Minsky Meltdowns and Modern Monetary Theory

"What enables such risky investment? What encourages excessive borrowing?"

By Jonathan Newman, Mises Institute

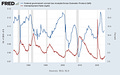

Modern Monetary Theory (MMT) posits that booms and busts can be explained by private versus public sectoral balances and the inherent instability of private financial markets. Stephanie Kelton frequently points to this graph of public and private surpluses and deficits:

The red bars show the government’s budget as a percent of GDP. When the government spends more than it collects in taxes, it runs a deficit and sells debt. The government’s debt is sold domestically and to foreign buyers. These groups become net lenders to the government to the extent they purchase government debt, and this is shown with the black and gray bars.

When the government (rarely) runs a surplus, it means that the government is collecting more in taxes than it is spending, and so the non-government sectors must collectively run a “deficit.”

This picture is highly misleading, as Bob Murphy and others have pointed out. Since interest payments from the federal government must come from either taxes or monetary inflation, the burden of government debt is not borne by the government, but by taxpayers and all the losers of money printing. Government deficits, then, are not really private sector surpluses, no matter how many times MMTers point at the sectoral balances.

Moreover, Kelton asserts that private sector deficits or a deterioration of private sector balance sheets are caused by government surpluses or smaller government deficits. Here, she takes a step beyond the mere accounting, which we’ve already seen is misleading, and makes a cause-and-effect claim. She says, “Government deficits are necessary to prevent private sector balance sheets from deteriorating.”

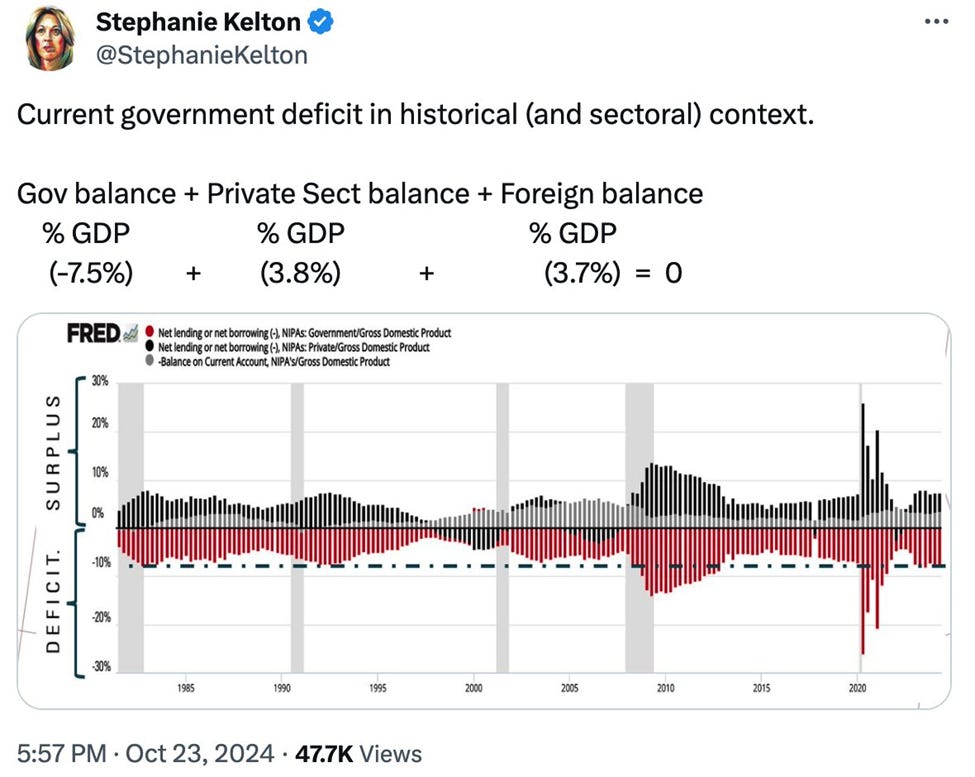

The problem with this is that government deficits are determined by two things: government spending and government revenues. Kelton implies that if only the government would increase spending to deepen deficits, then the private sector could stay afloat and we wouldn’t suffer downturns. But if you look at the time periods between recessions, the main driver of the changes in government deficits is tax revenues, which are a function of employment.

Source: https://fred.stlouisfed.org/graph/?g=1x3a9

Anybody familiar with Austrian business cycle will see what I’m getting at here. In the course of an unsustainable boom set in motion by artificially low interest rates, wages and employment increase, which means income tax revenues also increase. Higher tax revenues result in smaller government deficits and, in rare cases, government surpluses. Kelton claims that smaller government deficits lead to financial crises and recessions, but both are caused by credit expansion—first, government deficits shrink due to higher tax revenues, and then the inevitable bust, which is not caused by government deficits, but by the realization of errors made during the boom.

In the bust, government deficits get worse as government spending increases and tax revenues fall. This sets the stage for another time period between recessions for government spending to fall (but not back to pre-crisis levels), and for tax revenues to grow slowly as employment picks back up.

This is why there is an apparent correlation in government deficits and the business cycle. An uninformed observer could easily, but incorrectly, conclude causation from this correlation, saying that shrinking government deficits cause financial crises and recessions. In reality, artificial credit expansions cause both.

Kelton mentions Hyman Minsky, who developed a theory of financial crises based on the inherent instability of unregulated financial markets. The idea is that profits lead to speculative bubbles and overleveraging, and that this inevitably results in a default crisis. Households, businesses, and investors extrapolate the good times into the future, leading them to decrease savings, gamble their money in financial markets, and borrow more than they can pay back. As Janet Yellen put it in her speech at the 18th Annual Hyman P. Minsky Conference, “One of the critical features of Minsky’s world view is that borrowers, lenders, and regulators are lulled into complacency as asset prices rise. … a sense of safety on the part of investors is characteristic of financial booms.”

This, of course, is only part of the story. What enables such risky investment? What encourages excessive borrowing? What keeps interest rates low, even while there is a frenzy to borrow? How do profits, wages, asset prices, employment, stock market valuations, and debt all increase at the same time?

There’s a clue in Yellen’s speech, just a few moments later: “Fed monetary policy may also have contributed to the U.S. credit boom and the associated house price bubble by maintaining a highly accommodative stance from 2002 to 2004.”

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Man driving company car badly...

A friend says 'why do you treat this car so badly?'

'It's the SE Model' says the first man 'SOMEBODY ELSE'S.

And thus it is with ALL but very few governments, when it's 'somebody else's/taxpayers' money THEY DON'T CARE A FIG.

All government spending just grows and grows and grows, 99% of Public Sector employees have never run businesses, never employed people in the real world (Private Sector) never hired, fired, had to make books balance, had to sweat to please banks and investors. Public Sector staffs are children with the keys to the sweet shop. And when it all goes wrong, without fail, they always say 'Lessons have been learnt'. Except they NEVER learn.

This column brought back to mind a thought that I had long ago: It makes sense for a government to smooth out the economy to a degree. When the economy goes into recession, the government should spend money. When it is inflationary, the government should withdraw money. That's not some revelation, that's Econ 101.

But today, the government spends more money, no matter what. There used to be little government money or economic influence inserted directly into an individual's personal life. NOW look! Regardless of the economic issue (or any other issue), Big Brother is expected to fix it, usually by printing more money.