eurodollar” and you’ve provided the sense of scale I needed. Far bigger than the domestic market. I believe the TOL calls for those USDs to come running home, to the extent they are not wiped out by ridiculously high leverage. The German Bond’s interest rate is a joke. As is Japan’s. These are interesting times.

The juniors, at least some of them, are getting creamed, good time to load up.